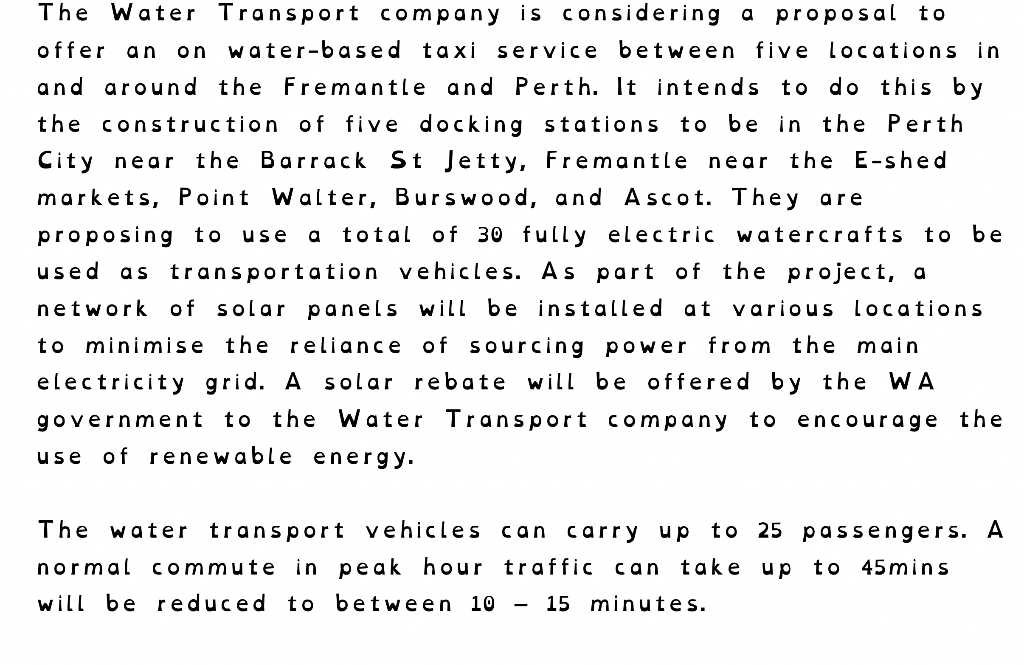

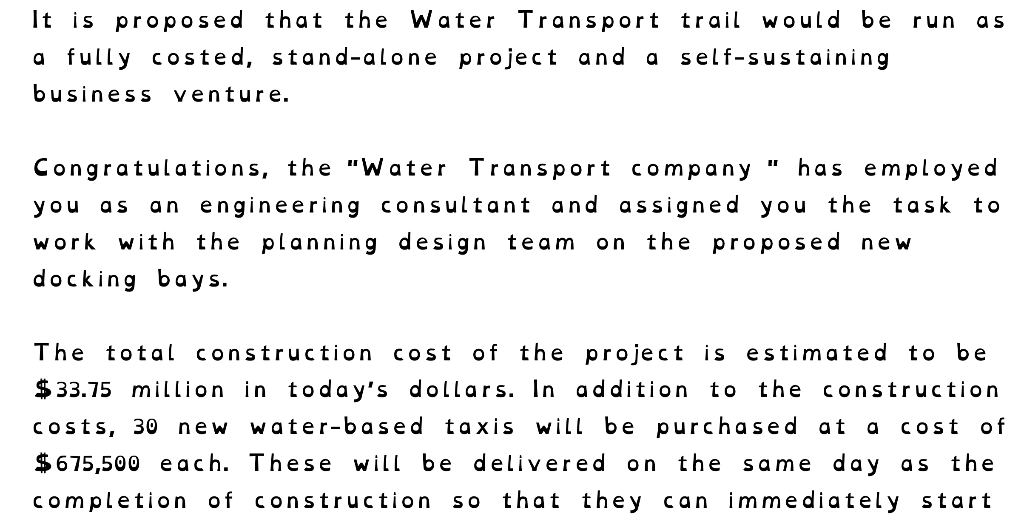

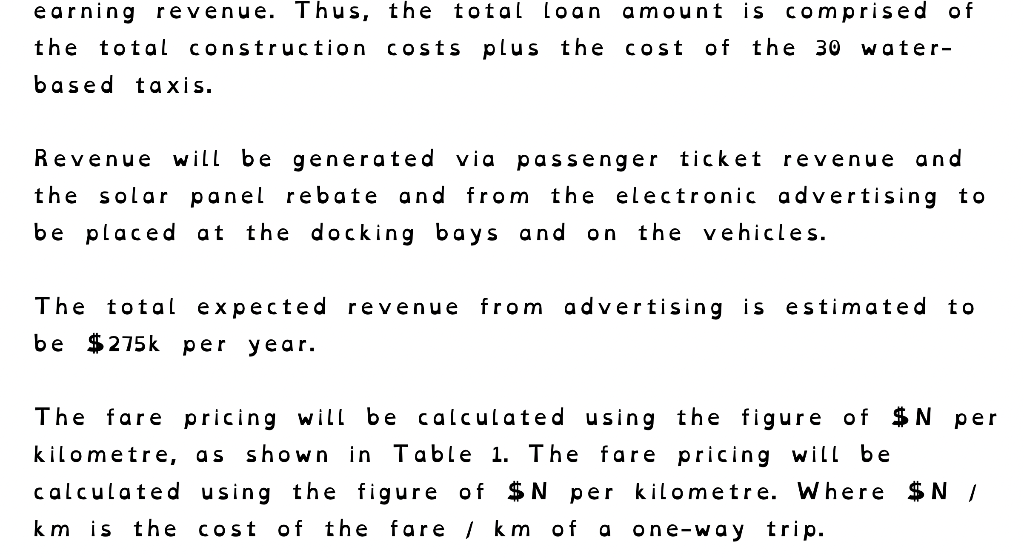

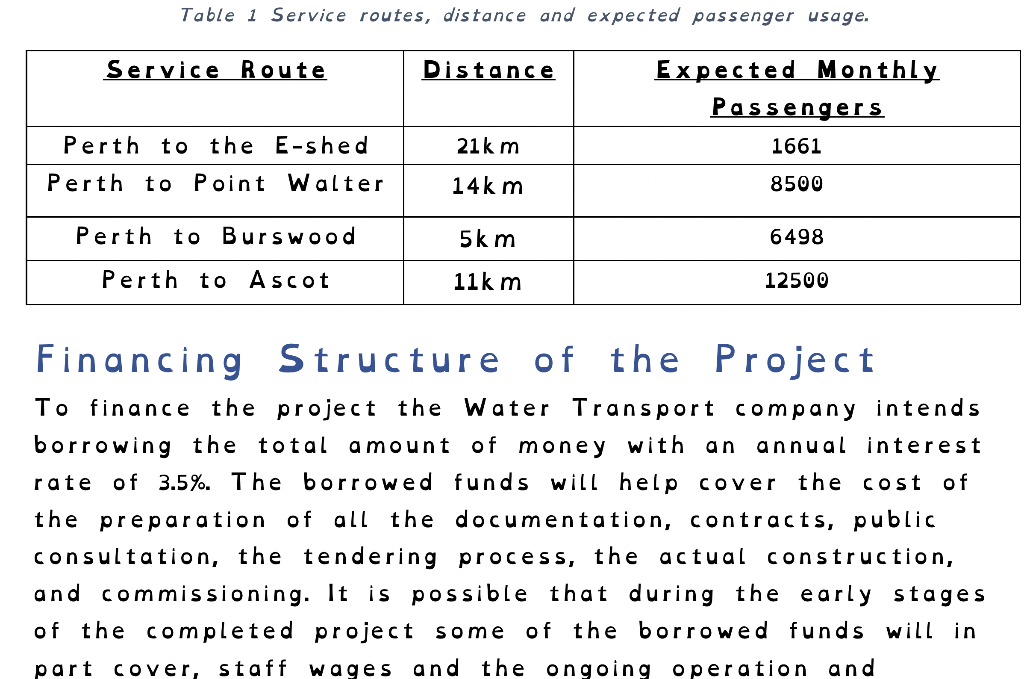

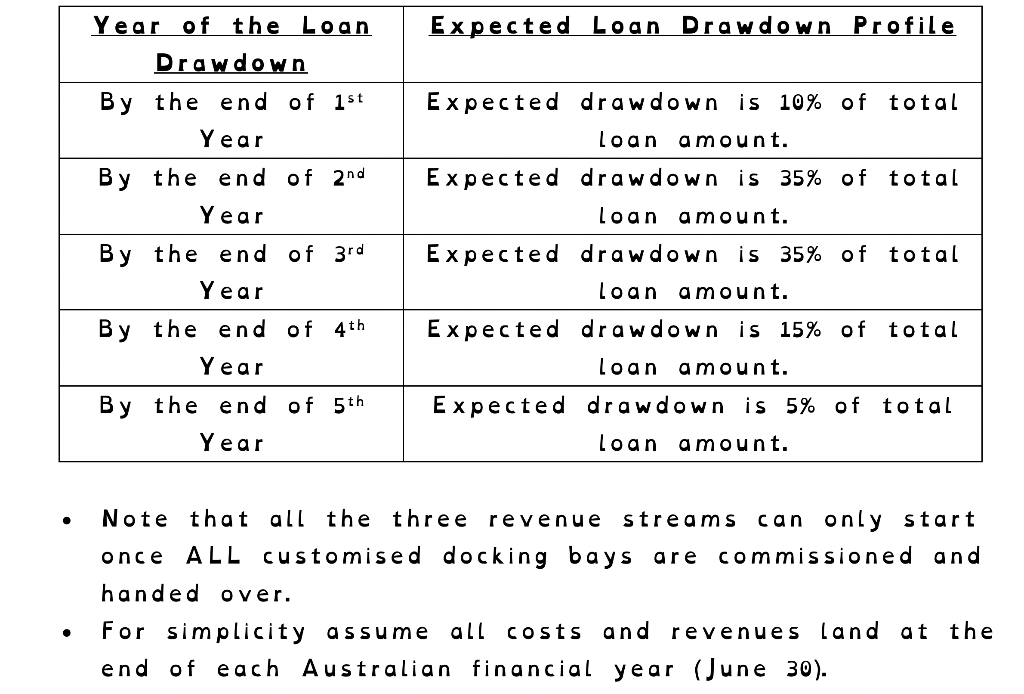

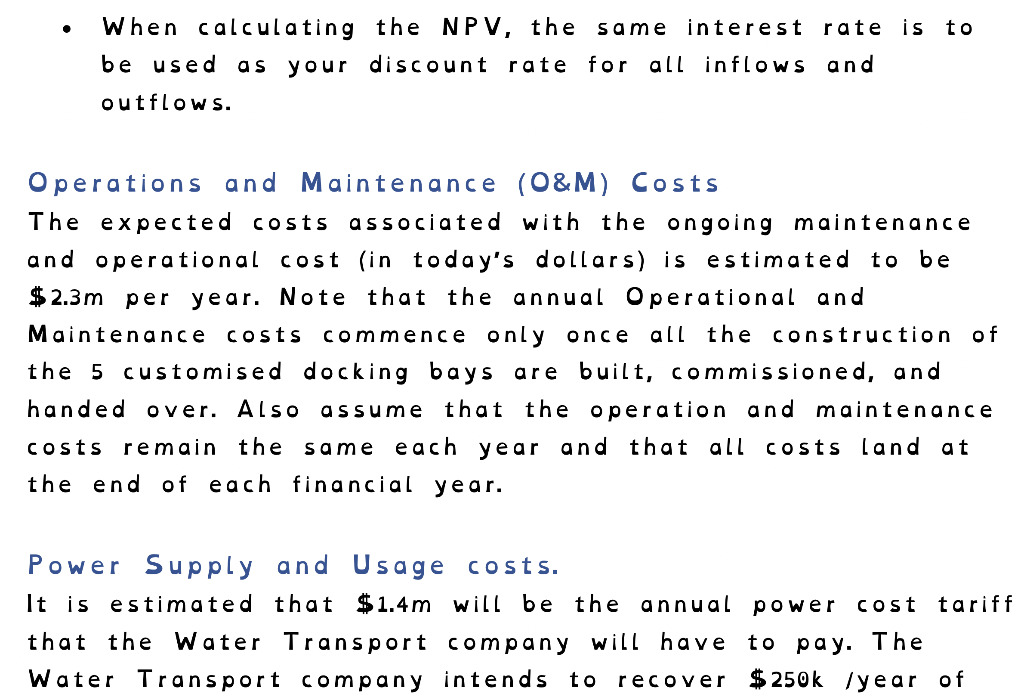

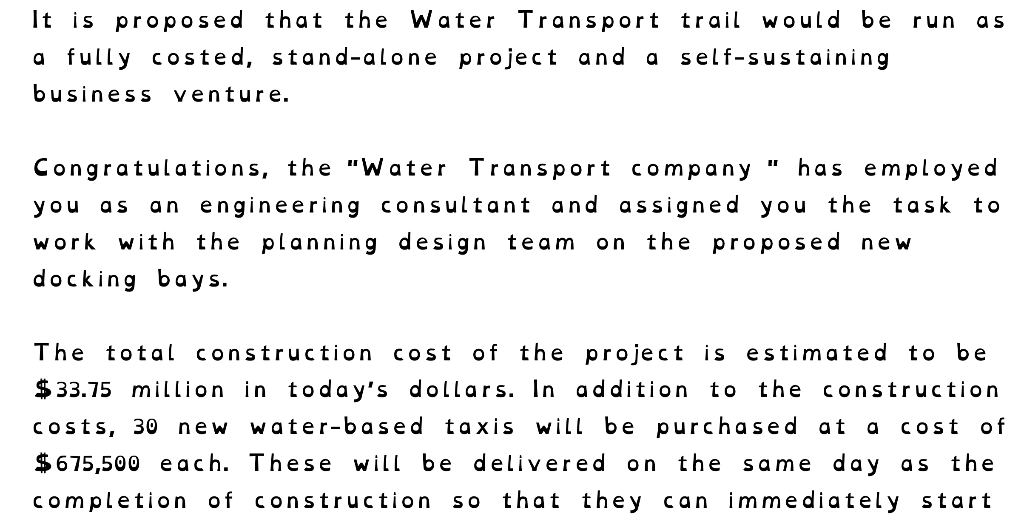

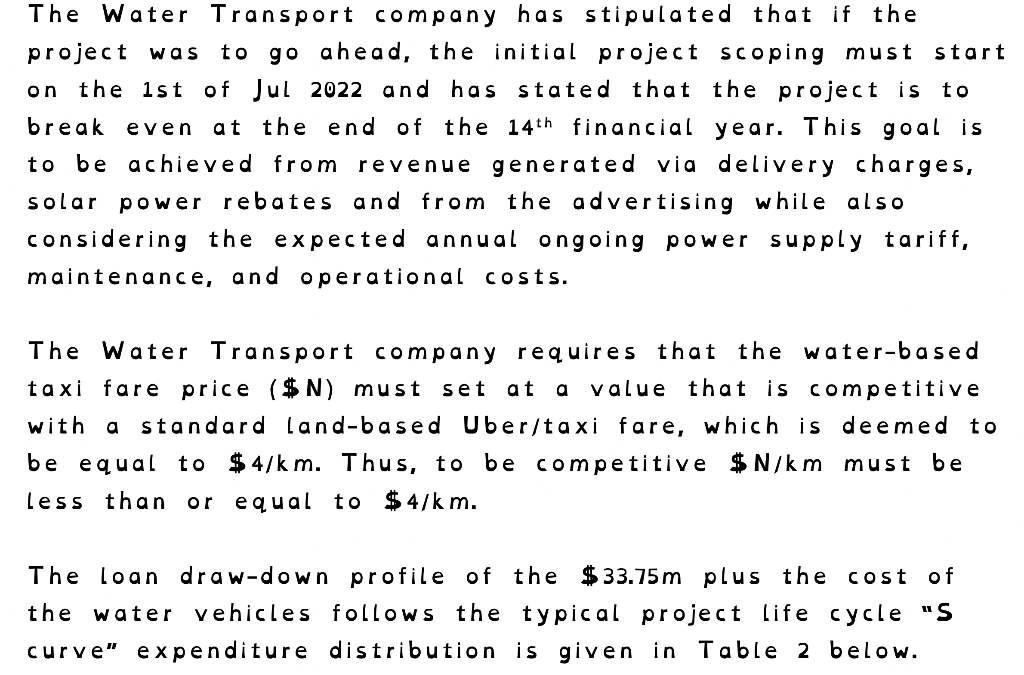

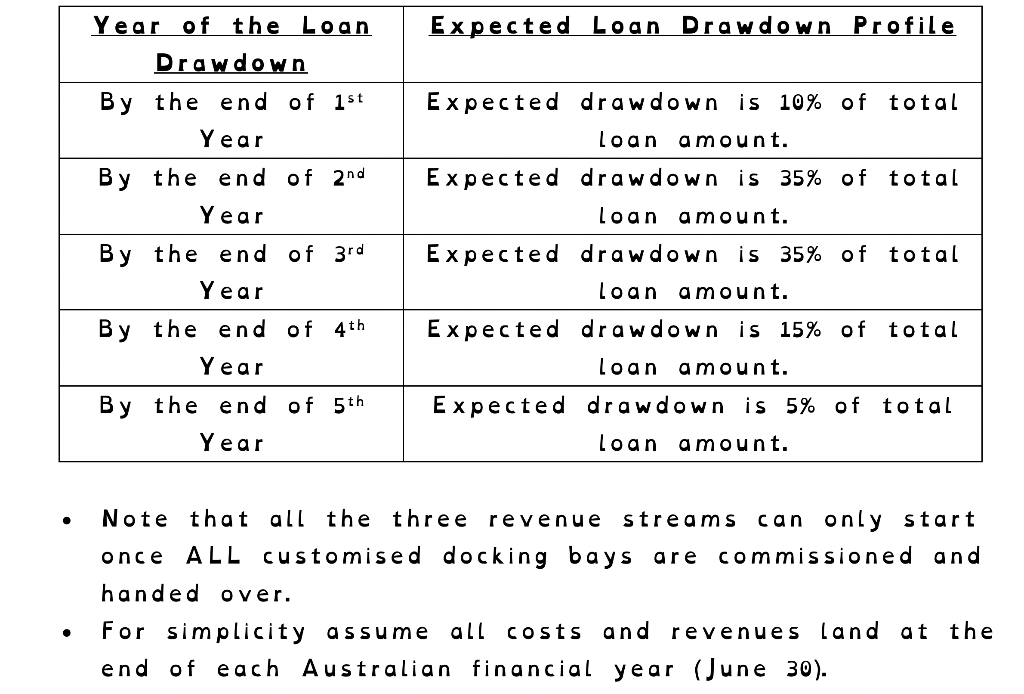

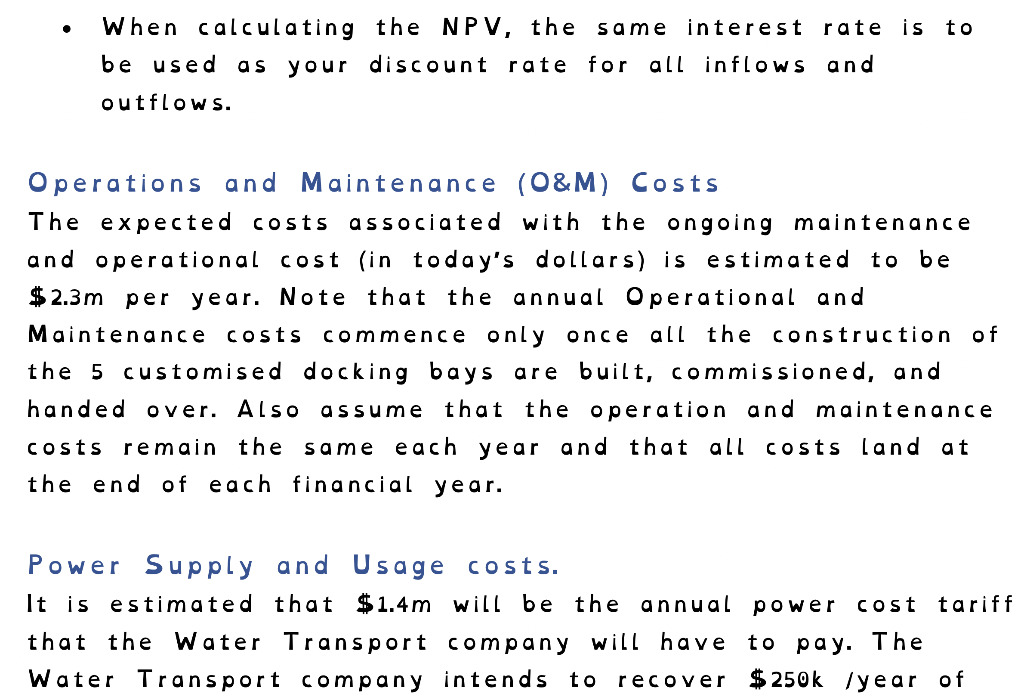

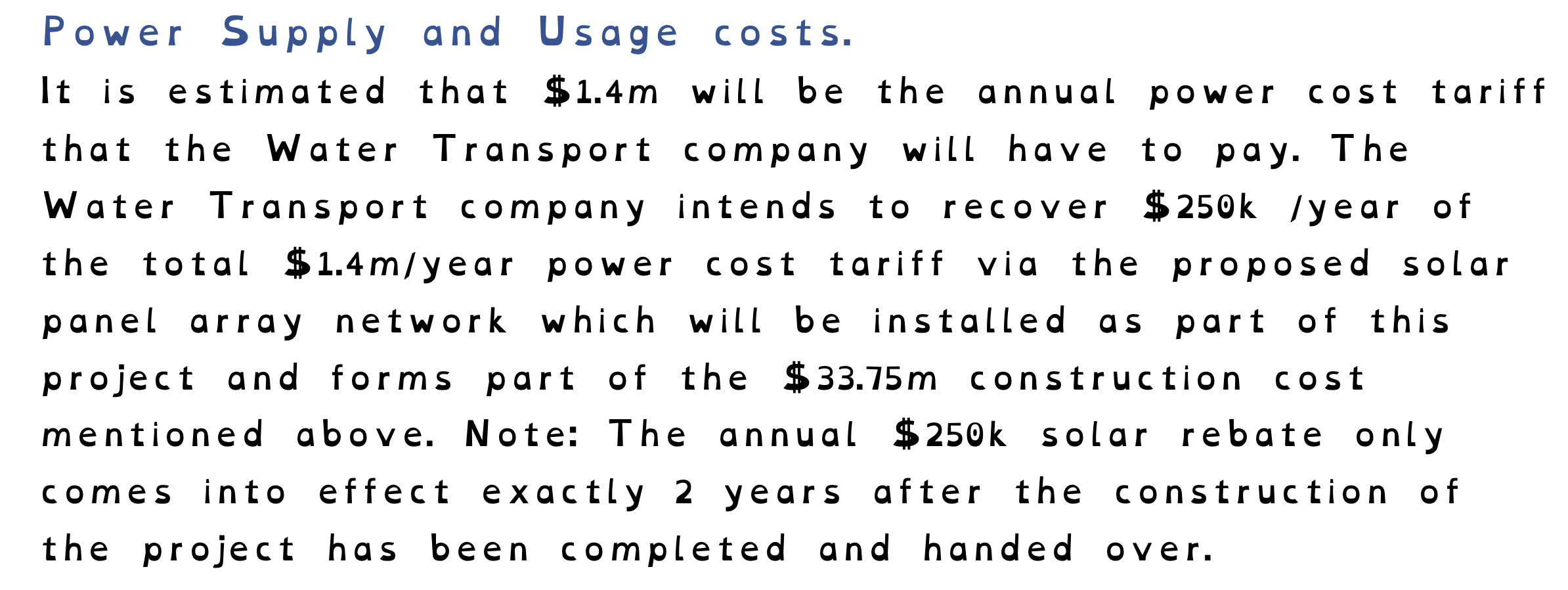

are The Water Transport company is considering a proposal to offer an on water-based taxi service between five locations in and around the Fremantle and Perth. It intends to do this by the construction of five docking stations to be in the Perth City near the Barrack St Jetty, Fremantle near the E-shed markets, Point Walter, Burswood, and Ascot. They proposing to use total of 30 fully electric watercrafts to be used as transportation vehicles. As part of the project, a network of solar panels will be installed at various locations to minimise the reliance of sourcing power from the main electricity