Answered step by step

Verified Expert Solution

Question

1 Approved Answer

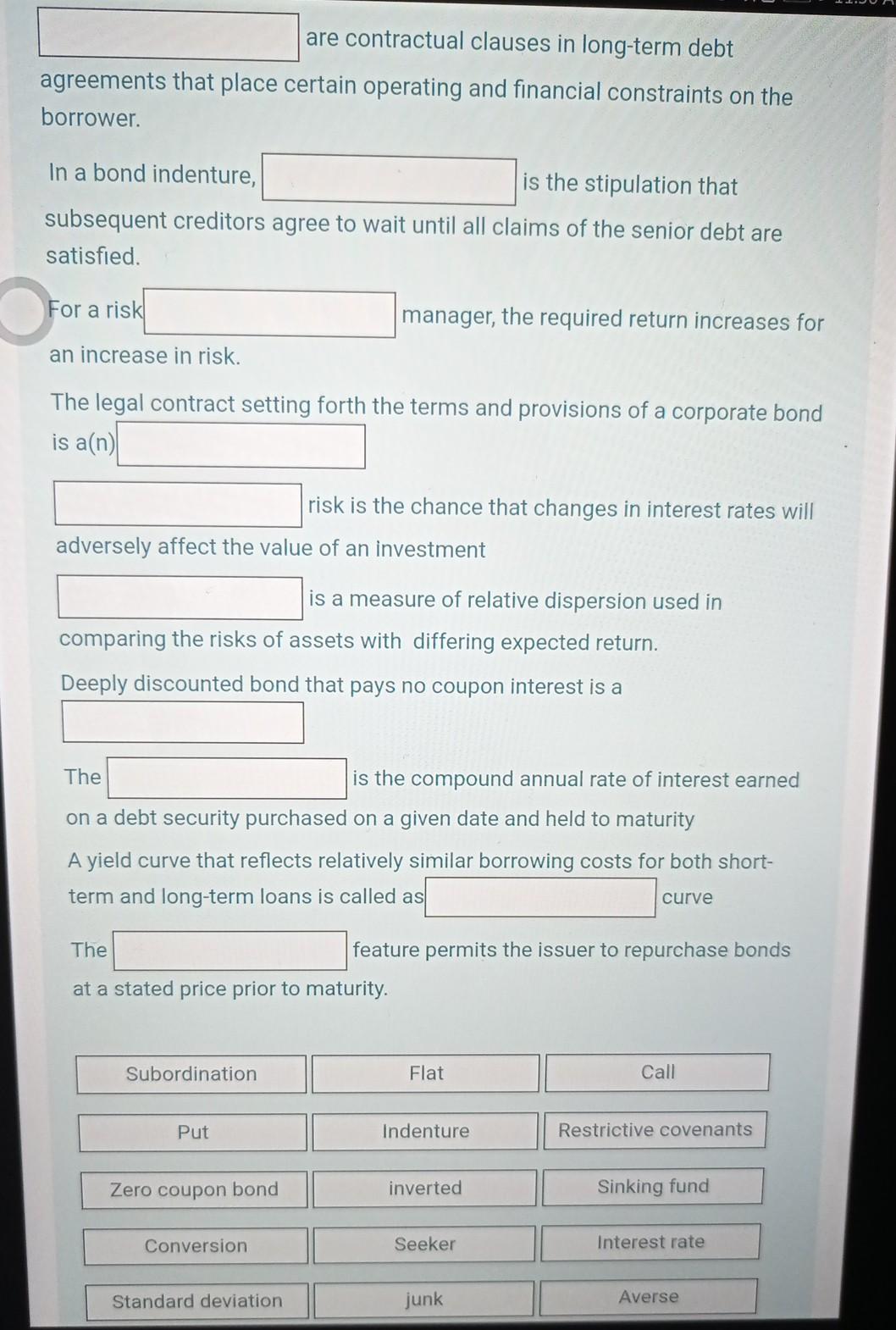

are contractual clauses in long-term debt agreements that place certain operating and financial constraints on the borrower. In a bond indenture, is the stipulation that

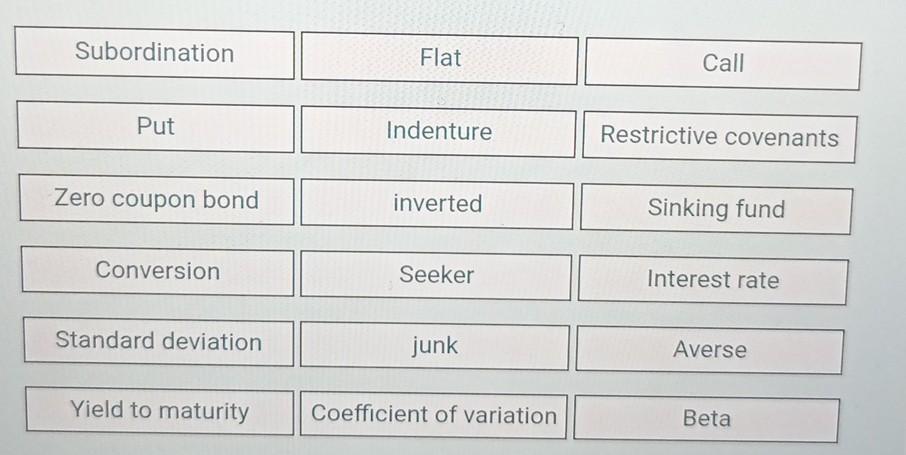

are contractual clauses in long-term debt agreements that place certain operating and financial constraints on the borrower. In a bond indenture, is the stipulation that subsequent creditors agree to wait until all claims of the senior debt are satisfied. For a risk For manager, the required return increases for an increase in risk. The legal contract setting forth the terms and provisions of a corporate bond is a(n) risk is the chance that changes in interest rates will adversely affect the value of an investment is a measure of relative dispersion used in comparing the risks of assets with differing expected return. Deeply discounted bond that pays no coupon interest is a The is the compound annual rate of interest earned on a debt security purchased on a given date and held to maturity A yield curve that reflects relatively similar borrowing costs for both short- term and long-term loans is called as curve The feature permits the issuer to repurchase bonds at a stated price prior to maturity. Subordination Flat Call Put Indenture Restrictive covenants Zero coupon bond inverted Sinking fund Conversion Seeker Interest rate Standard deviation junk Averse Subordination Flat Call Put Indenture Restrictive covenants Zero coupon bond inverted Sinking fund Conversion Seeker Interest rate Standard deviation junk Averse Yield to maturity Coefficient of variation Beta

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started