Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ariff was looking for suitable investment to be invested. After went through discussion with his broker, he found that there are two most attractive

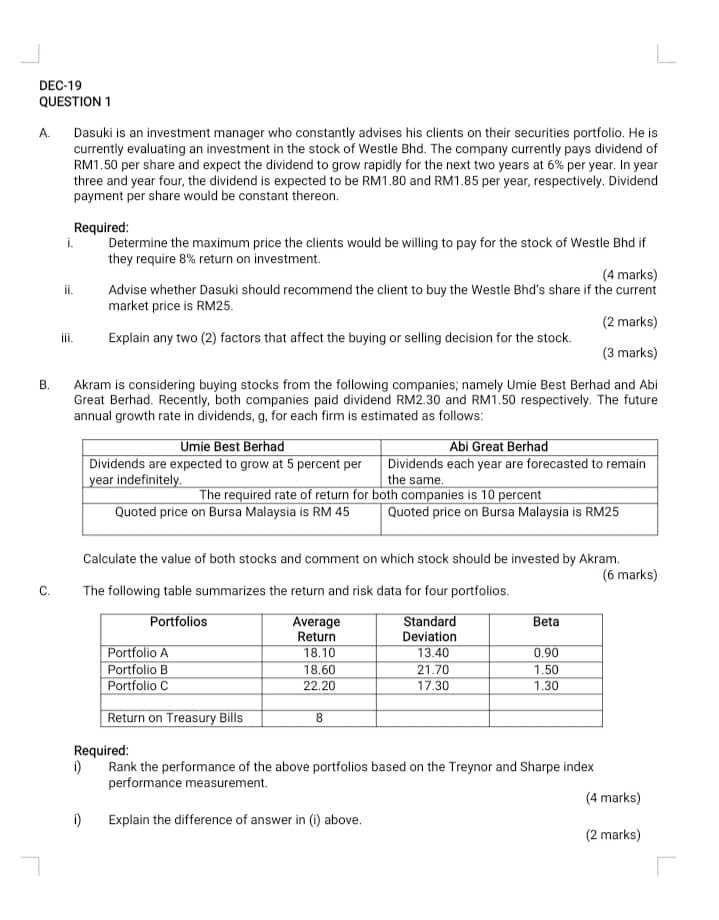

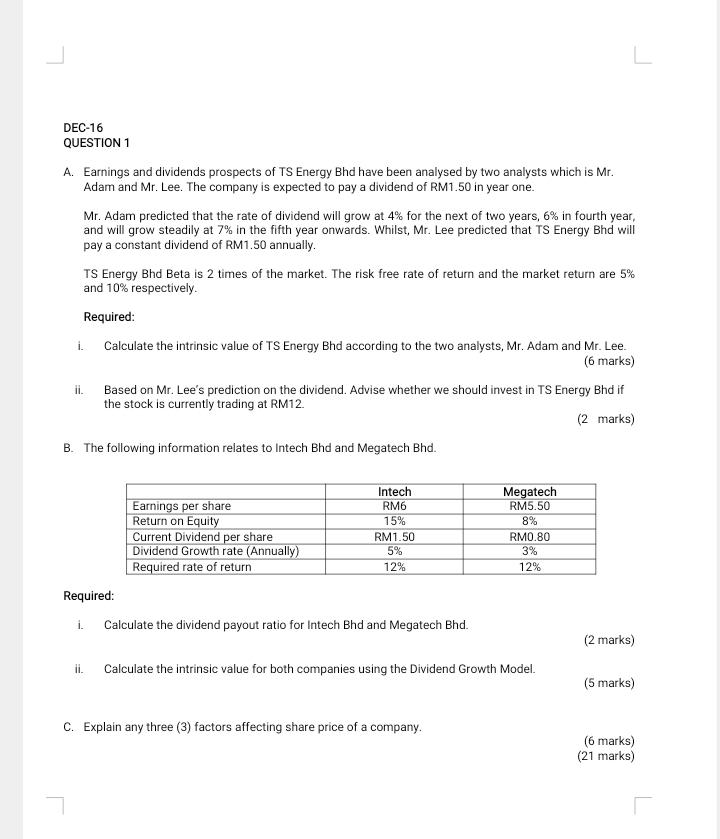

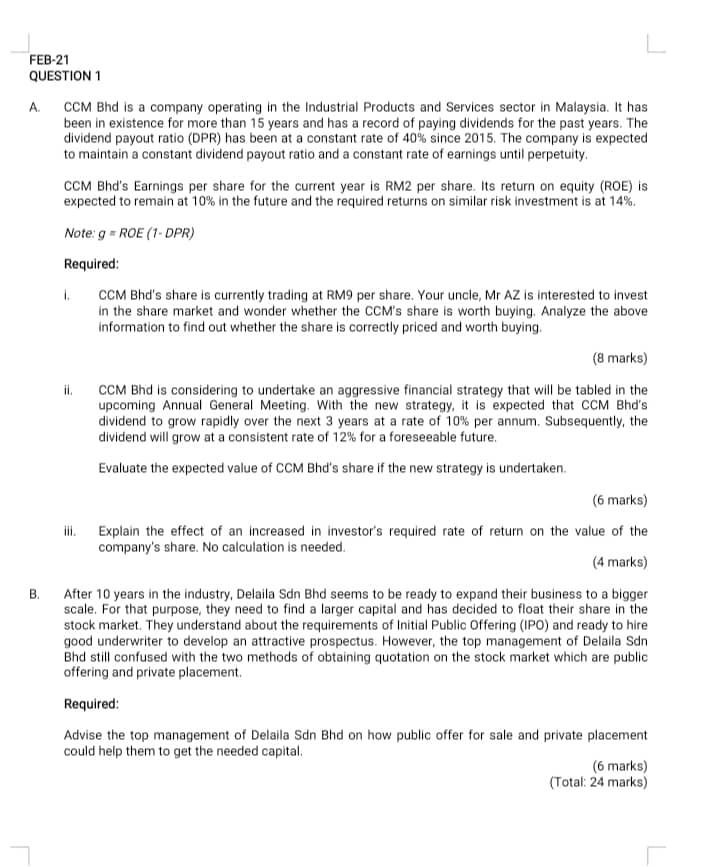

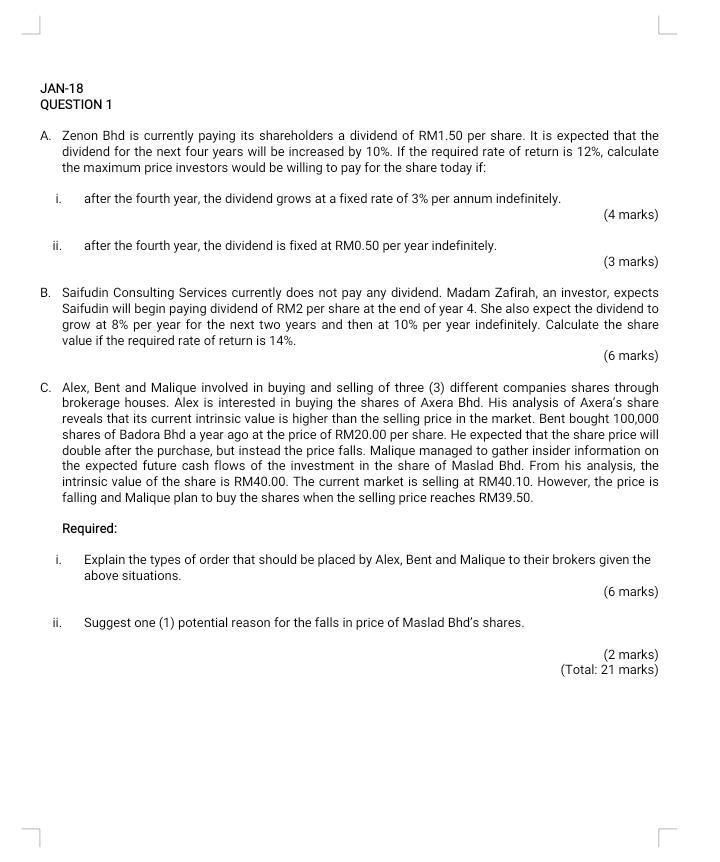

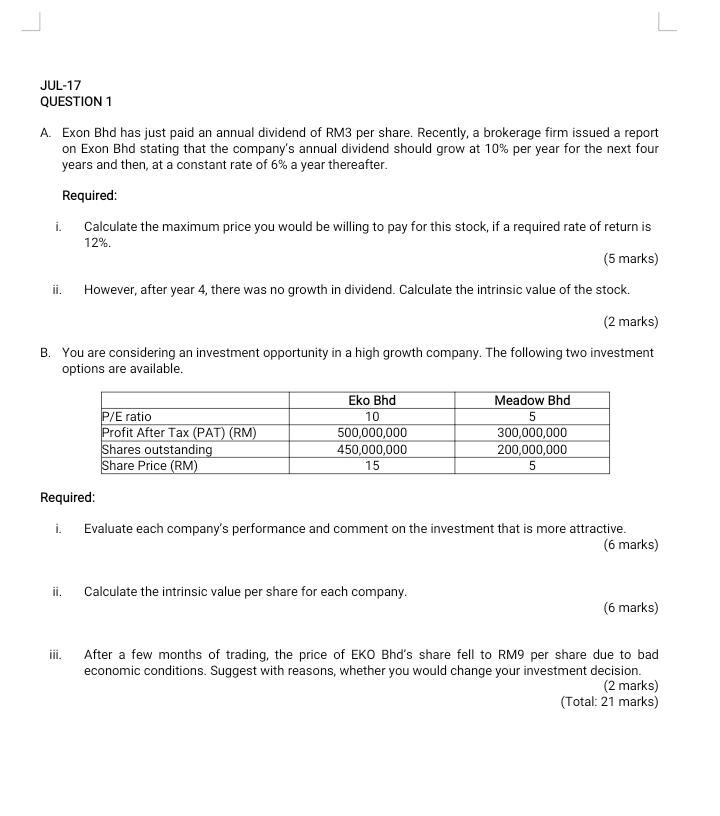

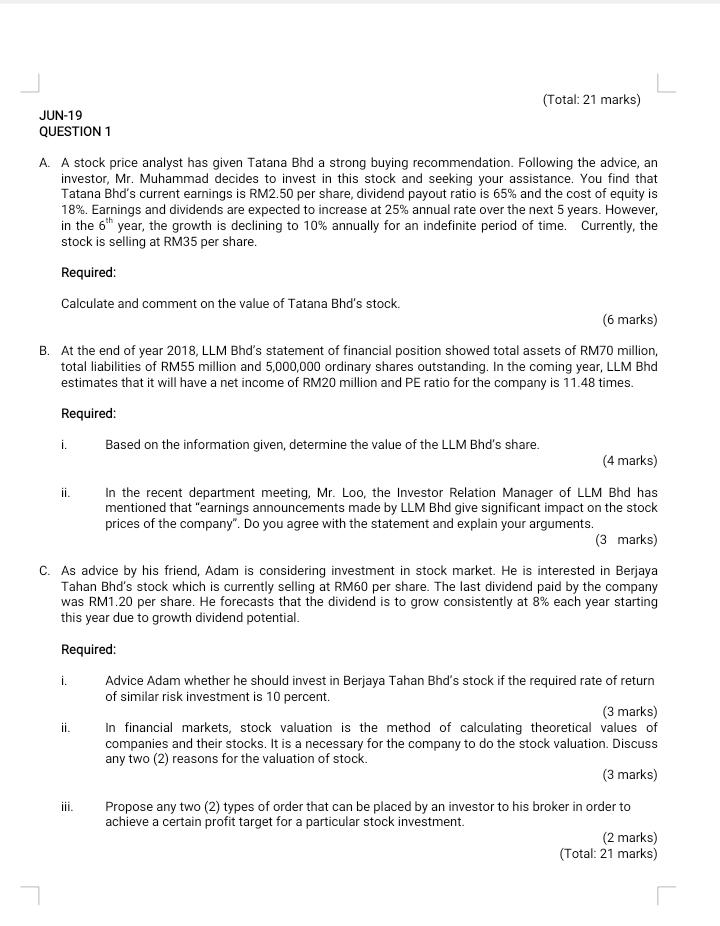

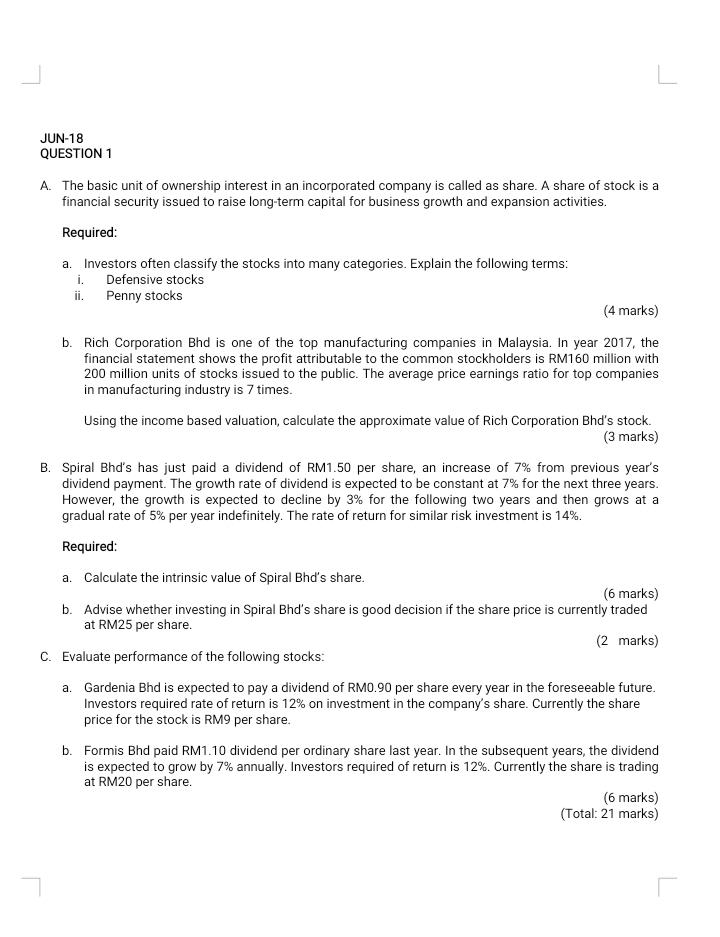

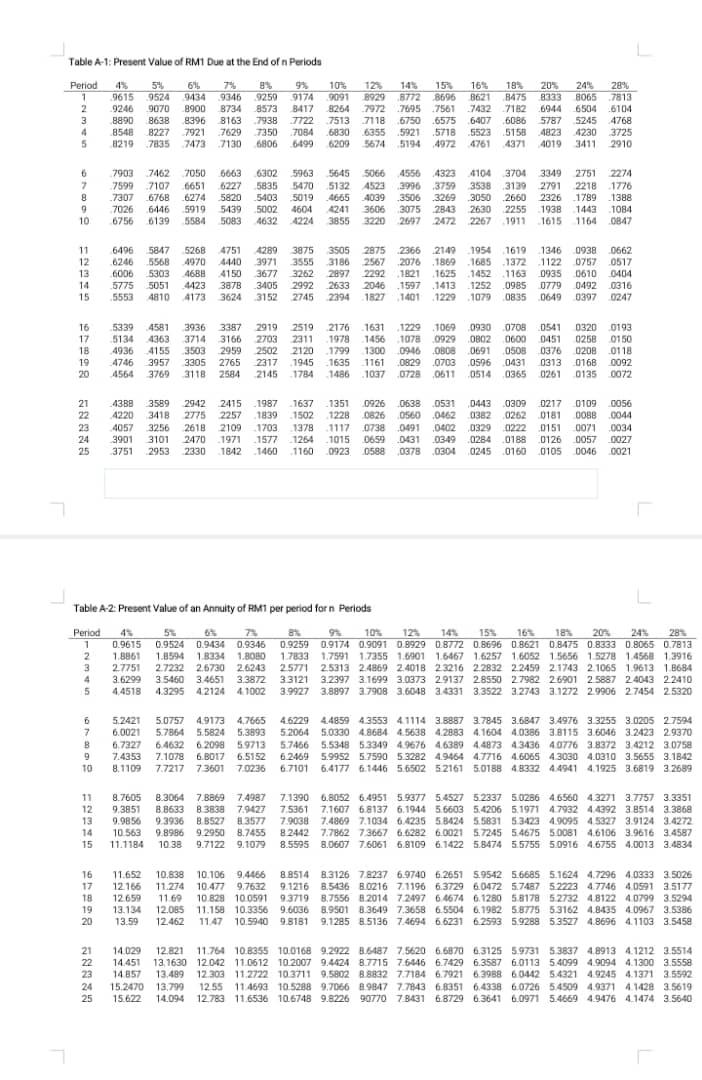

Ariff was looking for suitable investment to be invested. After went through discussion with his broker, he found that there are two most attractive stocks which were Reino Bhd and Seino Bhd. Both stocks are currently selling for RM7.50 per share and RM4.50 per share respectively. Dividend payout ratio for Reino Bhd is 15% whilst Selno Bhd is 13%. Below are some other information to assist Ariff in making decision: L. ii. E Return on Equity (ROE) Dividend per share 11. Reino Bhd 12% RMO.25 B. Aisyah noticed that Dammar Bhd paid annual dividend of RM1.50 per share. Due to the economic downturn, the dividends are expected to decline by 8% in the next 2 years, but to grow at a rate of 10% in the third year and at a constant rate of 6% thereafter. The required rate of return is 12%. Required: iii. Formula growth rate - ROEx (1-DPR) Required: Seino Bhd 11% RMO.25 Compute the intrinsic value of both stocks. Assume the required return is 14% Determine which stock that Ariff will invest and give reasons. (4 marks) (3 marks) C. Private companies may go public or be quated on the stock exchange by issuing shares through initial public offer (IPO) Calculate the value of share 3 years from today. Comment on Aisyah's decision to invest in Dammar Bhd if the dividend is fixed at RM0.80 per year indefinitely after the third year. The current market price of Dammar Bhd is RM10.20. (6 marks) Discuss two (2) reasons why do companies go public. (3 marks) Explain two (2) costs a company would incur when issuing shares through IPO (3 marks) Suggest two (2) possible reasons why "private placement of issuing shares is less preferable comparing to other methods. (2 marks) (Total: 21 marks) DEC-19 QUESTION 1 A. Dasuki is an investment manager who constantly advises his clients on their securities portfolio. He is currently evaluating an investment in the stock of Westle Bhd. The company currently pays dividend of RM1.50 per share and expect the dividend to grow rapidly for the next two years at 6% per year. In