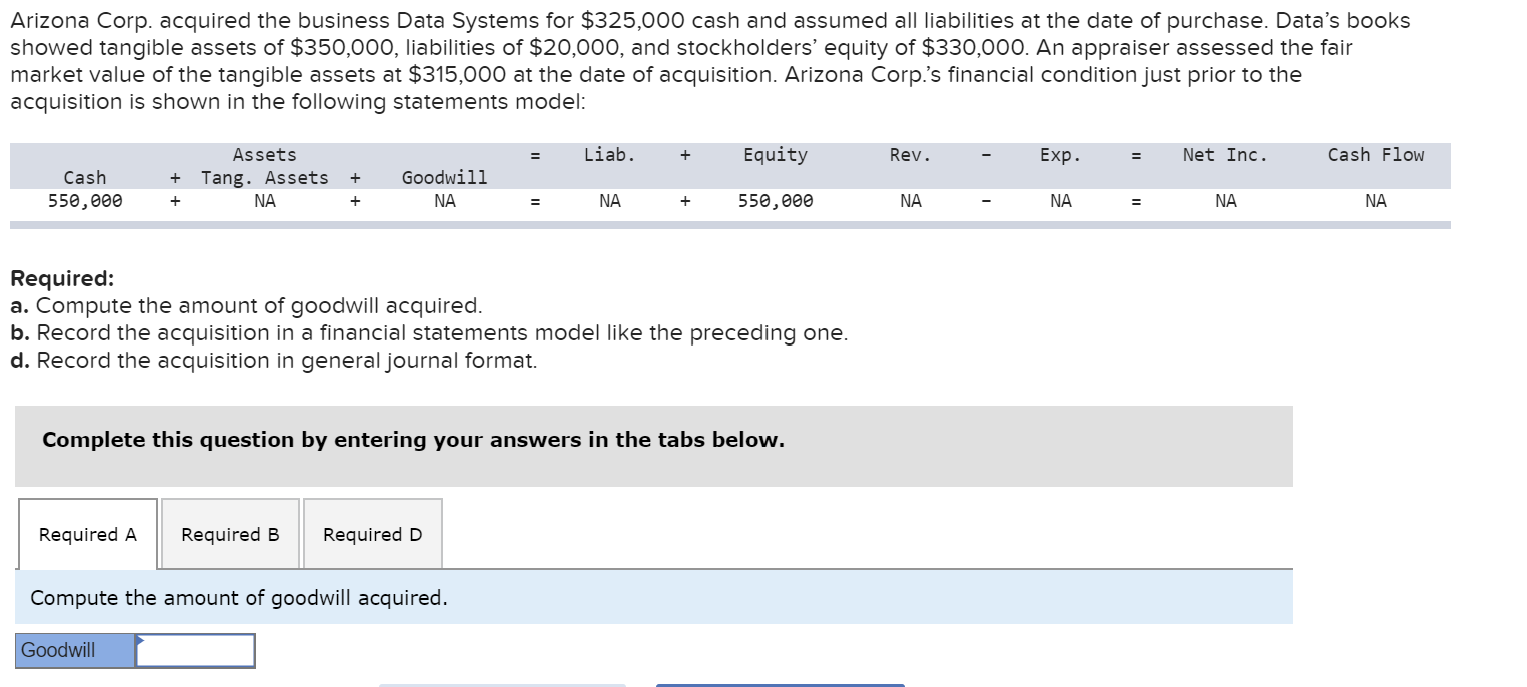

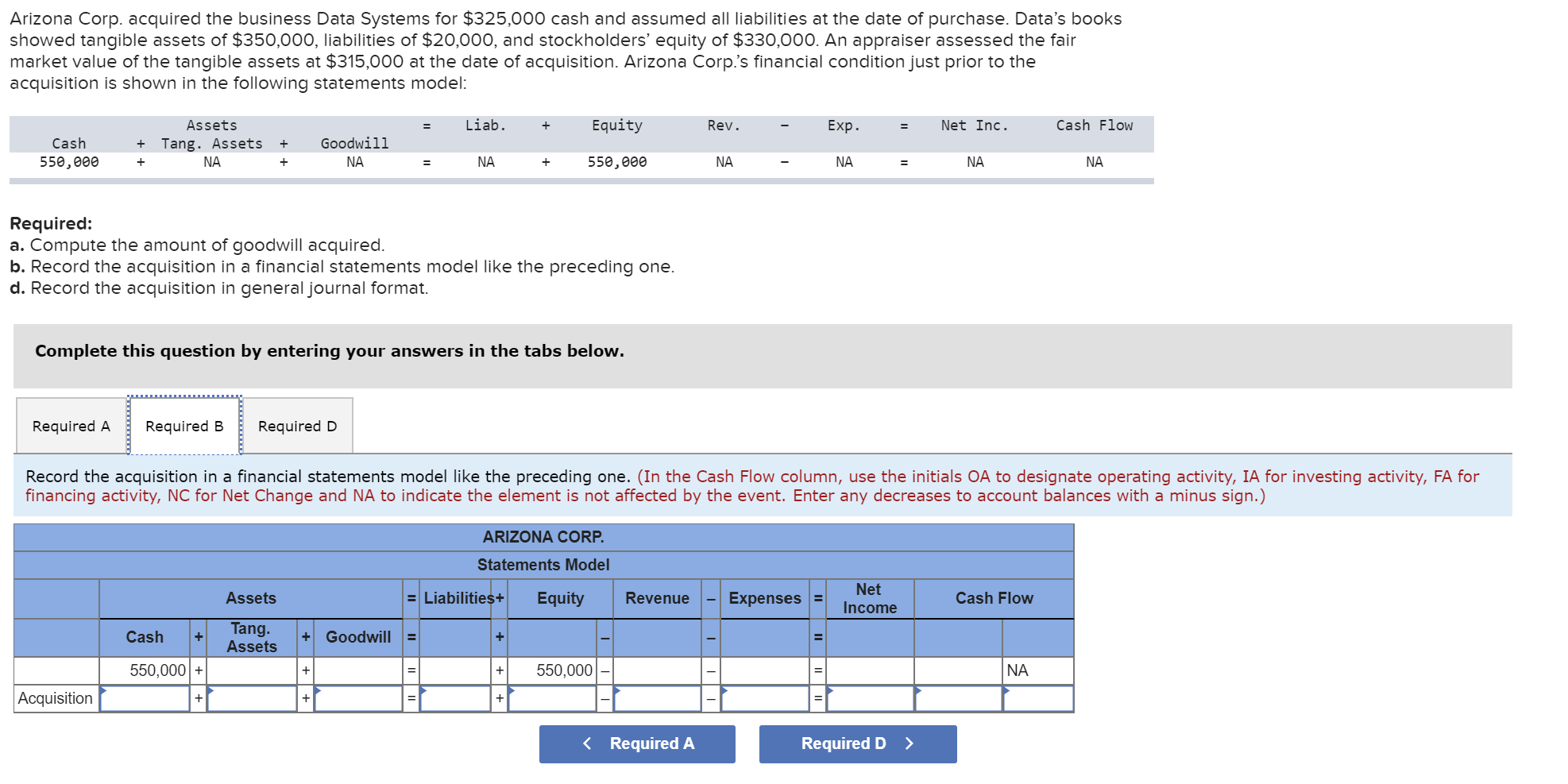

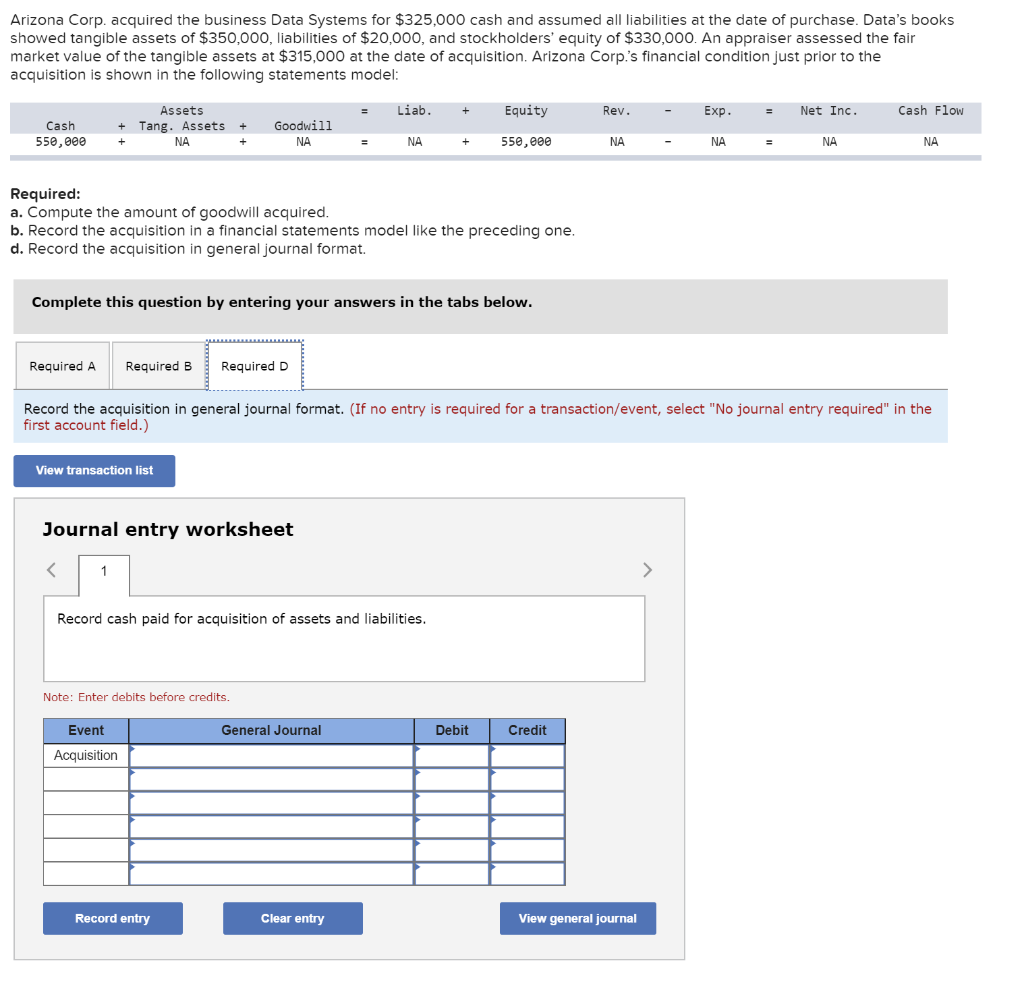

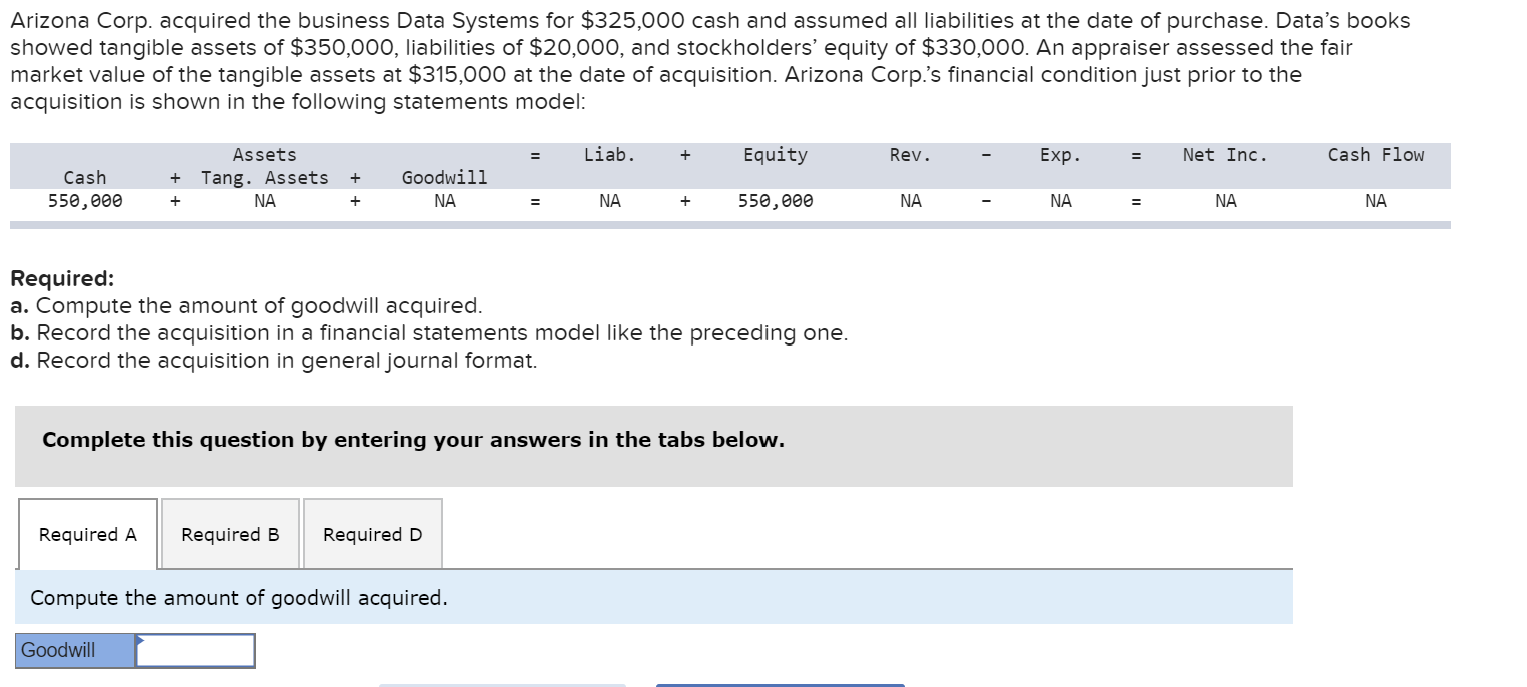

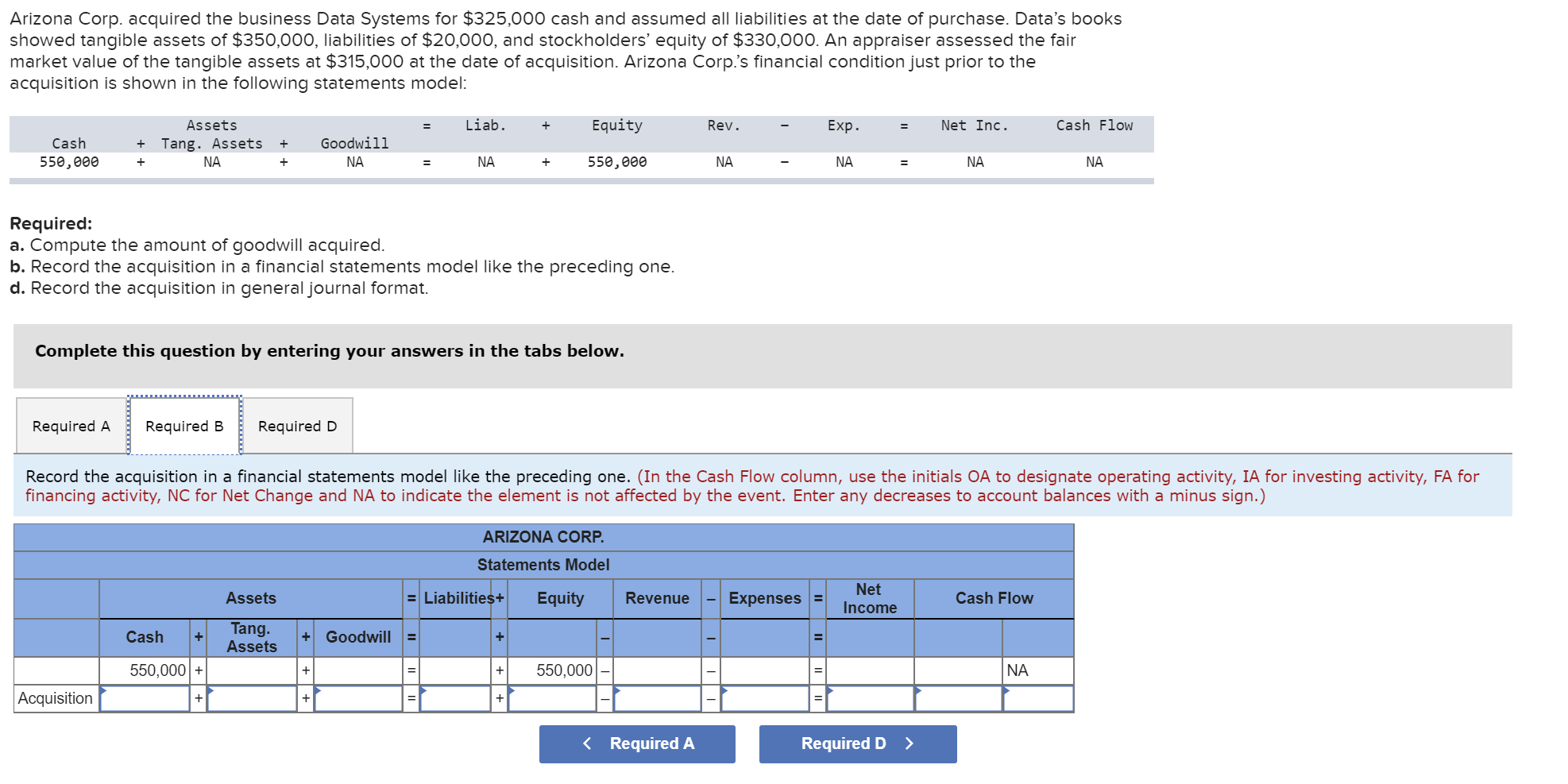

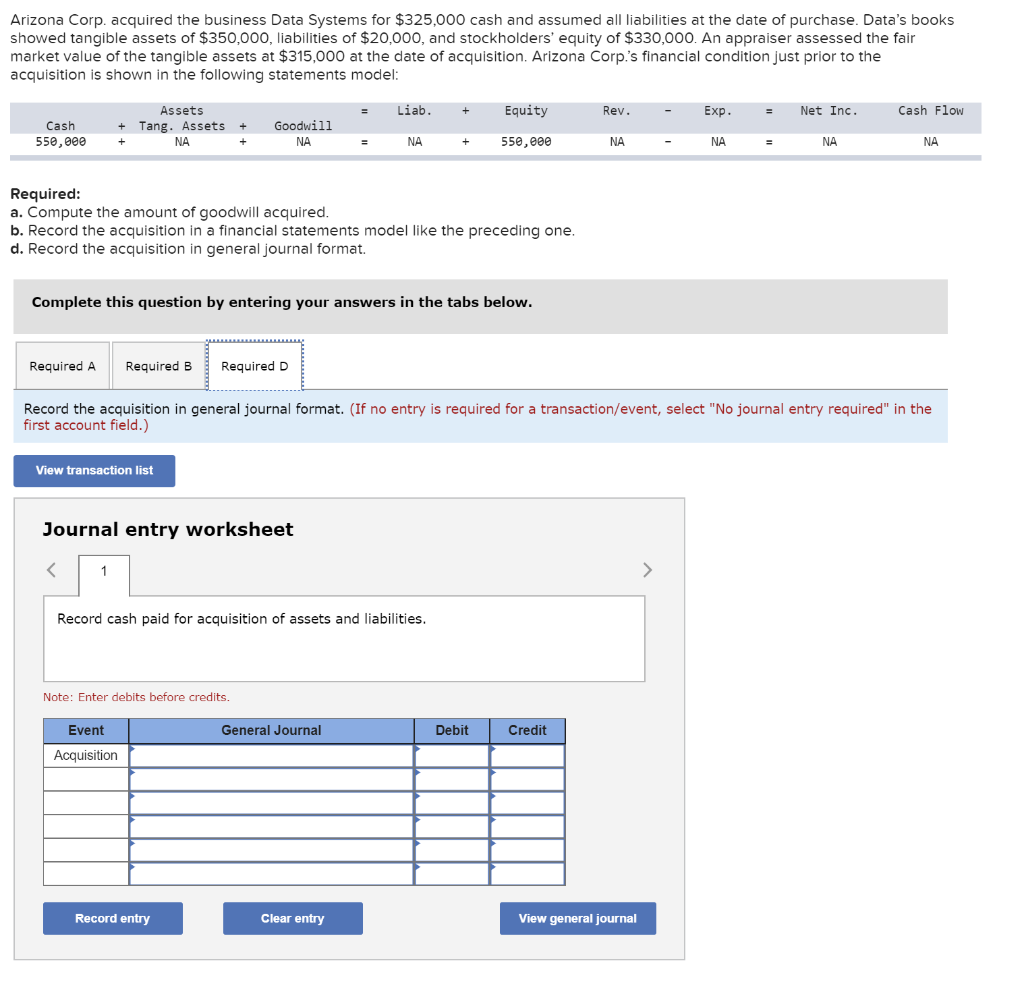

Arizona Corp. acquired the business Data Systems for $325,000 cash and assumed all liabilities at the date of purchase. Data's books showed tangible assets of $350,000, liabilities of $20,000, and stockholders' equity of $330,000. An appraiser assessed the fair market value of the tangible assets at $315,000 at the date of acquisition. Arizona Corp.s financial condition just