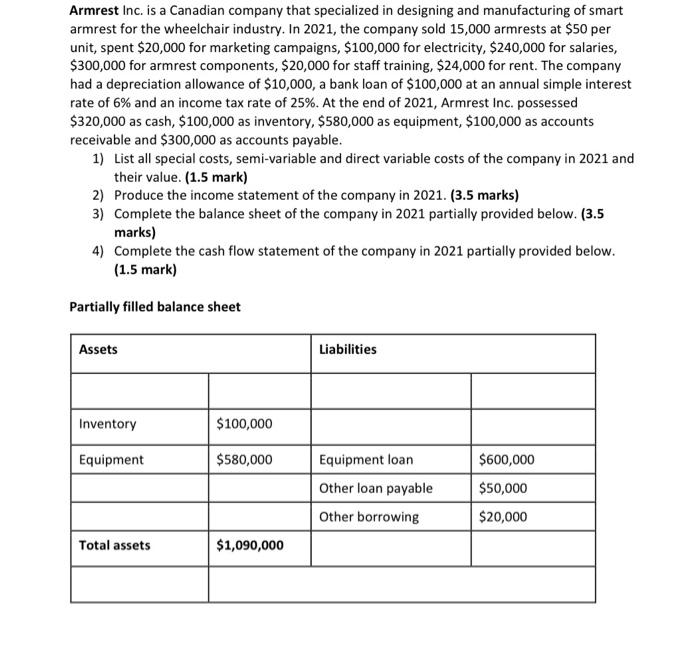

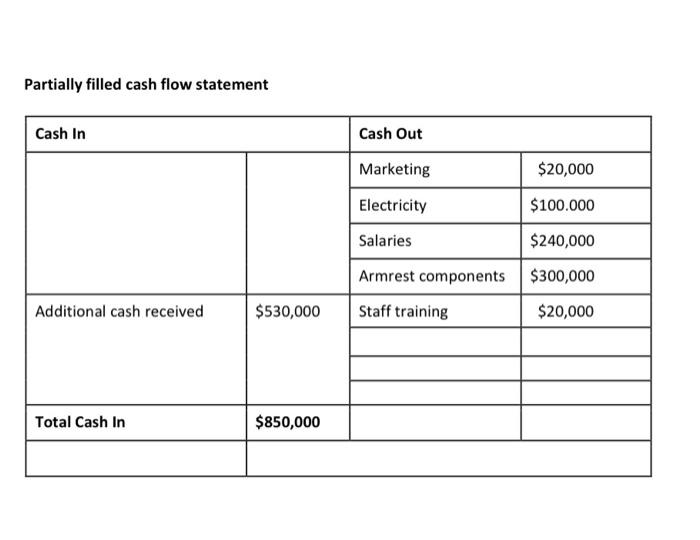

Armrest Inc. is a Canadian company that specialized in designing and manufacturing of smart armrest for the wheelchair industry. In 2021, the company sold 15,000 armrests at $50 per unit, spent $20,000 for marketing campaigns, $100,000 for electricity, $240,000 for salaries, $300,000 for armrest components, $20,000 for staff training, $24,000 for rent. The company had a depreciation allowance of $10,000, a bank loan of $100,000 at an annual simple interest rate of 6% and an income tax rate of 25%. At the end of 2021 , Armrest Inc. possessed $320,000 as cash, $100,000 as inventory, $580,000 as equipment, $100,000 as accounts receivable and $300,000 as accounts payable. 1) List all special costs, semi-variable and direct variable costs of the company in 2021 and their value. (1.5 mark) 2) Produce the income statement of the company in 2021. (3.5 marks) 3) Complete the balance sheet of the company in 2021 partially provided below. (3.5 marks) 4) Complete the cash flow statement of the company in 2021 partially provided below. (1.5 mark) Partially filled balance sheet Partially filled cash flow statement Armrest Inc. is a Canadian company that specialized in designing and manufacturing of smart armrest for the wheelchair industry. In 2021, the company sold 15,000 armrests at $50 per unit, spent $20,000 for marketing campaigns, $100,000 for electricity, $240,000 for salaries, $300,000 for armrest components, $20,000 for staff training, $24,000 for rent. The company had a depreciation allowance of $10,000, a bank loan of $100,000 at an annual simple interest rate of 6% and an income tax rate of 25%. At the end of 2021 , Armrest Inc. possessed $320,000 as cash, $100,000 as inventory, $580,000 as equipment, $100,000 as accounts receivable and $300,000 as accounts payable. 1) List all special costs, semi-variable and direct variable costs of the company in 2021 and their value. (1.5 mark) 2) Produce the income statement of the company in 2021. (3.5 marks) 3) Complete the balance sheet of the company in 2021 partially provided below. (3.5 marks) 4) Complete the cash flow statement of the company in 2021 partially provided below. (1.5 mark) Partially filled balance sheet Partially filled cash flow statement