year three and year four, the dividend is expected to be RM1.80 and RM1.85 per year, respectively. Dividend payment per share would be constant thereon. Required: B. C. i. ii. Determine the maximum price the clients would be willing to pay for the stock of Westle Bhd if they require 8% return on investment. (4 marks) Advise whether Dasuki should recommend the client to buy the Westle Bhd's share if the current market price is RM25. Explain any two (2) factors that affect the buying or selling decision for the stock. (1) Akram is considering buying stocks from the following companies; namely Umie Best Berhad and Abi Great Berhad. Recently, both companies paid dividend RM2.30 and RM1.50 respectively. The future annual growth rate in dividends, g, for each firm is estimated as follows: Umie Best Berhad Dividends are expected to grow at 5 percent per year indefinitely. The required rate of return for both companies is 10 percent Quoted price on Bursa Malaysia is RM 45 Portfolio A Portfolio B Portfolio C Return on Treasury Bills Calculate the value of both stocks and comment on which stock should be invested by Akram. (6 marks) The following table summarizes the return and risk data for four portfolios. Portfolios Standard Deviation 13.40 21.70 17.30 Average Return 18.10 Abi Great Berhad Dividends each year are forecasted to remain the same. 18.60 22.20 8 (2 marks) (3 marks) Quoted price on Bursa Malaysia is RM25 Beta 0.90 1.50 1.30 Required: (1) Rank the performance of the above portfolios based on the Treynor and Sharpe index performance measurement. (4 marks) Explain the difference of answer in (i) above. (2 marks) DEC-16 QUESTION 1 A. Earnings and dividends prospects of TS Energy Bhd have been analysed by two analysts which is Mr. Adam and Mr. Lee. The company is expected to pay a dividend of RM1.50 in year one. ii. Mr. Adam predicted that the rate of dividend will grow at 4% for the next of two years, 6% in fourth year, and will grow steadily at 7% in the fifth year onwards. Whilst, Mr. Lee predicted that TS Energy Bhd will pay a constant dividend of RM1.50 annually. i. TS Energy Bhd Beta is 2 times of the market. The risk free rate of return and the market return are 5% and 10% respectively. Required: Calculate the intrinsic value of TS Energy Bhd according to the two analysts, Mr. Adam and Mr. Lee. (6 marks) B. The following information relates to Intech Bhd and Megatech Bhd. ii. Based on Mr. Lee's prediction on the dividend. Advise whether we should invest in TS Energy Bhd if the stock is currently trading