Are these correct ? please only correct me if It's wrong

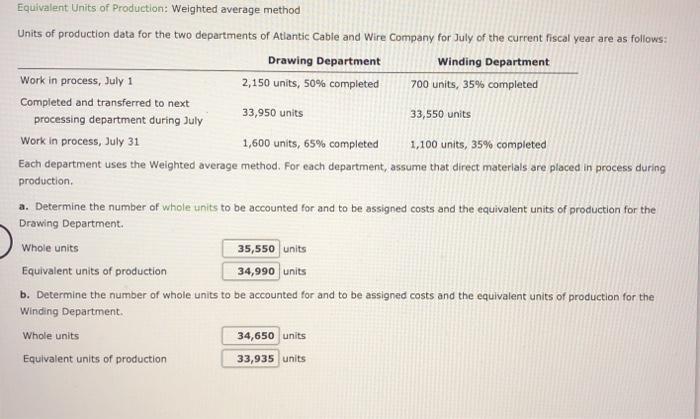

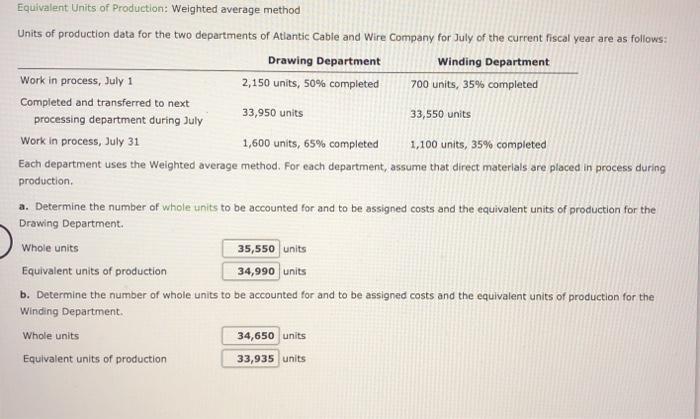

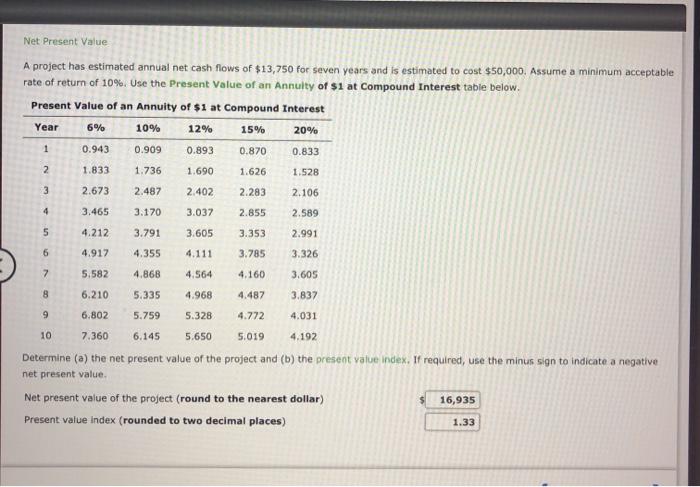

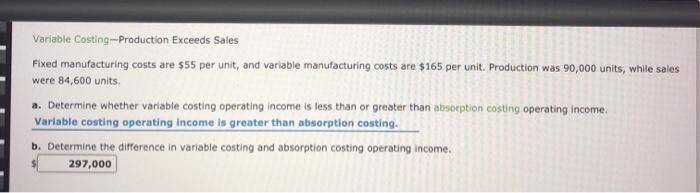

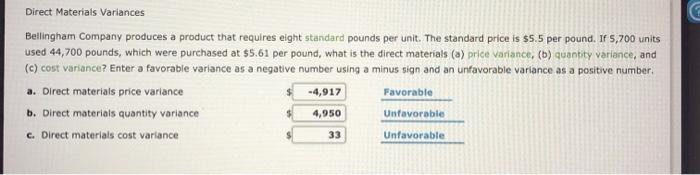

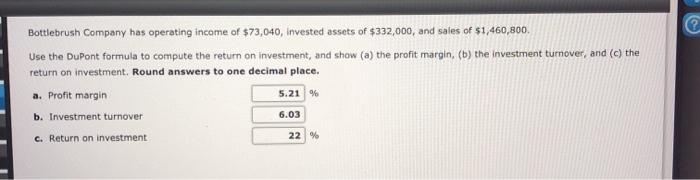

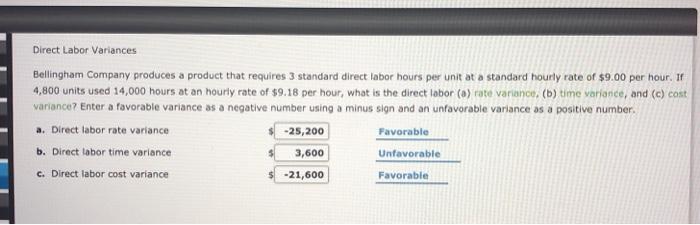

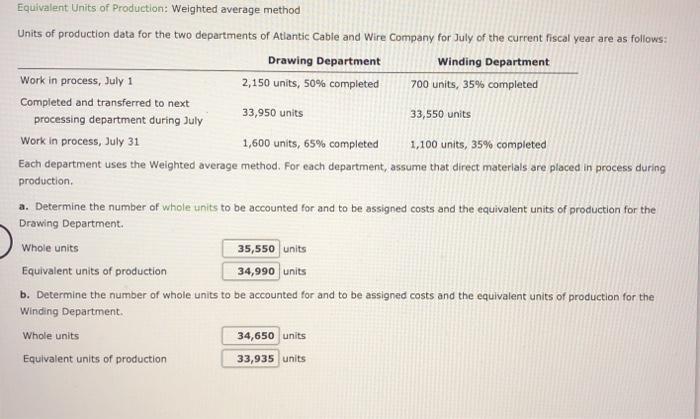

Equivalent Units of Production: Weighted average method Units of production data for the two departments of Atlantic Cable and Wire Company for July of the current fiscal year are as follows: Drawing Department Winding Department Work in process, July 1 2,150 units, 50% completed 700 units, 35% completed Completed and transferred to next 33,950 units 33,550 units processing department during July Work in process, July 31 1,600 units, 65% completed 1,100 units, 35% completed Each department uses the weighted average method. For each department, assume that direct materials are placed in process during production. a. Determine the number of whole units to be accounted for and to be assigned costs and the equivalent units of production for the Drawing Department Whole units 35,550 units Equivalent units of production 34,990 units b. Determine the number of whole units to be accounted for and to be assigned costs and the equivalent units of production for the Winding Department. Whole units 34,650 units Equivalent units of production 33,935 units Net Present Value A project has estimated annual net cash flows of $13,750 for seven years and is estimated to cost $50,000. Assume a minimum acceptable rate of return of 10%. Use the Present Value of an Annulty of $1 at Compound Interest table below. