Are the two companies in the introduction, growth or maturity stage of the company life cycle? Explain. (20 marks)

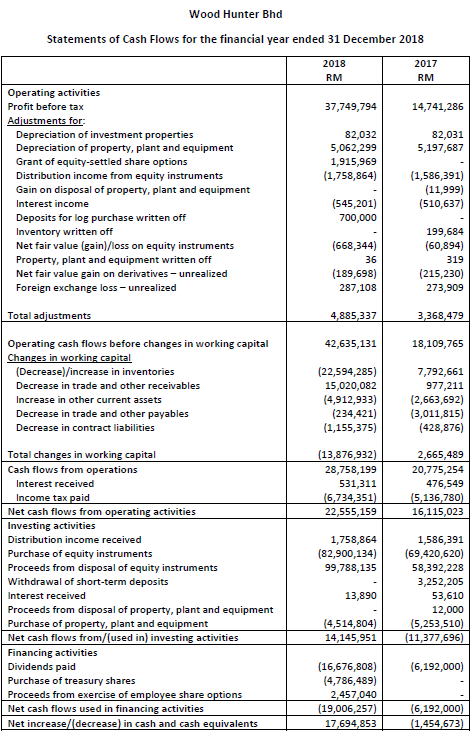

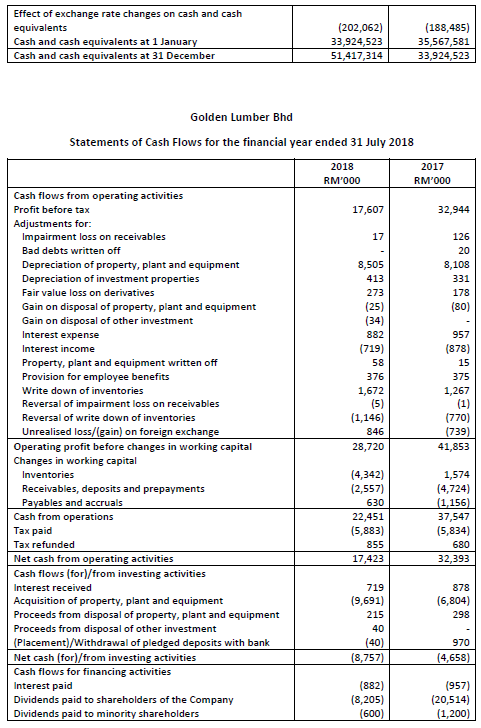

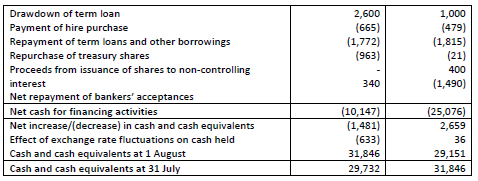

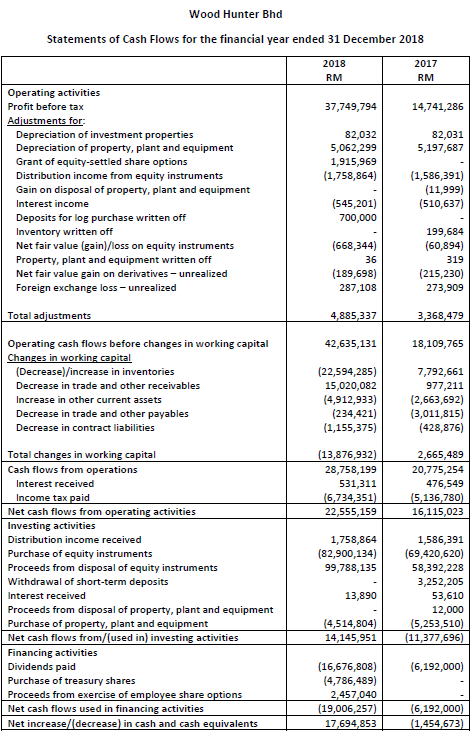

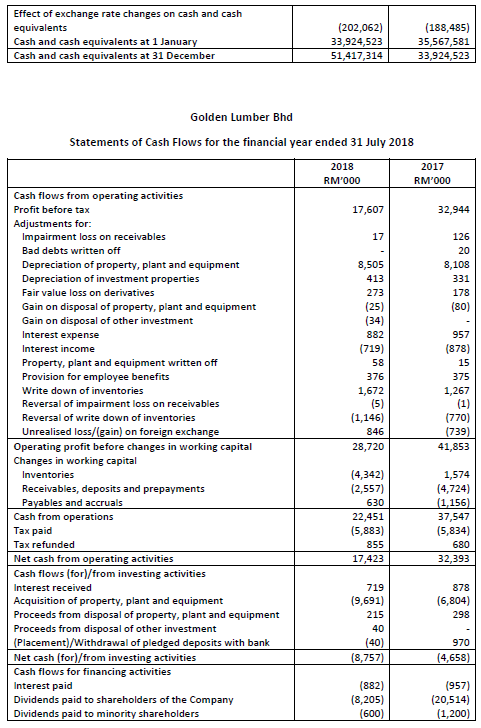

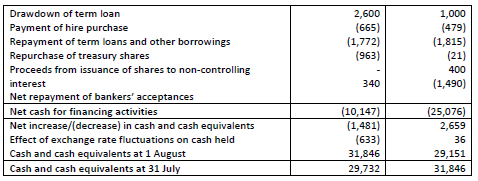

Wood Hunter Bhd Statements of Cash Flows for the financial year ended 31 December 2018 2018 RM 2017 RM 37,749,794 14,741,286 82,031 5,197,687 82,032 5,062,299 1,915,969 (1,758,864) Operating activities Profit before tax Adjustments for: Depreciation of investment properties Depreciation of property, plant and equipment Grant of equity-settled share options Distribution income from equity instruments Gain on disposal of property, plant and equipment Interest income Deposits for log purchase written off Inventory written off Net fair value (gain)/loss on equity instruments Property, plant and equipment written off Net fair value gain on derivatives - unrealized Foreign exchange loss - unrealized (1,586,391) (11,999) (510,637) (545,201) 700,000 (668,344) 36 (189,698) 287,108 199,684 (60,894) 319 (215,230) 273,909 Total adjustments 4,885,337 3,368,479 42,635,131 18,109,765 Operating cash flows before changes in working capital Changes in working capital (Decrease]/increase in inventories Decrease in trade and other receivables Increase in other current assets Decrease in trade and other payables Decrease in contract liabilities (22,594,285) 15,020,082 (4,912,933) (234,421) (1,155,375) 7,792,661 977,211 (2,663,692) (3,011,815) (428,876) (13,876,932) 28,758,199 531,311 16,734,351) 22,555,159 2,665,489 20,775,254 476,549 (5,136,780) 16,115,023 1,758,864 (82,900,134) 99,788,135 Total changes in working capital Cash flows from operations Interest received Income tax paid Net cash flows from operating activities Investing activities Distribution income received Purchase of equity instruments Proceeds from disposal of equity instruments Withdrawal of short-term deposits Interest received Proceeds from disposal of property, plant and equipment Purchase of property, plant and equipment Net cash flows from/(used in) investing activities Financing activities Dividends paid Purchase of treasury shares Proceeds from exercise of employee share options Net cash flows used in financing activities Net increase/ decrease) in cash and cash equivalents 1,586,391 (69,420,620) 58,392,228 3,252,205 53,610 12,000 (5,253,510) (11,377,696) 13,890 (4,514,804) 14,145,951 (6,192,000) (16,676,808) (4,786,489) 2,457,040 (19,006, 257) 17,694,853 (6,192,000) (1,454,673) Effect of exchange rate changes on cash and cash equivalents Cash and cash equivalents at 1 January Cash and cash equivalents at 31 December (202,062) 33,924,523 51,417,314 (188,485) 35,567,581 33,924,523 331 Golden Lumber Bhd Statements of Cash Flows for the financial year ended 31 July 2018 2018 2017 RM'000 RM'000 Cash flows from operating activities Profit before tax 17,607 32,944 Adjustments for: Impairment loss on receivables 17 126 Bad debts written off 20 Depreciation of property, plant and equipment 8,505 8,108 Depreciation of investment properties 413 Fair value loss on derivatives 273 178 Gain on disposal of property, plant and equipment (25) (80) Gain on disposal of other investment (34) Interest expense 882 957 Interest income (719) (878) Property, plant and equipment written off 58 15 Provision for employee benefits 376 375 Write down of inventories 1,672 1,267 Reversal of impairment loss on receivables (5) (1) Reversal of write down of inventories (1,146) (770) Unrealised loss/(gain) on foreign exchange 846 (739) Operating profit before changes in working capital 28,720 41,853 Changes in working capital Inventories (4,342) 1,574 Receivables, deposits and prepayments (2,557) (4,724) Payables and accruals 630 (1.156) Cash from operations 22,451 37,547 Tax paid (5,883) (5,834) Tax refunded 855 680 Net cash from operating activities 17,423 32,393 Cash flows (for)/from investing activities Interest received 719 878 Acquisition of property, plant and equipment (9,691) (6,804) Proceeds from disposal of property, plant and equipment 215 298 Proceeds from disposal of other investment 40 Placement)/Withdrawal of pledged deposits with bank (40) 970 Net cash (for)/from investing activities (8,757) (4,658) Cash flows for financing activities Interest paid (882) (957) Dividends paid to shareholders of the Company (8,205) (20,514) Dividends paid to minority shareholders (600) (1,200) 2,600 (665) (1,772) (963) 1,000 (479) (1,815) (21) 400 (1,490) 340 Drawdown of term loan Payment of hire purchase Repayment of term loans and other borrowings Repurchase of treasury shares Proceeds from issuance of shares to non-controlling interest Net repayment of bankers' acceptances Net cash for financing activities Net increase/(decrease) in cash and cash equivalents Effect of exchange rate fluctuations on cash held Cash and cash equivalents at 1 August Cash and cash equivalents at 31 July (10,147) (1,481) (633) 31,846 29,732 (25,076) 2,659 36 29,151 31,846 Wood Hunter Bhd Statements of Cash Flows for the financial year ended 31 December 2018 2018 RM 2017 RM 37,749,794 14,741,286 82,031 5,197,687 82,032 5,062,299 1,915,969 (1,758,864) Operating activities Profit before tax Adjustments for: Depreciation of investment properties Depreciation of property, plant and equipment Grant of equity-settled share options Distribution income from equity instruments Gain on disposal of property, plant and equipment Interest income Deposits for log purchase written off Inventory written off Net fair value (gain)/loss on equity instruments Property, plant and equipment written off Net fair value gain on derivatives - unrealized Foreign exchange loss - unrealized (1,586,391) (11,999) (510,637) (545,201) 700,000 (668,344) 36 (189,698) 287,108 199,684 (60,894) 319 (215,230) 273,909 Total adjustments 4,885,337 3,368,479 42,635,131 18,109,765 Operating cash flows before changes in working capital Changes in working capital (Decrease]/increase in inventories Decrease in trade and other receivables Increase in other current assets Decrease in trade and other payables Decrease in contract liabilities (22,594,285) 15,020,082 (4,912,933) (234,421) (1,155,375) 7,792,661 977,211 (2,663,692) (3,011,815) (428,876) (13,876,932) 28,758,199 531,311 16,734,351) 22,555,159 2,665,489 20,775,254 476,549 (5,136,780) 16,115,023 1,758,864 (82,900,134) 99,788,135 Total changes in working capital Cash flows from operations Interest