Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Are both methods (i.e. NPV and IRR) good in these situations?What would you do if you were the one in Sinning?s position?According to your opinion,

- Are both methods (i.e. NPV and IRR) good in these situations?What would you do if you were the one in Sinning?s position?According to your opinion, which project is better for thiscompany?

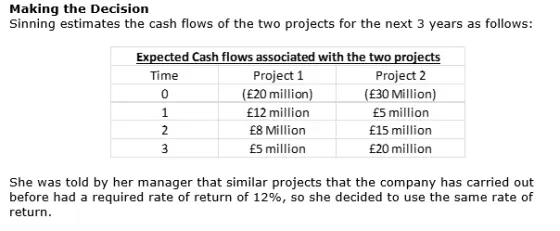

Making the Decision Sinning estimates the cash flows of the two projects for the next 3 years as follows: Expected Cash flows associated with the two projects Time Project 2 0 1 2 3 Project 1 (20 million) 12 million 8 Million 5 million (30 Million) 5 million 15 million 20 million She was told by her manager that similar projects that the company has carried out before had a required rate of return of 12%, so she decided to use the same rate of return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Both the Net Present Value NPV and Internal Rate of Return IRR methods are commonly used to evaluate investment projects The NPV method calculates the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started