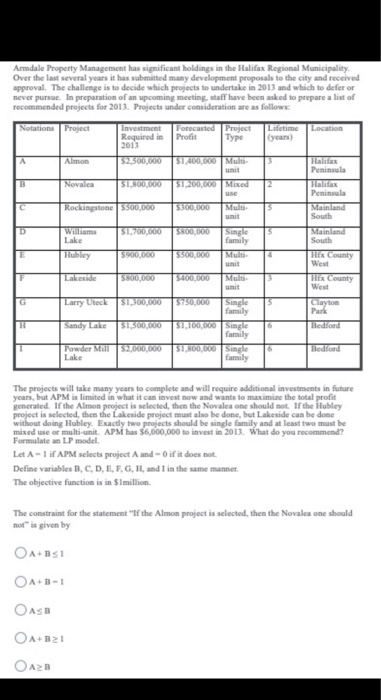

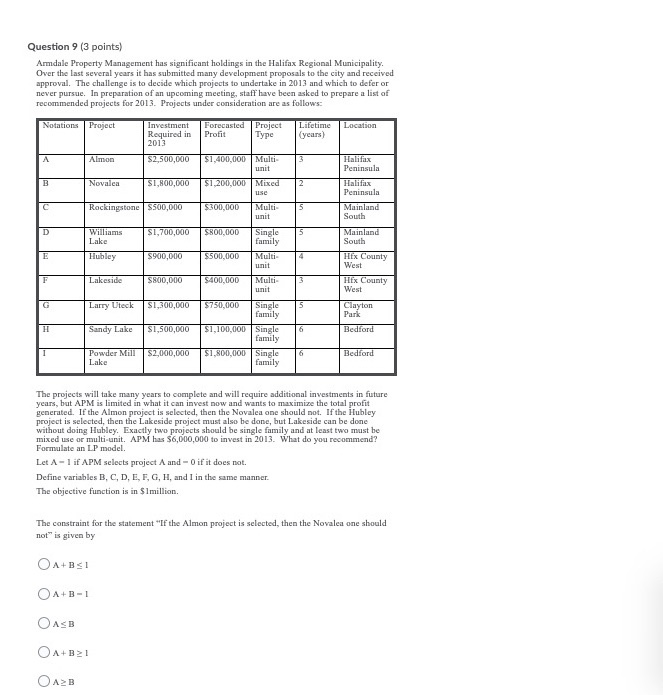

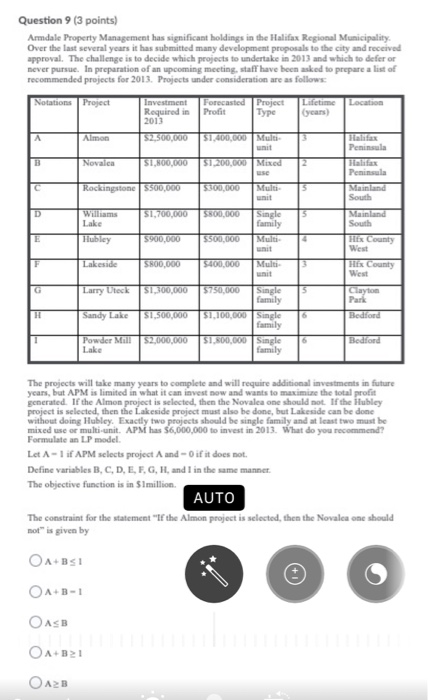

Armdale Property Management has significant holdings in the Halifax Regional Municipality Over the last several years it has submitted many development proposals to the city and received approval. The challenge is to decide which projects to undertake in 2013 and which to defer or never pursue. In preparation of an upcoming meeting, staff have been asked to prepare a list of recommended projects for 2013. Projects under consideration are as follow Notations Project Investment Forecasted Project Lifetime Location Required in Profit Type years) 2013 A Almon $2,500,000 51. Multi 13 Peninsula Novalca SINOO $1,200.00 Mixed 2 Peninsula Rockingstone 500.000 500.000 Multi 5 Mainland South 51,700,000 SOLO Single Mainland Lake family South E Hubley 5900,000 SCOOTED Mu 4 HE County West F Lakeside SOTO SCOO,000 Multi 3 use C D His County G Larry UK S13000 Clayton Park Bedford Sandy Lake 5750,000 Single family 51.100 Single family $1,800,000 Single family 51.500.000 6 1 Powder Mill 52,000,000 Lake 6 Bedford The projects will take many years to complete and will require additional investments in future years, but APM is limited in what it can invest now and wants to maximize the total profit generated. If the Almon project is selected, then the Novalea one should not. If the Hubley project is selected, then the Lakeside project must also be done, but Lakeside can be done without doing Hubley. Exactly two projects should be single family and at least two must be mixed use or multi-unit. AP has 56,000,000 to invest in 2013. What do you recommend? Formulate an LP model Let A-lif APM selects project Aand-Oif it does not Define variables B, C, D, E, F, G, H, and I in the same manner. The objective function is in 5 million The constraint for the statement "If the Almon project is selected, then the Novalca one should not" is given by OA+B51 OA+B-1 OASB OA+B21 OA2B Question 9 (3 points) Armdale Property Management has significant holdings in the Halifax Regional Municipality Over the last several years it has submitted many development proposals to the city and received approval. The challenge is to decide which projects to undertake in 2013 and which to defer or never pursue. In preparation of an upcoming meeting, staff have been asked to prepare a list of recommended projects for 2013. Projects under consideration are as follows: Notations Project Location Investment Required in 2013 Forecasted Project Profit Type Lifetime (years) A Almon $2,500,000 3 $1,400,000 Multi unit B Novalea S1,800,000 2 $1,200,000 Mixed use $300,000 Muit unit c Rockingstone $500,000 5 D Williams Lake Peninsula Halifax Peninsula Mainland South Mainland South Hex County West Hex County West $1,700,000 S800.000 Single family Multi- unit E Hubley $900,000 S500.000 4 F Lakeside $800,000 $400.000 3 Multi- unit G Larry Uteck $1,300,000 5 