received Income tax paid Net cash flows from operating activities Investing activities Distribution income received Purchase of equity instruments Proceeds from disposal of equity instruments Withdrawal of short-term deposits Interest received Proceeds from disposal of property, plant and equipment Purchase of property, plant and equipment Net cash flows from/(used in) investing activities Financing activities Dividends paid Purchase of treasury shares Proceeds from exercise of employee share options Net cash flows used in financing activities Net increase/ decrease) in cash and cash equivalents 1,586,391 (69,420,620) 58,392,228 3,252,205 53,610 12,000 (5,253,510) (11,377,696) 13,890 (4,514,804) 14,145,951 (6,192,000) (16,676,808) (4,786,489) 2,457,040 (19,006, 257) 17,694,853 (6,192,000) (1,454,673) Effect of exchange rate changes on cash and cash equivalents Cash and cash equivalents at 1 January Cash and cash equivalents at 31 December (202,062) 33,924,523 51,417,314 (188,485) 35,567,581 33,924,523 331 Golden Lumber Bhd Statements of Cash Flows for the financial year ended 31 July 2018 2018 2017 RM'000 RM'000 Cash flows from operating activities Profit before tax 17,607 32,944 Adjustments for: Impairment loss on receivables 17 126 Bad debts written off 20 Depreciation of property, plant and equipment 8,505 8,108 Depreciation of investment properties 413 Fair value loss on derivatives 273 178 Gain on disposal of property, plant and equipment (25) (80) Gain on disposal of other investment (34) Interest expense 882 957 Interest income (719) (878) Property, plant and equipment written off 58 15 Provision for employee benefits 376 375 Write down of inventories 1,672 1,267 Reversal of impairment loss on receivables (5) (1) Reversal of write down of inventories (1,146) (770) Unrealised loss/(gain) on foreign exchange 846 (739) Operating profit before changes in working capital 28,720 41,853 Changes in working capital Inventories (4,342) 1,574 Receivables, deposits and prepayments (2,557) (4,724) Payables and accruals 630 (1.156) Cash from operations 22,451 37,547 Tax paid (5,883) (5,834) Tax refunded 855 680 Net cash from operating activities 17,423 32,393 Cash flows (for)/from investing activities Interest received 719 878 Acquisition of property, plant and equipment (9,691) (6,804) Proceeds from disposal of property, plant and equipment 215 298 Proceeds from disposal of other investment 40 Placement)/Withdrawal of pledged deposits with bank (40) 970 Net cash (for)/from investing activities (8,757) (4,658) Cash flows for financing activities Interest paid (882) (957) Dividends paid to shareholders of the Company (8,205) (20,514) Dividends paid to minority shareholders (600) (1,200) 2,600 (665) (1,772) (963) 1,000 (479) (1,815) (21) 400 (1,490) 340 Drawdown of term loan Payment of hire purchase Repayment of term loans and other borrowings Repurchase of treasury shares Proceeds from issuance of shares to non-controlling interest Net repayment of bankers' acceptances Net cash for financing activities Net increase/(decrease) in cash and cash equivalents Effect of exchange rate fluctuations on cash held Cash and cash equivalents at 1 August Cash and cash equivalents at 31 July (10,147) (1,481) (633) 31,846 29,732 (25,076) 2,659 36 29,151 31,846