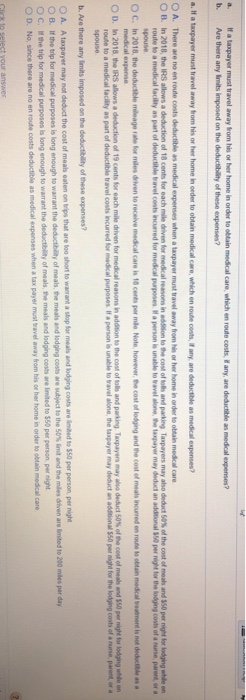

Are there any limits imposed on the deductibility of these expenses? O A. There are no en route costs deductible as medical expenses when a taxpayer must traveaway from his or her home in order to obtain medcal care 1 2018 the IRS allows a dediction of It ce bio each mle drin, for med calmas minaddlebthe cost of toh and Paling Taxpayers may also ded t50% of the cost of meals and S50 per night fr lod ng whie en route to a medical facility as part of deductible travel costs incurred for medical purposes OB Oo a person is unable to travel alone the taxpayer may deduct an additional 550 per night for the lodging costs of a nurse parent, or spouse In t medical expese the deducible" eage iale lo mas d'entorece e medcal care is 18ceti-mae Note however -cost od odgng and re cost of meals i umed o' rote to cun medea-ement is noe de ctble as a reasons n adak nt, th, e se otus and p-ing Taxpayer, may also deu t 50% one cost of mesh and SS nani neies arenada adi, a route to a medical facility as part of deductible travel costs incurred for medical purposes If a person is unable to travel alone, the taxpayer may deduct an additional $50 per night for the lodging costs of a nuse,parent or a spouse sor each ma, an enfor medica per nght lodge g whi on b. Are there any limits imposed on the deductibility of these expenses? OA. A taxpayer may O B. If the trip for medical purposes is long not deduct the cost of meals eaten on trips that are too short to warrant a stop for meals and lodging costs are lmbed to 550 per person, per night or meals, te meals and lodging costs are sulpect to the 50% limt and the nies dien are limited to 200 miles per day O C. If the trip for medical to warrant the deductibility of meals, the meals and lodging costs are limited to $50 per person,per night D. No, since there are no en route costs deductible as medical expenses when a tax payer must tavel away hom his or her Are there any limits imposed on the deductibility of these expenses? O A. There are no en route costs deductible as medical expenses when a taxpayer must traveaway from his or her home in order to obtain medcal care 1 2018 the IRS allows a dediction of It ce bio each mle drin, for med calmas minaddlebthe cost of toh and Paling Taxpayers may also ded t50% of the cost of meals and S50 per night fr lod ng whie en route to a medical facility as part of deductible travel costs incurred for medical purposes OB Oo a person is unable to travel alone the taxpayer may deduct an additional 550 per night for the lodging costs of a nurse parent, or spouse In t medical expese the deducible" eage iale lo mas d'entorece e medcal care is 18ceti-mae Note however -cost od odgng and re cost of meals i umed o' rote to cun medea-ement is noe de ctble as a reasons n adak nt, th, e se otus and p-ing Taxpayer, may also deu t 50% one cost of mesh and SS nani neies arenada adi, a route to a medical facility as part of deductible travel costs incurred for medical purposes If a person is unable to travel alone, the taxpayer may deduct an additional $50 per night for the lodging costs of a nuse,parent or a spouse sor each ma, an enfor medica per nght lodge g whi on b. Are there any limits imposed on the deductibility of these expenses? OA. A taxpayer may O B. If the trip for medical purposes is long not deduct the cost of meals eaten on trips that are too short to warrant a stop for meals and lodging costs are lmbed to 550 per person, per night or meals, te meals and lodging costs are sulpect to the 50% limt and the nies dien are limited to 200 miles per day O C. If the trip for medical to warrant the deductibility of meals, the meals and lodging costs are limited to $50 per person,per night D. No, since there are no en route costs deductible as medical expenses when a tax payer must tavel away hom his or her