Clayton Park Sandy Lake $1,500,000 6 Bedford $750,000 Single family $1,100,000 Single family $1,800,000 Single family 1 $2,000,000 6 Powder MI Lake Bedford The projects will take many years to complete and will require additional investments in future years, but APM is limited in what it can invest now and wants to maximize the total profit generated. If the Almon project is selected, then the Novalea one should not. If the Hubley project is selected, then the Lakeside project must also be done, but Lakeside can be done without doing Hubley. Exactly two projects should be single family and at least two must be mixed use of multi-unit. APM has $6,000,000 to invest in 2013. What do you recommend? Formulate an LP model. Let A-1 if APM selects project A and - O if it does not. Define variables B, C, D, E, F, G, H, and I in the same manner. The objective function is in $1million, The constraint for the statement "If the Almon project is selected, then the Novalea one should not" is given by A+BS1 OA+B-1 OASB OA+B21 OA2B Question 9 (3 points) Armdale Property Management has significant holdings in the Halifax Regional Municipality Over the last several years it has submitted many development proposals to the city and received approval. The challenge is to decide which projects to undertake in 2013 and which to defer or never pursue. In preparation of an upcoming meeting, staff have been asked to prepare a list of recommended projects for 2013. Projects under consideration are as follows: Notations Project Investment Forecasted Project Lifetime Location Required in Profit Type (years) 2013 Almon $2,500,000 1,400,000 Mul Peninsula 3 Novalea SI NOO,000 51,200,000 Mixed Peninsula Rockingstone $500,000 5300,000 Multi 5 Mainland South Williams S1,700,000 S800.000 Single Mainland Lake family South Hubley $900.000 5500,000 Hus County West F Lakeside $800,000 $400,000 Multi HR County West D 5 G Larry Uteck S1,300,000 5 Clayton Park H Sandy Lake S1,500,000 $750,000 Single family $1,100,000 Single family S1.800.000 Single 6 Bediond 1 6 Powder Mill $2,000,000 Lake Bedford The projects will take many years to complete and will require additional investments in future years, but APM is limited in what it can invest now and wants to maximize the total profit generated. If the Almon project is selected, then the Novalca one should not. If the Hubley project is selected, then the Lakeside project must also be done, but Lakeside can be done without doing Hubley. Exactly two projects should be single family and at least two must be mixed use or multi-unit. APM has $6,000,000 to invest in 2013. What do you recommend? Formulate an LP model. Let A-1 if APM selects project A and Oif it does not Define variables B, C, D, E, F, G, H, and I in the same manner. The objective function is in S1million. AUTO The constraint for the statement "If the Almon project is selected, then the Novalca one should not" is given by OA+BS1 OA+B-1 OASB OA+B21 OAB