at RM12. (2 marks) Required: i. Earnings per share Return on Equity Current Dividend per share Dividend Growth rate (Annually) Required rate of return Intech RM6 15% RM1.50 5% 12% Calculate the dividend payout ratio for Intech Bhd and Megatech Bhd. L Megatech RM5.50 8% C. Explain any three (3) factors affecting share price of a company. RMO.80 3% 12% Calculate the intrinsic value for both companies using the Dividend Growth Model. (2 marks) (5 marks) (6 marks) (21 marks) FEB-21 QUESTION 1 A. B. CCM Bhd is a company operating in the Industrial Products and Services sector in Malaysia. It has been in existence for more than 15 years and has a record of paying dividends for the past years. The dividend payout ratio (DPR) has been at a constant rate of 40% since 2015. The company is expected to maintain a constant dividend payout ratio and a constant rate of earnings until perpetuity. CCM Bhd's Earnings per share for the current year is RM2 per share. Its return on equity (ROE) is expected to remain at 10% in the future and the required returns on similar risk investment is at 14%. Note: g = ROE (1-DPR) Required: 1. il. CCM Bhd's share is currently trading at RM9 per share. Your uncle, Mr AZ is interested to invest in the share market and wonder whether the CCM's share is worth buying. Analyze the above information to find out whether the share is correctly priced and worth buying. (8 marks) CCM Bhd is considering to undertake an aggressive financial strategy that will be tabled in the upcoming Annual General Meeting. With the new strategy, it is expected that CCM Bhd's dividend to grow rapidly over the next 3 years at a rate of 10% per annum. Subsequently, the dividend will grow at a consistent rate of 12% for a foreseeable future. Evaluate the expected value of CCM Bhd's share if the new strategy is undertaken. (6 marks) iii. Explain the effect of an increased in investor's required rate of return on the value of the company's share. No calculation is needed. (4 marks) After 10 years in the industry, Delaila Sdn Bhd seems to be ready to expand their business to a bigger scale. For that purpose, they need to find a larger capital and has decided to float their share in the stock market. They understand about the requirements of Initial Public Offering (IPO) and ready to hire good underwriter to develop an attractive prospectus. However, the top management of Delaila Sdn Bhd still confused with the two methods of obtaining quotation on the stock market which are public offering and private placement. Required: