Answered step by step

Verified Expert Solution

Question

1 Approved Answer

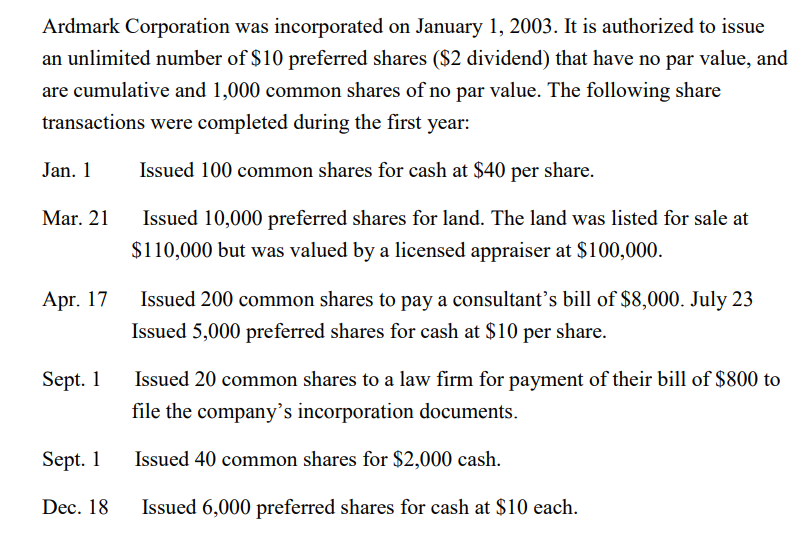

Ardmark Corporation was incorporated on January 1, 2003. It is authorized to issue an unlimited number of $10 preferred shares ($2 dividend) that have no

Ardmark Corporation was incorporated on January 1, 2003. It is authorized to issue an unlimited number of $10 preferred shares (\$2 dividend) that have no par value, and are cumulative and 1,000 common shares of no par value. The following share transactions were completed during the first year: Jan. 1 Issued 100 common shares for cash at $40 per share. Mar. 21 Issued 10,000 preferred shares for land. The land was listed for sale at $110,000 but was valued by a licensed appraiser at $100,000. Apr. 17 Issued 200 common shares to pay a consultant's bill of $8,000. July 23 Issued 5,000 preferred shares for cash at $10 per share. Sept. 1 Issued 20 common shares to a law firm for payment of their bill of $800 to file the company's incorporation documents. Sept. 1 Issued 40 common shares for $2,000 cash. Dec. 18 Issued 6,000 preferred shares for cash at $10 each. Instructions (a) Journalize the transactions. (b) Calculate the year-end balance in each of the share capital accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started