Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Armada is a public limited company reporting under IFRSs. It is preparing the financial statements as at31 December 2021. Included in trade receivables is

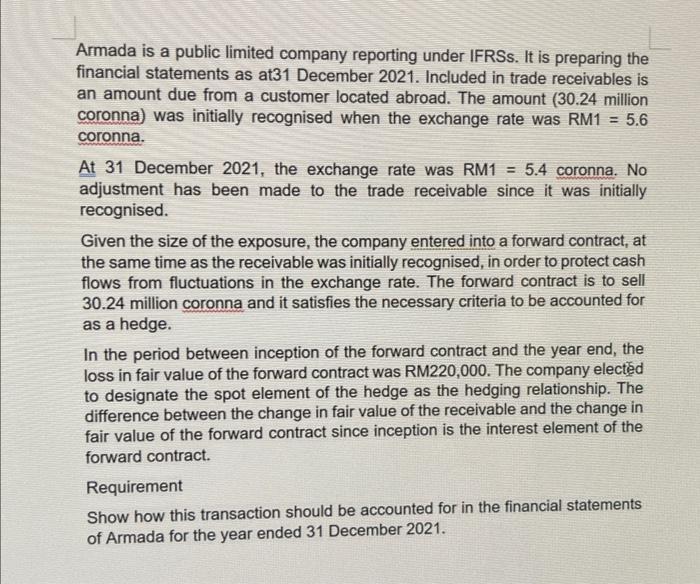

Armada is a public limited company reporting under IFRSs. It is preparing the financial statements as at31 December 2021. Included in trade receivables is an amount due from a customer located abroad. The amount (30.24 million coronna) was initially recognised when the exchange rate was RM1 = 5.6 coronna. At 31 December 2021, the exchange rate was RM1= 5.4 coronna. No adjustment has been made to the trade receivable since it was initially recognised. Given the size of the exposure, the company entered into a forward contract, at the same time as the receivable was initially recognised, in order to protect cash flows from fluctuations in the exchange rate. The forward contract is to sell 30.24 million coronna and it satisfies the necessary criteria to be accounted for as a hedge. In the period between inception of the forward contract and the year end, the loss in fair value of the forward contract was RM220,000. The company elected to designate the spot element of the hedge as the hedging relationship. The difference between the change in fair value of the receivable and the change in fair value of the forward contract since inception is the interest element of the forward contract. Requirement Show how this transaction should be accounted for in the financial statements of Armada for the year ended 31 December 2021.

Step by Step Solution

★★★★★

3.47 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started