Advise the top management of Delaila Sdn Bhd on how public offer for sale and private placement could help them to get the needed capital. (6 marks) (Total: 24 marks) JAN-18 QUESTION 1 A. Zenon Bhd is currently paying its shareholders a dividend of RM1.50 per share. It is expected that the dividend for the next four years will be increased by 10%. If the required rate of return is 12%, calculate the maximum price investors would be willing to pay for the share today if: i. after the fourth year, the dividend grows at a fixed rate of 3% per annum indefinitely. ii. i. after the fourth year, the dividend is fixed at RM0.50 per year indefinitely. (3 marks) B. Saifudin Consulting Services currently does not pay any dividend. Madam Zafirah, an investor, expects Saifudin will begin paying dividend of RM2 per share at the end of year 4. She also expect the dividend to grow at 8% per year for the next two years and then at 10% per year indefinitely. Calculate the share value if the required rate of return is 14%. (6 marks) C. Alex, Bent and Malique involved in buying and selling of three (3) different companies shares through brokerage houses. Alex is interested in buying the shares of Axera Bhd. His analysis of Axera's share reveals that its current intrinsic value is higher than the selling price in the market. Bent bought 100,000 shares of Badora Bhd a year ago at the price of RM20.00 per share. He expected that the share price will double after the purchase, but instead the price falls. Malique managed to gather insider information on the expected future cash flows of the investment in the share of Maslad Bhd. From his analysis, the intrinsic value of the share is RM40.00. The current market is selling at RM40.10. However, the price is falling and Malique plan to buy the shares when the selling price reaches RM39.50. Required: ii. (4 marks) Explain the types of order that should be placed by Alex, Bent and Malique to their brokers given the above situations. (6 marks) Suggest one (1) potential reason for the falls in price of Maslad Bhd's shares. (2 marks) (Total: 21 marks) JUL-17 QUESTION 1 A. Exon Bhd has just paid an annual dividend of RM3 per share. Recently, a brokerage firm issued a report on Exon Bhd stating that the company's annual dividend should grow at 10% per year for the next four years and then, at a constant rate of 6% a year thereafter. Required: i. ii. B. You are considering an investment opportunity in a high growth company. The following two investment options are available. Calculate the maximum