Question

Armstrong Fisheries took out a $400,000 loan. Clyde Armstrong wants to know the semiannual payment for the next 10 years at the loan interest

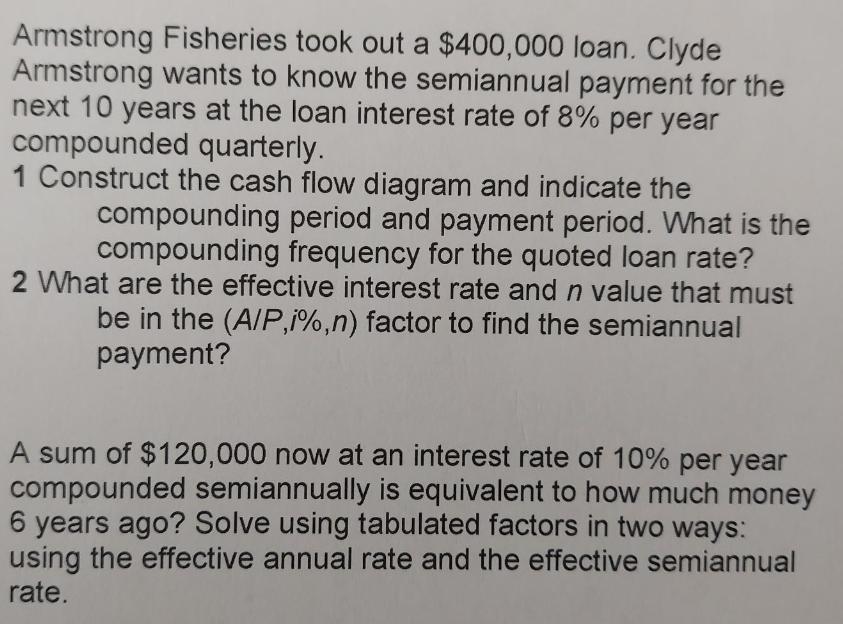

Armstrong Fisheries took out a $400,000 loan. Clyde Armstrong wants to know the semiannual payment for the next 10 years at the loan interest rate of 8% per year compounded quarterly. 1 Construct the cash flow diagram and indicate the compounding period and payment period. What is the compounding frequency for the quoted loan rate? 2 What are the effective interest rate and n value that must be in the (A/P,i%,n) factor to find the semiannual payment? A sum of $120,000 now at an interest rate of 10% per year compounded semiannually is equivalent to how much money 6 years ago? Solve using tabulated factors in two ways: using the effective annual rate and the effective semiannual rate.

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 To construct the cash flow diagram we need to identify the cash flows and the timing of those cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Government and Not for Profit Accounting Concepts and Practices

Authors: Michael Granof, Saleha Khumawala, Thad Calabrese, Daniel Smith

7th edition

1118983270, 978-1119175025, 111917502X, 978-1119175001, 978-1118983270

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App