Answered step by step

Verified Expert Solution

Question

1 Approved Answer

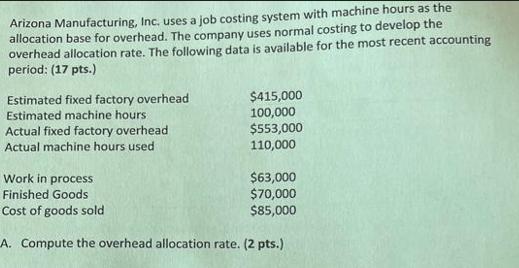

Arizona Manufacturing, Inc. uses a job costing system with machine hours as the allocation base for overhead. The company uses normal costing to develop

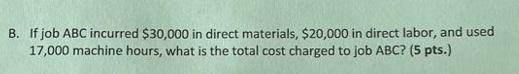

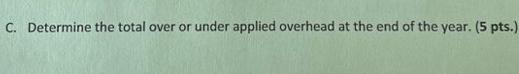

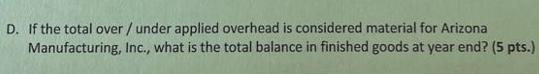

Arizona Manufacturing, Inc. uses a job costing system with machine hours as the allocation base for overhead. The company uses normal costing to develop the overhead allocation rate. The following data is available for the most recent accounting period: (17 pts.) Estimated fixed factory overhead Estimated machine hours Actual fixed factory overhead Actual machine hours used $415,000 100,000 $553,000 110,000 Work in process Finished Goods Cost of goods sold A. Compute the overhead allocation rate. (2 pts.) $63,000 $70,000 $85,000 B. If job ABC incurred $30,000 in direct materials, $20,000 in direct labor, and used 17,000 machine hours, what is the total cost charged to job ABC? (5 pts.) C. Determine the total over or under applied overhead at the end of the year. (5 pts.) D. If the total over / under applied overhead is considered material for Arizona Inc., what is the total balance in finished goods at year end? (5 pts.) Manufacturing,

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer of PartA Overhead allocation rate Estimated FOH Estimated Production 415000100000415 is our O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started