price you would be willing to pay for this stock, if a required rate of return is 12%. (5 marks) However, after year 4, there was no growth in dividend. Calculate the intrinsic value of the stock. (2 marks) Required: i. ii. iii. P/E ratio Profit After Tax (PAT) (RM) Shares outstanding Share Price (RM) Eko Bhd 10 500,000,000 450,000,000 15 Meadow Bhd 5 300,000,000 200,000,000 5 Evaluate each company's performance and comment on the investment that is more attractive. (6 marks) Calculate the intrinsic value per share for each company. (6 marks) After a few months of trading, the price of EKO Bhd's share fell to RM9 per share due to bad economic conditions. Suggest with reasons, whether you would change your investment decision. (2 marks) (Total: 21 marks) JUN-19 QUESTION 1 A. A stock price analyst has given Tatana Bhd a strong buying recommendation. Following the advice, an investor, Mr. Muhammad decides to invest in this stock and seeking your assistance. You find that Tatana Bhd's current earnings is RM2.50 per share, dividend payout ratio is 65% and the cost of equity is 18%. Earnings and dividends are expected to increase at 25% annual rate over the next 5 years. However, in the 6th year, the growth is declining to 10% annually for an indefinite period of time. Currently, the stock is selling at RM35 per share. Required: Calculate and comment on the value of Tatana Bhd's stock. (6 marks) B. At the end of year 2018, LLM Bhd's statement of financial position showed total assets of RM70 million, total liabilities of RM55 million and 5,000,000 ordinary shares outstanding. In the coming year, LLM Bhd estimates that it will have a net income of RM20 million and PE ratio for the company is 11.48 times. Required: i. ii. (4 marks) In the recent department meeting, Mr. Loo, the Investor Relation Manager of LLM Bhd has mentioned that "earnings announcements made by LLM Bhd give significant impact on the stock prices of the company". Do you agree with the statement and explain your arguments. (3 marks) C. As advice by his friend, Adam is considering investment in stock market. He is interested in Berjaya Tahan Bhd's stock which is currently selling at RM60 per share. The last dividend paid by the company was RM1.20 per share. He forecasts that the dividend is to grow consistently at 8% each year starting this year due to growth dividend potential. Required: i. (Total: 21 marks) ii. Based on the information given, determine the value of the LLM Bhd's share. iii. Advice Adam whether he should invest in Berjaya Tahan Bhd's