Answered step by step

Verified Expert Solution

Question

1 Approved Answer

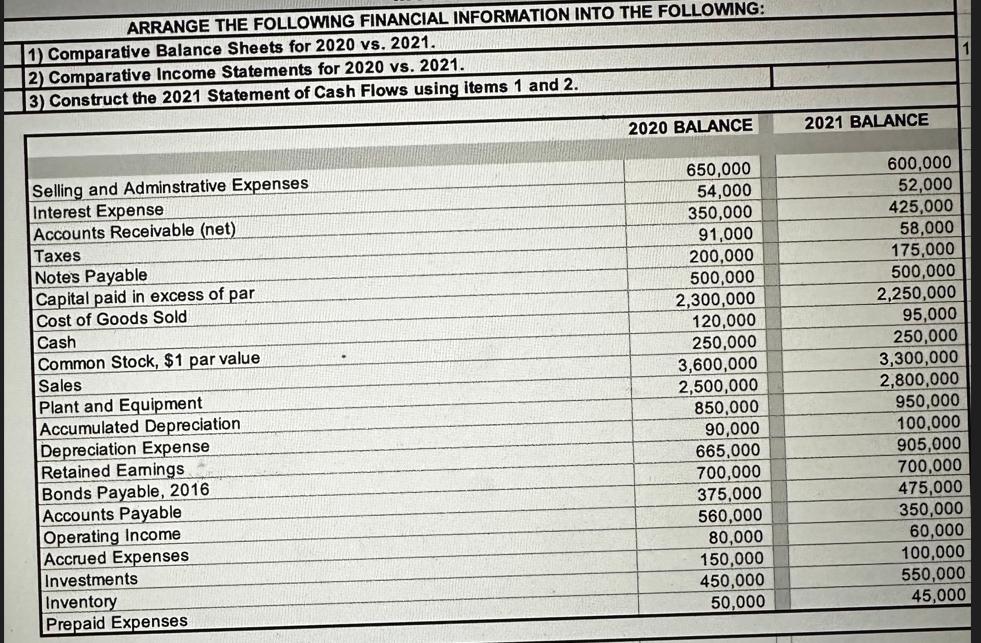

ARRANGE THE FOLLOWING FINANCIAL INFORMATION INTO THE FOLLOWING: 1) Comparative Balance Sheets for 2020 vs. 2021. 2) Comparative Income Statements for 2020 vs. 2021.

ARRANGE THE FOLLOWING FINANCIAL INFORMATION INTO THE FOLLOWING: 1) Comparative Balance Sheets for 2020 vs. 2021. 2) Comparative Income Statements for 2020 vs. 2021. 3) Construct the 2021 Statement of Cash Flows using items 1 and 2. Selling and Adminstrative Expenses Interest Expense Accounts Receivable (net) Taxes Notes Payable Capital paid in excess of par Cost of Goods Sold Cash Common Stock, $1 par value Sales Plant and Equipment Accumulated Depreciation Depreciation Expense Retained Eamings Bonds Payable, 2016 Accounts Payable Operating Income Accrued Expenses Investments Inventory Prepaid Expenses 2020 BALANCE 650,000 54,000 350,000 91,000 200,000 500,000 2,300,000 120,000 250,000 3,600,000 2,500,000 850,000 90,000 665,000 700,000 375,000 560,000 80,000 150,000 450,000 50,000 T 2021 BALANCE 600,000 52,000 425,000 58,000 175,000 500,000 2,250,000 95,000 250,000 3,300,000 2,800,000 950,000 100,000 905,000 700,000 475,000 350,000 60,000 100,000 550,000 45,000

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started