Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Arial 10 JAA = = = ale AEE Currency $ % 9 El Conditional Formatting Format as Table Cell Styles Paste BI U 60 .00

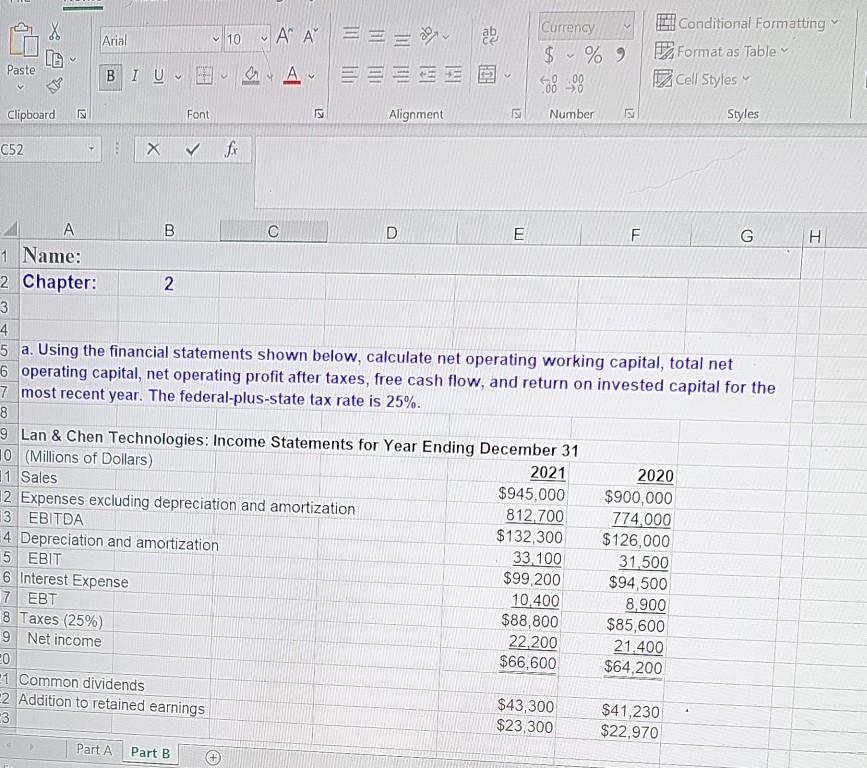

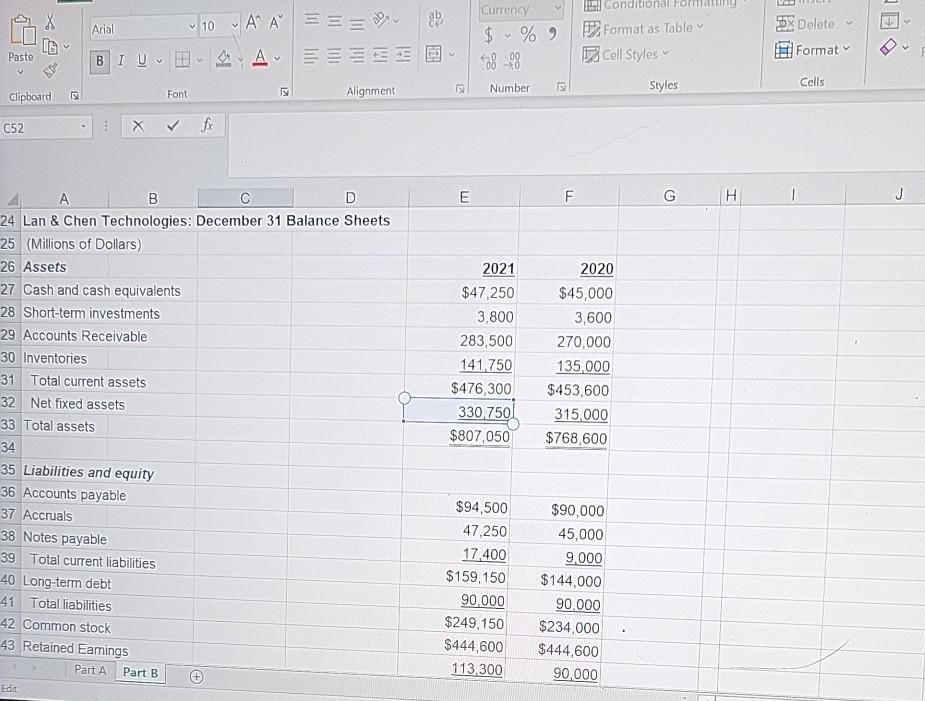

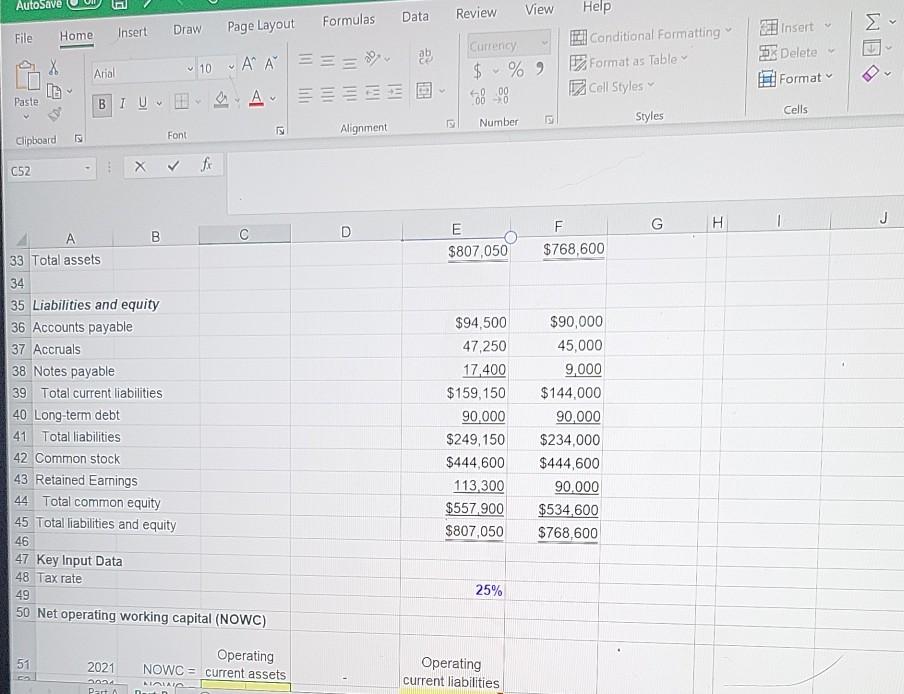

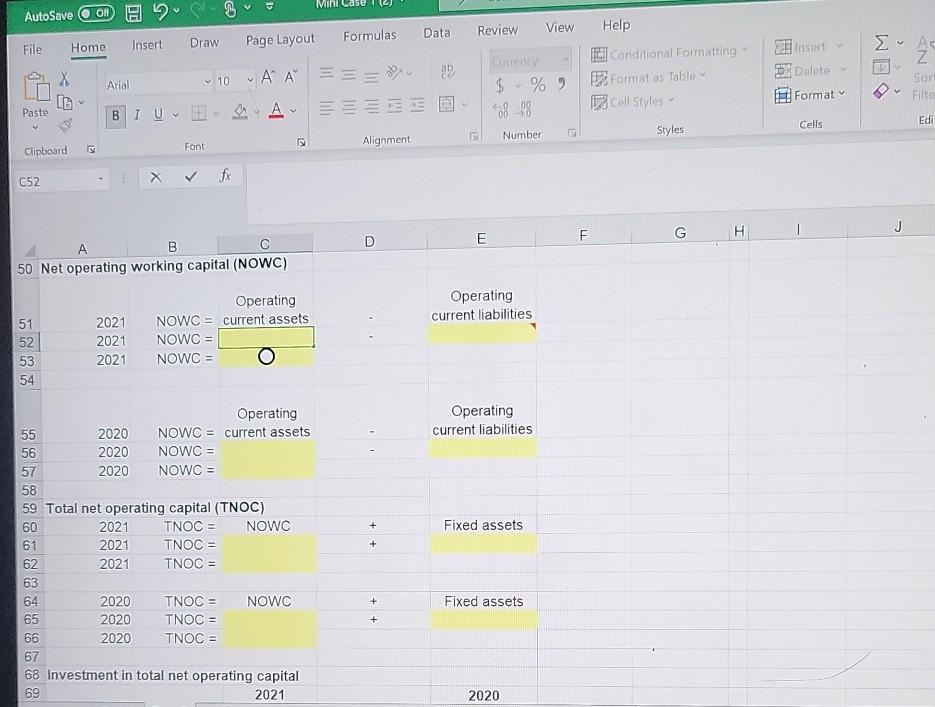

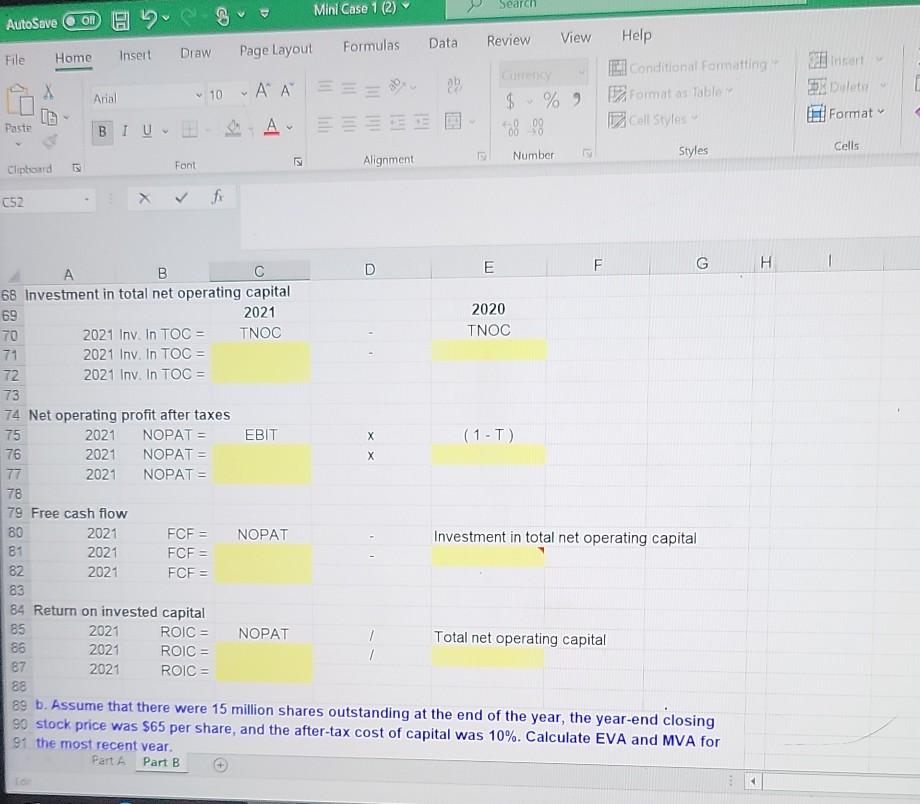

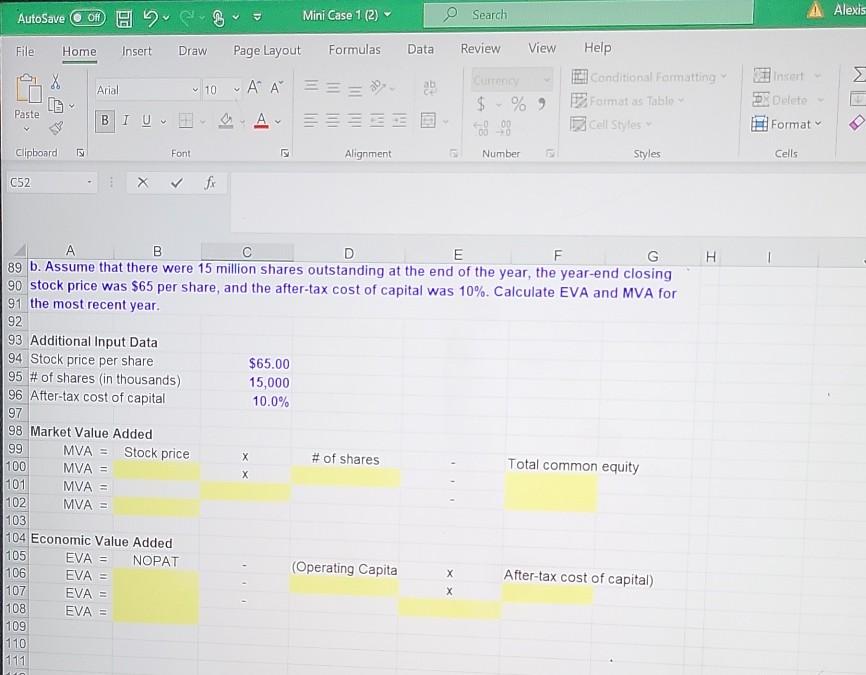

Arial 10 JAA = = = ale AEE Currency $ % 9 El Conditional Formatting Format as Table Cell Styles Paste BI U 60 .00 Clipboard Font Alignment Number Styles C52 X fx H . B D E F G 1 Name: 2 Chapter: 2 3 4. 5 a. Using the financial statements shown below, calculate net operating working capital, total net 6 operating capital, net operating profit after taxes, free cash flow, and return on invested capital for the 7 most recent year. The federal-plus-state tax rate is 25%. 