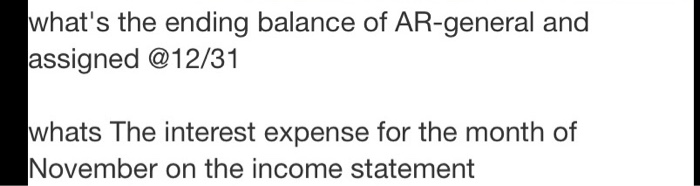

AR-general options are 377k, 323k, 341k, and 360k

AR-assigned options are 70k, 67k, 65k, and 60k

int exp options are 2550, 5000, 8626, and 7550

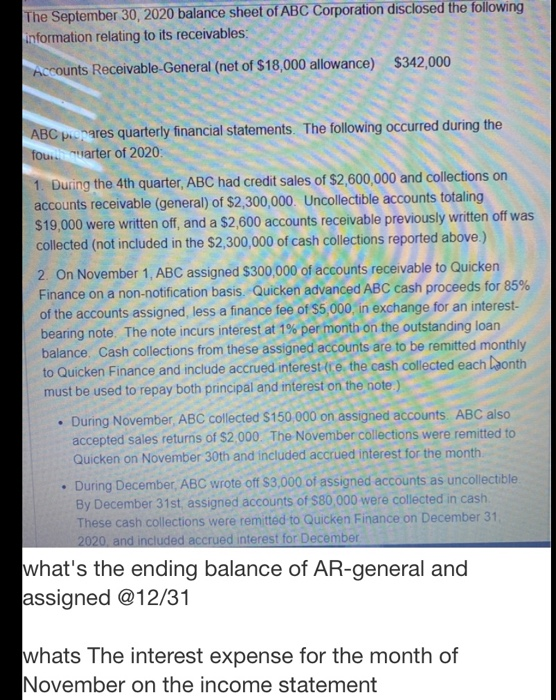

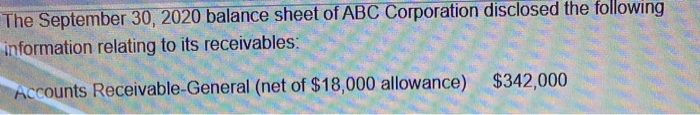

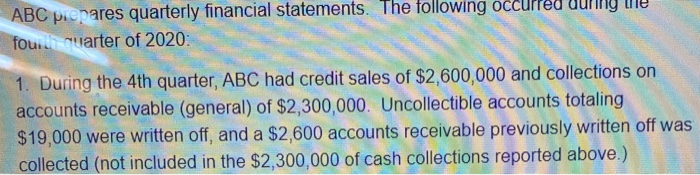

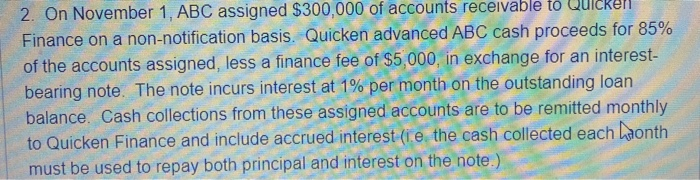

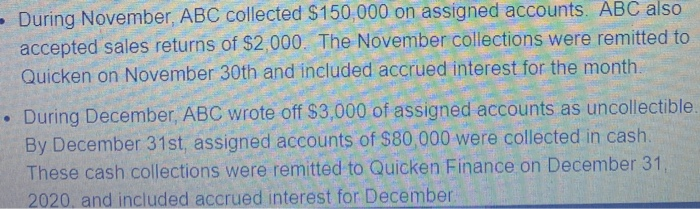

The September 30, 2020 balance sheet of ABC Corporation disclosed the following information relating to its receivables: Accounts Receivable-General (net of $18,000 allowance) $342,000 ABC prepares quarterly financial statements. The following occurred during the four Cuarter of 2020: 1. During the 4th quarter, ABC had credit sales of $2,600,000 and collections on accounts receivable (general) of $2,300,000. Uncollectible accounts totaling $19,000 were written off, and a $2,600 accounts receivable previously written off was collected (not included in the $2,300,000 of cash collections reported above.) 2. On November 1, ABC assigned $300,000 of accounts receivable to Quicken Finance on a non-notification basis. Quicken advanced ABC cash proceeds for 85% of the accounts assigned less a finance fee of $5,000, in exchange for an interest- bearing note. The note incurs interest at 1% per month on the outstanding loan balance. Cash collections from these assigned accounts are to be remitted monthly to Quicken Finance and include accrued interest (re. the cash collected each Daonth must be used to repay both principal and interest on the note.) During November, ABC collected $150,000 on assigned accounts. ABC also accepted sales returns of $2.000. The November collections were remitted to Quicken on November 30th and included accrued interest for the month. During December, ABC wrote off $3,000 of assigned accounts as uncollectible. By December 31st, assigned accounts of $80,000 were collected in cash. These cash collections were remitted to Quicken Finance on December 31 2020, and included accrued interest for December what's the ending balance of AR-general and assigned @12/31 . . whats The interest expense for the month of November on the income statement The September 30, 2020 balance sheet of ABC Corporation disclosed the following information relating to its receivables: $342,000 Accounts Receivable-General (net of $18,000 allowance) ABC prepares quarterly financial statements. The following four quarter of 2020: 1. During the 4th quarter, ABC had credit sales of $2,600,000 and collections on accounts receivable (general) of $2,300,000. Uncollectible accounts totaling $19,000 were written off, and a $2,600 accounts receivable previously written off was collected (not included in the $2,300,000 of cash collections reported above.) 2. On November 1, ABC assigned $300,000 of accounts receivable to Quick Finance on a non-notification basis. Quicken advanced ABC cash proceeds for 85% of the accounts assigned, less a finance fee of $5,000, in exchange for an interest- bearing note. The note incurs interest at 1% per month on the outstanding loan balance. Cash collections from these assigned accounts are to be remitted monthly to Quicken Finance and include accrued interest (ie the cash collected each aonth must be used to repay both principal and interest on the note.) - During November, ABC collected $150,000 on assigned accounts. ABC also accepted sales returns of $2,000. The November collections were remitted to Quicken on November 30th and included accrued interest for the month. During December, ABC wrote off $3,000 of assigned accounts as uncollectible. By December 31st, assigned accounts of $80,000 were collected in cash These cash collections were remitted to Quicken Finance on December 31, 2020, and included accrued interest for December what's the ending balance of AR-general and assigned @12/31 whats The interest expense for the month of November on the income statement