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 4.192 6.145 5.650 5.019 Determine (a) the net present value of the project and (b) the present value Index. If required, use the minus sign to indicate a negative net present value Net present value of the project (round to the nearest dollar) 16,935 Present value index (rounded to two decimal places) 1.33 Variable Costing--Production Exceeds Sales Fixed manufacturing costs are $55 per unit, and variable manufacturing costs are $165 per unit. Production was 90,000 units, while sales were 84,600 units a. Determine whether variable costing operating income is less than or greater than absorption costing operating income. Variable costing operating income is greater than absorption costing. b. Determine the difference in variable costing and absorption costing operating income. 297,000 Direct Materials Variances Bellingham Company produces a product that requires eight standard pounds per unit. The standard price is $5.5 per pound. If 5,700 units used 44,700 pounds, which were purchased at $5.61 per pound, what is the direct materials (a) price variance, (b) quantity variance, and (c) cost variance? Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. a. Direct materials price variance -4,917 Favorable b. Direct materials quantity variance 4,950 Unfavorable c. Direct materials cost variance Unfavorable 33 2 Bottlebrush Company has operating income of $73,040, invested assets of $332,000, and sales of $1,460,800. Use the DuPont formula to compute the return on investment, and show (a) the profit margin, (b) the investment tumover, and (c) the return on investment. Round answers to one decimal place. a. Profit margin b. Investment turnover 5.21 % 6.03 c. Return on investment 22 % Direct Labor Variances Bellingham Company produces a product that requires 3 standard direct labor hours per unit at a standard hourly rate of $9.00 per hour. If 4,800 units used 14,000 hours at an hourly rate of $9.18 per hour, what is the direct labor (a) rate variano, (b) time variance, and (c) cost variance? Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. a. Direct labor rate variance -25,200 Favorable b. Direct labor time variance Unfavorable c. Direct labor cost variance -21,600 Favorable 3,600