Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ariff has just opened up a bookshop in Batang Kali. He plans to borrow RM250,000.00 from CMCM bank to pay for equipment, inventories and

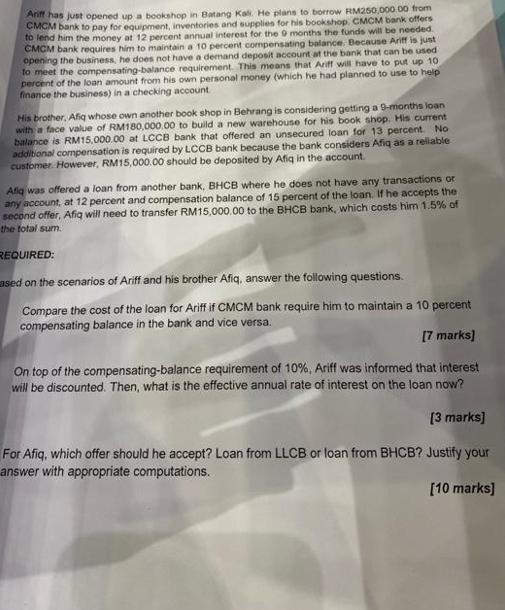

Ariff has just opened up a bookshop in Batang Kali. He plans to borrow RM250,000.00 from CMCM bank to pay for equipment, inventories and supplies for his bookshop. CMCM bank offers to lend him the money at 12 percent annual interest for the 9 months the funds will be needed. CMCM bank requires him to maintain a 10 percent compensating balance. Because Ariff is just opening the business, he does not have a demand deposit account at the bank that can be used i to meet the compensating-balance requirement. This means that Ariff will have to put up 101 percent of the loan amount from his own personal money (which he had planned to use to help finance the business) in a checking account. His brother, Afiq whose own another book shop in Behrang is considering getting a 9-months loan with a face value of RM180,000.00 to build a new warehouse for his book shop. His current balance is RM15,000.00 at LCCB bank that offered an unsecured loan for 13 percent. No additional compensation is required by LCCB bank because the bank considers Afiq as a reliable customer. However, RM15,000.00 should be deposited by Afiq in the account. Afiq was offered a loan from another bank, BHCB where he does not have any transactions or any account, at 12 percent and compensation balance of 15 percent of the loan. If he accepts the second offer, Afiq will need to transfer RM15,000.00 to the BHCB bank, which costs him 1.5% of the total sum. REQUIRED: ased on the scenarios of Ariff and his brother Afiq, answer the following questions. Compare the cost of the loan for Ariff if CMCM bank require him to maintain a 10 percent compensating balance in the bank and vice versa. [7 marks] On top of the compensating-balance requirement of 10%, Ariff was informed that interest will be discounted. Then, what is the effective annual rate of interest on the loan now? [3 marks] For Afiq, which offer should he accept? Loan from LLCB or loan from BHCB? Justify your answer with appropriate computations. [10 marks]

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a The cost of the loan for Ariff if CMCM bank require him to maintain a 10 percent compensating bala...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started