grid. A solar rebate will be offered by the WA government to the Water Transport company to encourage the of renewable energy. a use The water transport vehicles can carry up to 25 passengers. A normal commute in peak hour traffic can take up to 45mins will be reduced to between 10 15 minutes. as It is proposed that the Water Transport trail would be run a fully costed, stand-alone project and a self-sustaining business venture. II Congratulations, the "Water Transport company has employed you as an engineering consultant and assigned you the task to work with the planning design team the proposed new docking bays. on The total construction cost of the project is estimated to be $ 33.75 million in today's dollars. In addition to the construction costs, 30 new water-based taxis will be purchased at a cost of $ 675,500 each These will e delivered on th same day as the completion of construction that they can immediately start SO earning revenue. Thus, the total loan amount is comprised of the total construction costs plus the cost of the 30 water- based taxis. Revenue will be generated via passenger ticket revenue and the solar panel rebate and from the electronic advertising to be placed at the docking bays and on the vehicles. The total expected revenue be $275k per year. from advertising is estimated to The fare pricing will be calculated using the figure of $ N per kilometre, as shown in Table 1. The fare pricing will be calculated using the figure of $ N per kilometre. Where $ N / km is the cost of the fare l km of a one-way trip. Table 1 Service routes, distance and expected passenger usage. Service Route Distance Expected Monthly Passengers 1661 21 km Perth to the E-shed Perth to Point Walter 14 km 8500 Perth to Burswood 5 km 6498 Perth to Ascot 11km 12500 Financing Structure of the Project To finance the project the Water Transport company intends borrowing the total amount of money with an annual interest rate of 3.5%. The borrowed funds will help cover the cost of the preparation of all the documentation, contracts, public consultation, the tendering process, the actual