8 9 Lan & Chen Technologies: Income Statements for Year Ending December 31 10 (Millions of Dollars) 2021 11 Sales $945,000 12 Expenses excluding depreciation and amortization 812,700 13 EBITDA $132.300 14 Depreciation and amortization 33 100 5 EBIT $99,200 6 Interest Expense 10,400 7 EBT $88,800 8 Taxes (25%) 22.200 9 Net income $66,600 20 21 Common dividends 22 Addition to retained earnings $43,300 $23,300 -3 2020 $900,000 774,000 $126,000 31.500 $94,500 8.900 $85,600 21.400 $64,200 $41,230 $22.970 Part A Part B conditional Format Arial 10 AASS=0 BIU EAE Currency $ % 9 too 98 2 Format as Table cell Styles 38 Delete E Format Paste Number Styles Cells Clipboard Font Alignment 052 X & fx E F G I 1 J A D B C 24 Lan & Chen Technologies: December 31 Balance Sheets 25 (Millions of Dollars) 26 Assets 27 Cash and cash equivalents 28 Short-term investments 29 Accounts Receivable 30 Inventories 31 Total current assets 32 Net fixed assets 33 Total assets 34 35 Liabilities and equity 36 Accounts payable 37 Accruals 38 Notes payable 39 Total current liabilities 40 Long-term debt 41 Total liabilities 42 Common stock 43 