Answered step by step

Verified Expert Solution

Question

1 Approved Answer

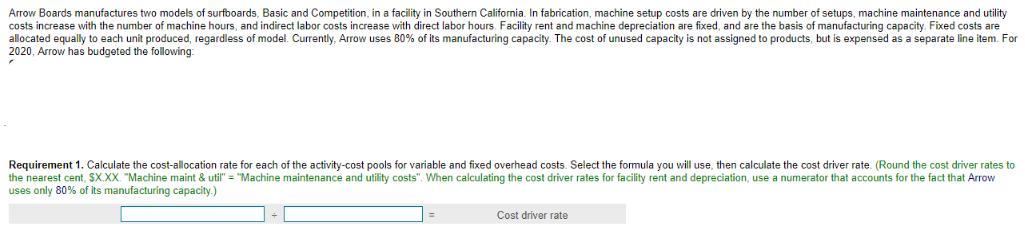

Arrow Boards manufactures two models of surfboards, Basic and Competition, in a facility in Southern California. In fabrication, machine setup costs are driven by

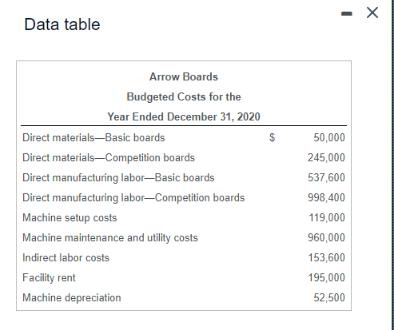

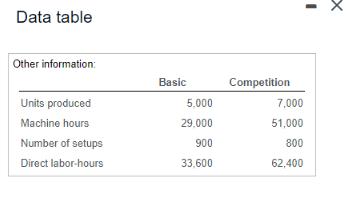

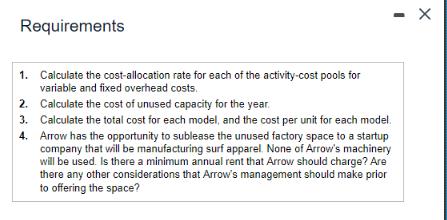

Arrow Boards manufactures two models of surfboards, Basic and Competition, in a facility in Southern California. In fabrication, machine setup costs are driven by the number of setups, machine maintenance and utility costs increase with the number of machine hours, and indirect labor costs increase with direct labor hours. Facility rent and machine depreciation are fixed, and are the basis of manufacturing capacity. Fixed costs are allocated equally to each unit produced, regardless of model. Currently, Arrow uses 80% of its manufacturing capacity. The cost of unused capacity is not assigned to products, but is expensed as a separate line item. For 2020, Arrow has budgeted the following: Requirement 1. Calculate the cost-allocation rate for each of the activity-cost pools for variable and fixed overhead costs. Select the formula you will use, then calculate the cost driver rate. (Round the cost driver rates to the nearest cent, $X.XX. "Machine maint & util" = "Machine maintenance and utility costs". When calculating the cost driver rates for facility rent and depreciation, use a numerator that accounts for the fact that Arrow uses only 80% of its manufacturing capacity.) Cost driver rate Data table Arrow Boards Budgeted Costs for the Year Ended December 31, 2020 Direct materials-Basic boards Direct materials Competition boards Direct manufacturing labor-Basic boards Direct manufacturing labor-Competition boards Machine setup costs Machine maintenance and utility costs Indirect labor costs Facility rent Machine depreciation $ - X 50,000 245,000 537,600 998,400 119,000 960,000 153,600 195,000 52,500 Data table Other information: Units produced Machine hours Number of setups Direct labor-hours Basic 5.000 29,000 900 33,600 Competition 7,000 51,000 800 62,400 x Requirements Calculate the cost-allocation rate for each of the activity-cost pools for variable and fixed overhead costs. - X 1. 2. Calculate the cost of unused capacity for the year. 3. Calculate the total cost for each model, and the cost per unit for each model. 4. Arrow has the opportunity to sublease the unused factory space to a startup company that will be manufacturing surf apparel. None of Arrow's machinery will be used. Is there a minimum annual rent that Arrow should charge? Are there any other considerations that Arrow's management should make prior to offering the space?

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Calculate the costallocation rate for each of the activitycost pools for variable and fixed overhead costs Cost Allocation Rate for Variable Overhead Costs Variable Overhead Cost Total C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started