construction, and commissioning. It is possible that during the early stages of the completed project some of the borrowed funds will in part cover, staff wages and the ongoing operation and of the completed project some of the borrowed funds will in part cover, staff wages and the ongoing operation and maintenance costs. The proposed financing arrangement for the loan is to be financed over a 14-year a 14-year period. The Water Transport company has stipulated that if the project was to go ahead, the initial project scoping must start on the 1st of Jul 2022 and has stated that the project is to break even at the end of the 14th financial year. This goal is to be achieved from revenue generated via delivery charges, solar power rebates and from the advertising while also considering the expected annual ongoing power supply tariff, maintenance, and operational costs. The Water Transport company requires that the water-based taxi fare price ($N) must set at a value that is competitive with a standard land-based Uber/taxi fare, which is deemed to be equal to $ 4/km. Thus, to be competitive $ N/km must be less than or equal to $4/km. The loan draw-down profile of the $33.75m plus the cost of the water vehicles follows the typical project life cycle "S curve" expenditure distribution is given in Table 2 below. Expected Loan Drawdown Profile Year of the Loan Drawdown By the end of 1st Year By the end of 2nd Year By the end of 3rd Year By the end of 4th Year By the end of 5th Year Expected drawdown is 10% of total loan a mount. Expected drawdown is 35% of total loan amount. Expected drawdown is 35% of total Loan amount. Expected drawdown is 15% of total loan amount. Expected drawdown is 5% of total loan amount. . Note that all the three revenue streams can only start once ALL customised docking bays are commissioned and handed over. For simplicity assume all costs and revenues land at the end of each Australian financial year (June 30). When calculating the NPV, the same interest rate is to be used as your discount rate for all inflows and outflows. Operations and Maintenance (O&M) Costs The expected