Retained Eamings Part A Part B 2021 $47,250 3.800 283,500 141.750 $476,300 330.750 $807,050 2020 $45,000 3,600 270,000 135 000 $453,600 315,000 $768,600 $94,500 47.250 17,400 $159,150 90.000 $249,150 $444,600 113.300 $90,000 45,000 9,000 $144,000 90.000 $234,000 $444,600 90,000 Edit AutoSave Review Data View Formulas Page Layout Insert Draw File Home Help El Conditional Formatting Format as Table Cell Styles 23 insert Delete Format WE Currency $ % 9 48.00 Arial 10 A A == BIUDE a. Av ===== Paste - Cells Number 19 Styles Alignment Font Clipboard C52 X & fr G H J D E $807,050 F $768,600 A B 33 Total assets 34 35 Liabilities and equity 36 Accounts payable 37 Accruals 38 Notes payable 39 Total current liabilities 40 Long-term debt 41 Total liabilities 42 Common stock 43 Retained Earnings 44 Total common equity 45 Total liabilities and equity 46 47 Key Input Data 48 Tax rate 49 50 Net operating working capital (NOWC) $94,500 47,250 17,400 $159,150 90,000 $249,150 $444,600 113.300 $557,900 $807,050 $90,000 45,000 9,000 $144,000 90,000 $234,000 $444,600 90.000 $534,600 $768,600 25% 51 Operating NOWC = current assets 2021 09 Part Operating current liabilities 8 AIAIA Curreng $ -% 9 C Conditional Formatting Formatia Table cell Styles Insert deto OEM Paste B IU O 00 Format Clipboard Font Alignment Number Styles Cells C52 X fix H 0 A B D E F G 89 b. Assume that there were 15 million shares outstanding at the end of the year, the year-end closing 90 stock price was $65 per share, and the after-tax cost of capital was 10%. Calculate EVA and MVA for 91 the most recent year. 92 93 Additional Input Data 94 Stock price per share $65.00 95 # of shares (in thousands) 15,000 96 After-tax cost of capital 10.0% 97 98 Market Value Added 99 MVA = Stock price # of shares Total common equity 100 MVA = 101 MVA = 102 MVA = 103 104 Economic Value Added 105 EVA = NOPAT (Operating Capita 106 After-tax cost of capital) EVA = 107 EVA = 108 EVA = 109 110 111 X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started