Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Are these correct? if not please, show process. thank you so much As discussed in the text, in the absence of market imperfections and tax

Are these correct? if not please, show process. thank you so much

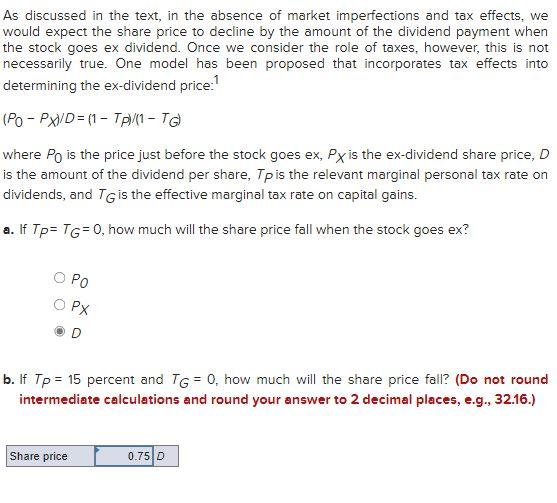

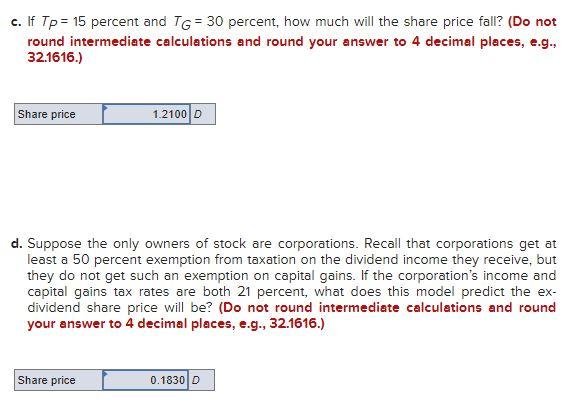

As discussed in the text, in the absence of market imperfections and tax effects, we would expect the share price to decline by the amount of the dividend payment when the stock goes ex dividend. Once we consider the role of taxes, however, this is not necessarily true. One model has been proposed that incorporates tax effects into determining the ex-dividend price: 1 (P0PX)/D=(1TP)/(1TG) where P0 is the price just before the stock goes ex, PX is the ex-dividend share price, D is the amount of the dividend per share, Tp is the relevant marginal personal tax rate on dividends, and TG is the effective marginal tax rate on capital gains. a. If TP=TG=0, how much will the share price fall when the stock goes ex? POPXD b. If TP=15 percent and TG=0, how much will the share price fall? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. If TP=15 percent and TG=30 percent, how much will the share price fall? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.) d. Suppose the only owners of stock are corporations. Recall that corporations get at least a 50 percent exemption from taxation on the dividend income they receive, but they do not get such an exemption on capital gains. If the corporation's income and capital gains tax rates are both 21 percent, what does this model predict the exdividend share price will be? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started