costs associated with the ongoing maintenance and operational cost (in today's dollars) is estimated to be $ 2.3m per year. Note that the annual Operational and Maintenance costs commence only once all the construction of the 5 customised docking bays are built, commissioned, and handed over. Also assume that the operation and maintenance costs remain the same each year and that all costs land at the end of each financial year. Power Supply and Usage costs. It is estimated that $1.4m will be the annual power cost tariff that the Water Transport company will have to pay. The Water Transport company intends $ 250k year of to recover Power Supply and Usage costs. It is estimated that $ 1.4m will be the annual power cost tariff that the Water Transport company will have to pay. The Water Transport company intends to recover $250k /year of the total $ 1.4 m/year power cost tariff via the proposed solar panel array network which will be installed as part of this project and forms part of the $33.75m construction cost mentioned above. Note: The annual $250k solar rebate only comes into effect exactly 2 years after the construction of the project has been completed and handed over. 6. The project is to break even at the end of 14 years (this includes all feasibility and construction times). By calculating the value of $N, the value of $ N, determine the taxi fare price in dollar terms per kilometre given that the Water Transport company can negotiate an interest rate of 3.5% for the total loan amount. Also comment on the competitiveness of the calculated $ N value (show your working and equations used*) [20 Mark s). even 8. You are asked to look at a further scenario, where the Water Transport company wants to set to set the taxi fare price of $ N at $ 3.40 and that the project must break at the end of 12 years using a total of 30 water vehicles. Calculate the required interest rate value to be negotiated to achieve this. Give your answer as a %, to an accuracy of seven significant figures. (Show your working and equations used to calculate this*). Comment on the calculated interest rate [20 Marks]