stock if the required rate of return of similar risk investment is 10 percent. (3 marks) In financial markets, stock valuation is the method of calculating theoretical values of companies and their stocks. It is a necessary for the company to do the stock valuation. Discuss any two (2) reasons for the valuation of stock. (3 marks) Propose any two (2) types of order that can be placed by an investor to his broker in order to achieve a certain profit target for a particular stock investment. (2 marks) (Total: 21 marks) JUN-18 QUESTION 1 A. The basic unit of ownership interest in an incorporated company is called as share. A share of stock is a financial security issued to raise long-term capital for business growth and expansion activities. Required: a. Investors often classify the stocks into many categories. Explain the following terms: i. Defensive stocks ii. Penny stocks (4 marks) b. Rich Corporation Bhd is one of the top manufacturing companies in Malaysia. In year 2017, the financial statement shows the profit attributable to the common stockholders is RM160 million with 200 million units of stocks issued to the public. The average price earnings ratio for top companies in manufacturing industry is 7 times. Using the income based valuation, calculate the approximate value of Rich Corporation Bhd's stock. (3 marks) B. Spiral Bhd's has just paid a dividend of RM1.50 per share, an increase of 7% from previous year's dividend payment. The growth rate of dividend is expected to be constant at 7% for the next three years. However, the growth is expected to decline by 3% for the following two years and then grows at a gradual rate of 5% per year indefinitely. The rate of return for similar risk investment is 14%. Required: a. Calculate the intrinsic value of Spiral Bhd's share. (6 marks) b. Advise whether investing in Spiral Bhd's share is good decision if the share price is currently traded at RM25 per share. (2 marks) C. Evaluate performance of the following stocks: a. Gardenia Bhd is expected to pay a dividend of RM0.90 per share every year in the foreseeable future. Investors required rate of return is 12% on investment in the company's share. Currently the share price for the stock is RM9 per share. b. Formis Bhd paid RM1.10 dividend per ordinary share last year. In the subsequent years, the dividend is expected to grow by 7% annually. Investors required of return is 12%. Currently the share is trading at RM20 per share. (6 marks) (Total: 21 marks) Table A-1: Present Value of RM1 Due at the End of n Periods 1 2 Period 4% 5% 6% 7% 9615 9524 9434 9346 9246 9070 8900 8734 8890 8638 8396 8163 .7938 8548 8227 7921 7629 8219 7835 7473 7130 3 4 5 SNOOD NG PPER 58839 6 7903 7462 7050 6663 6302 5963 5645 5066 7599 7107 6651 6227 5835 5470 5132 4523 7307 6768 6274 5820 5403 5019 4665 4039 7026 6446 5919 5439 5002 4604 4241 3606 10. 