Answered step by step

Verified Expert Solution

Question

1 Approved Answer

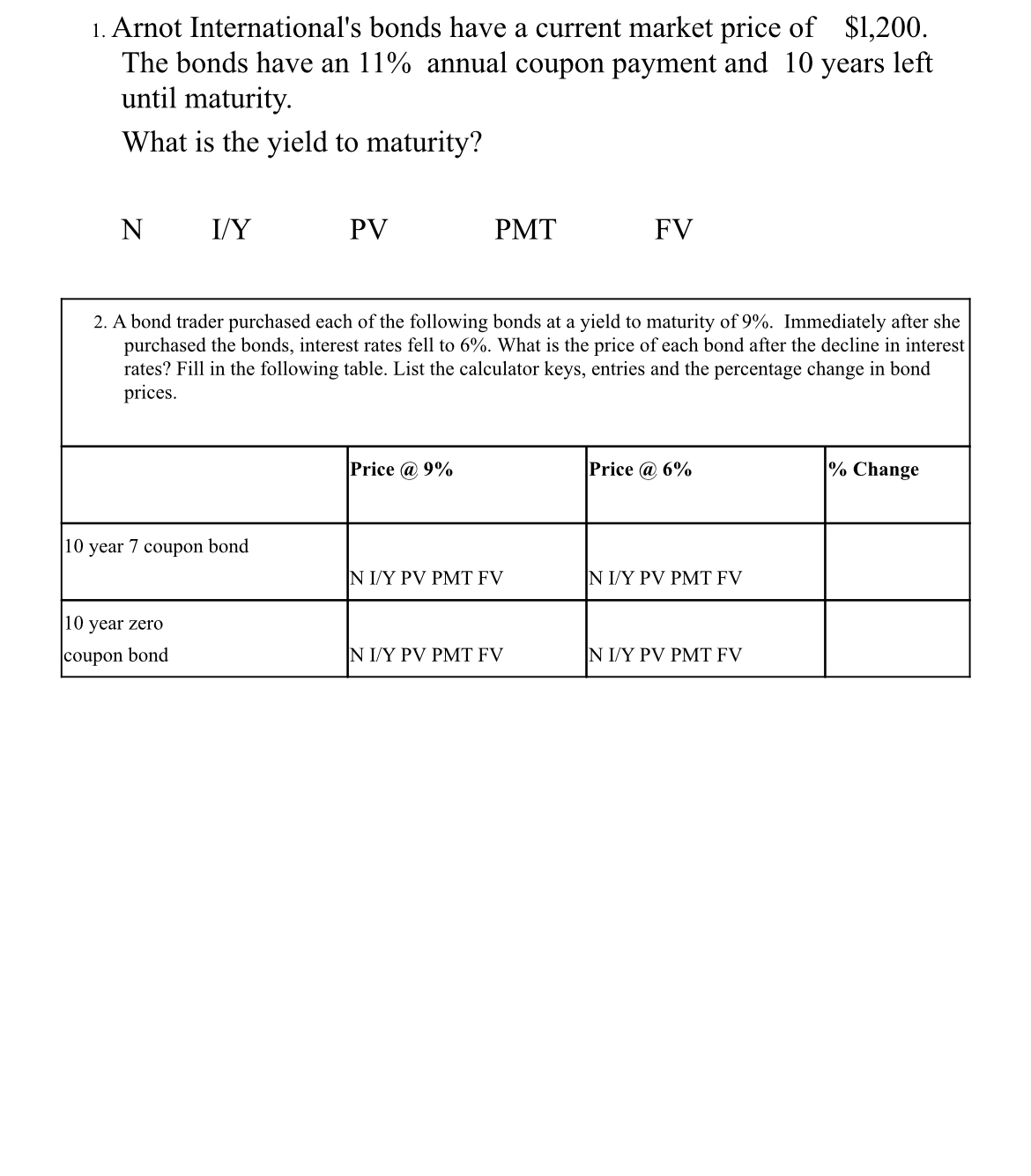

Arnot International's bonds have a current market price of $ 1 , 2 0 0 . The bonds have an 1 1 % annual coupon

Arnot International's bonds have a current market price of $ The bonds have an annual coupon payment and years left until maturity.

What is the yield to maturity?

IY

PV

PMT

FV

tabletable A bond trader purchased each of the following bonds at a yield to maturity of Immediately after shepurchased the bonds, interest rates fell to What is the price of each bond after the decline in interestrates Fill in the following table. List the calculator keys, entries and the percentage change in bondpricesPrice @ Price @ Change year coupon bond,N IY PV PMT FVtable year zerocoupon bondN IY PV PMT FVN IY PV PMT FV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started