prior to the acquisition is shown in the following statements model: Cash 550,000 Assets + Tang. Assets + + NA + Goodwill NA NA = - Liab. NA + + Equity 550,000 Rev. NA - - Exp. NA = - Net Inc. NA Cash Flow NA Required: a. Compute the amount of goodwill acquired. b. Record the acquisition in a financial statements model like the preceding one. d. Record the acquisition in general journal format. Complete this question by entering your answers in the tabs below. Required A Required B Required D Compute the amount of goodwill acquired. Goodwill Arizona Corp. acquired the business Data Systems for $325,000 cash and assumed all liabilities at the date of purchase. Data's books showed tangible assets of $350,000, liabilities of $20,000, and stockholders' equity of $330,000. An appraiser assessed the fair market value of the tangible assets at $315,000 at the date of acquisition. Arizona Corp.'s financial condition just prior to the acquisition is shown in the following statements model: = Liab. + Equity Rev. - Exp. = Net Inc. Cash Flow Cash 550,000 Assets + Tang. Assets + + NA + Goodwill NA NA = NA + O 550,000 NA NA + NA NA Required: a. Compute the amount of goodwill acquired. b. Record the acquisition in a financial statements model like the preceding one. d. Record the acquisition in general journal format. Complete this question by entering your answers in the tabs below. Required A Required B Required D Record the acquisition in a financial statements model like the preceding one. (In the Cash Flow column, use the initials OA to designate operating activity, IA for investing activity, FA for financing activity, NC for Net Change and NA to indicate the element is not affected by the event. Enter any decreases to account balances with a minus sign.) Assets ARIZONA CORP. Statements Model = Liabilities+ Equity + Goodwill = + Goodwill = + + = + 550,000 Revenue - Expenses = Net Income Cash Flow . Tang. + + Cash + * 550,000 + Assets + + NA Acquisition Il + + + Arizona Corp. acquired the business Data Systems for $325,000 cash and assumed all liabilities at the date of purchase. Data's books showed tangible assets of $350,000, liabilities of $20,000, and stockholders' equity of $330,000. An appraiser assessed the fair market value of the tangible assets at $315,000 at the date of acquisition. Arizona Corp.'s financial condition just prior to the acquisition is shown in the following statements model: = Liab. + Equity Rev. - Exp. = Net Inc. Cash Flow Cash 550,000 Assets + Tang. Assets + + NA Goodwill NA NA + 550,000 NA - NA - NA NA Required: a. Compute the amount of goodwill acquired. b. Record the acquisition in a financial statements model like the preceding one. d. Record the acquisition in general journal format. Complete this question by entering your answers in the tabs below. Required A Required B Required D Record the acquisition in general journal format. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record cash paid for acquisition of assets and liabilities. Note: Enter debits before credits. General Journal Debit Credit Event Acquisition Record entry Clear entry View general journal