6756 6139 5584 5083 4632 4224 3855 3220 7 8 9 11 6496 12 6246 13 6006 14 5775 5553 15 16 17 18 19 20 21 4388 23 5339 5134 3 4 5 4936 4746 4564 6 7 B 9 10 5847 5568 5268 4970 21 22 4751 4440 23 24 25 5303 4688 4150 5051 4423 3878 4810 4173 3624 8% 9% 10% 12% 14% 15% 16% 18% 20% 24% 28% 9259 9174 9091 8929 8772 8696 8621 8475 8333 8065 7813 8573 8417 8264 7972 7695 7561 7432 7182 6944 6504 6104 7722 7513 7118 6750 .6575 6407 6086 5787 5245 4768 7350 7084 6830 6355 5921 5718 5523 5158 4823 4230 3725 6806 6499 6209 5674 5194 4972 4761 4371 4019 3411 2910 4581 3936 3387 4363 3714 3166 4155 3503 2959 3305 2765 3118 2584 3957 3769 3589 22 4220 2942 2415 1987 1637 1351 0926 0638 0531 0443 0309 0217 0109 0056 3418 2775 2257 1839 1502 1228 0826 0560 0462 0382 0262 0181 0088 0044 4057 3256 2618 2109 1703 1378 1117 0738 0491 0402 0329 0222 0151 0071 0034 3901 3101 2470 1971 1577 1264 1015 0659 0431 0349 0284 0188 0126 0057 0027 25 3751 2953 2330 1842 1460 1160 0923 0588 0378 0304 0245 0160 0105 0046 0021 24 3875 3505 4289 3971 3555 3186 3677 3262 2897 3405 2992 2633 3152 2745 2394 Table A-2: Present Value of an Annuity of RM1 per period forn Periods Period 4% 5% 65 8% 1 0.9615 0.9524 0.9434 0.9346 0.9259 2 2919 2519 2176 1631 1229 1069 2703 2311 1978 1456 1078 0929 2502 2120 1799 1300 0946 0808 2317 1945 1635 1161 0829 0703 2145 1784 1486 1037 0728 0611 4556 4323 4104 4104 3704 3349 2751 2274 3996 3759 3538 3139 2791 2218 1776 3506 3269 3050 2660 2326 1789 1388 3075 2843 2630 2255 1938 1443 1084 2697 2472 2472 2267 1911 1615 1164 0847 2875 2366 2149 1954 1619 1346 0938 0662 2567 2076 1869 1685 1372 1122 0757 0517 2292 1821 1625 1452 1163 0935 0610 0404 2046 1597 1413 1252 0985 0779 0492 0316 1827 1401 1229 1079 0835 0649 0397 0247 1.8861 1.8594 1.8334 1.8080 1.7833 1,7591 2.7751 2.7232 2.6730 2.6243 2.5771 3.6299 3.5460 3.4651 3.3872 4,4518 4.3295 42124 41002 0930 0708 0541 0320 0193 0802 0600 0451 0258 0150 0691 0508 0376 0208 0118 0596 0431 0313 0168 0092 0514 0365 0261 0135 0072 9% 10% 12% 14% 15% 16% 18% 20% 24% 28% 0.9174 0.9091 0.8929 0.8772 0.8696 0.8621 0.8475 0.8333 0.8065 0.7813 1.7591 1.7355 1.6901 1.6467 1.6257 1.6052 1.5656 1.5278 1.4568 1.3916 2.5313 2.4869 2.4018 23216 2.2832 2.2459 21743 2.1065 1.9613 1.8684 3.3121 3.2397 3.1699 3.0373 2.9137 28550 27982 26901 2.5887 2.4043 22410 3.9927 3.8897 3.7908 3.6048 3.4331 3.3522 3.2743 3.1272 2.9906 27454 2.5320 11 8.7605 8.3064 7.8869 7.4987 7.1390 6.8052 6.4951 5.9377 5.4527 52337 5.0286 4.6560 4.3271 3.7757 3.3351 12 9.3851 8.8633 83838 7.9427 7.5361 7.1607 6.8137 6.1944 5.6603 5.4206 5.1971 47932 44392 3.8514 3.3868 13 9.9856 9.3936 8.8527 83577 7.9038 7.4869 7.1034 6.4235 5.8424 5.5831 5.3423 4.9095 4.5327 3.9124 3.4272 14 10.563 9.8986 9.2950 8.7455 8.2442 7.7862 7.3667 6.6282 6.0021 57245 5.4675 50081 4.6106 3.9616 3.4587 15 11.1184 10.38 9.7122 9.1079 8.5595 8.0607 7.6061 6.8109 6.1422 5.8474 5.5755 5.0916 4.6755 4.0013 3.4834 5.2421 5.0757 4.9173 4.7665 4.6229 4.4859 4.3553 41114 3.8887 3.7845 3.6847 3.4976 3.3255 3.0205 2.7594 6.0021 5.7864 5.5824 5.3893 5.2064 5.0330 4.8684 4.5638 4.2883 4.1604 4.0386 3.8115 3.6046 3.2423 2.9370 6.7327 6.4632 62098 5.9713 5.7466 5.5348 5.3349 4.9676 4.6389 4.4873 4.3436 4.0776 3.8372 3.4212 3.0758 7.4353 7.1078 6.8017 6.5152 6.2469 5.9952 57590 5.3282 49464 4.7716 4.6065 4.3030 4.0310 3.5655 3.1842 8.1109 7.7217 7.3601 7.0236 6.7101 6.4177 6.1446 5.6502 52161 5.0188 4.8332 4.4941 4.1925 3.6819 3.2689 16 11.652 10.838 10.106 9,4466 8.8514 8.3126 7.8237 6.9740 6.2651 5.9542 5.6685 5.1624 4.7296 4.0333 3.5026 17 12.166 11.274 10.477 9.7632 9.1216 8.5436 80216 7.1196 6.3729 6.0472 5.7487 52223 4.7746 4.0591 3.5177 18 12.659 11.69 10.829 10.0591 9.3719 8.7556 8.2014 7.2497 6.4674 6.1280 5.8178 5.2732 4.8122 4.0799 3.5294 19 13.134 12.085 11.158 10.3356 9.6036 8.9501 8.3649 7.3658 6.5504 6.1982 5.8775 5.3162 4.8435 4.0967 3.5386 20 13.59 12.462 11.47 10.5940 9.8181 9.1285 8.5136 7.4694 6.6231 6.2593 5.9288 5.3527 4.8696 4.1103 3.5458 14.029 12.821 11.764 10.8355 10.0168 9.2922 8.6487 7.5620 6.6870 6.3125 5.9731 5.3837 4.8913 4.1212 3.5514 14.451 13,1630 12.042 11.0612 10.2007 9.4424 8.7715 7.6446 6.7429 6.3587 60113 5.4099 4.9094 4.1300 3.5558 14 857 13.489 12.303 11.2722 10.3711 9.5802 88832 7.7184 6.7921 6.3988 60442 5.4321 4.9245 4.1371 3.5592 15.2470 13,799 12.55 11:4693 10.5288 9.7066 89847 7.7843 6.8351 6.4338 6.0726 5.4509 4.9371 4.1428 3.5619 15.622 14.094 12.783 11.6536 10.6748 9.8226 90770 7.8431 6.8729 6.3641 6.0971 5.4669 4.9476 4.1474 3.5640

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Calculate the intrinsic value of both the stocks as follows Reino Bhd Intrinsic Value 025110214102 275501428 1929 Seino Bhd Intrinsic Value 02510957...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started