Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Arrow Co. entered into a contract with a customer for $480,000. The contract is for the delivery of equipment and a 3 -year service maintenance

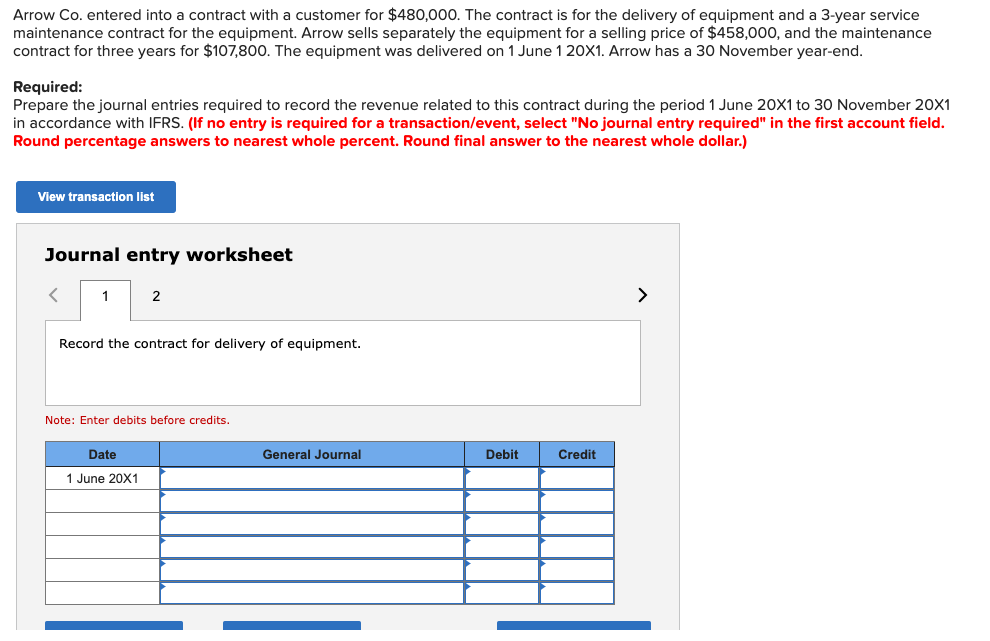

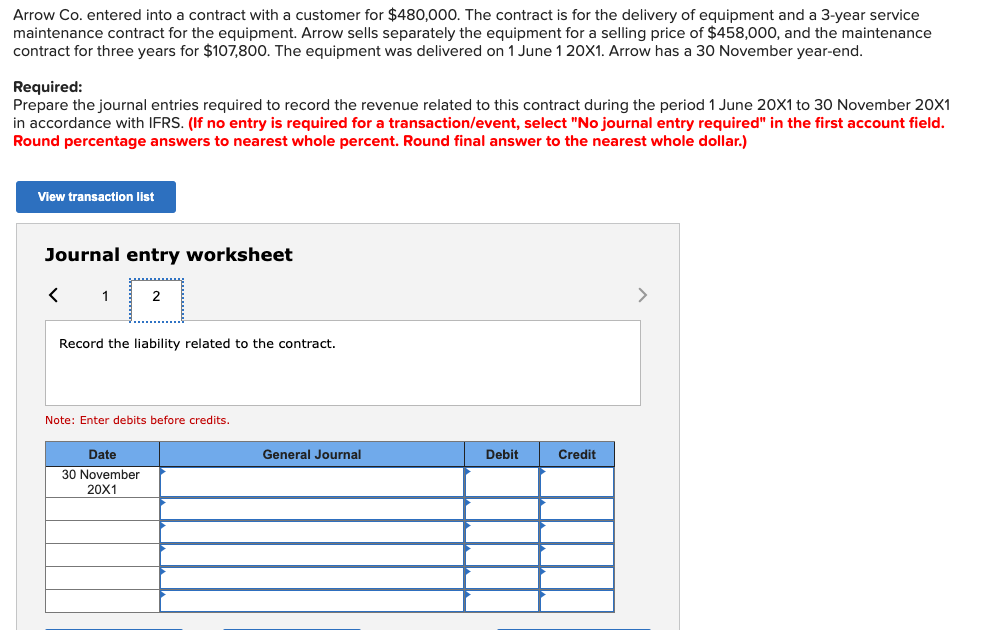

Arrow Co. entered into a contract with a customer for $480,000. The contract is for the delivery of equipment and a 3 -year service maintenance contract for the equipment. Arrow sells separately the equipment for a selling price of $458,000, and the maintenance contract for three years for $107,800. The equipment was delivered on 1 June 1201. Arrow has a 30 November year-end. Required: Prepare the journal entries required to record the revenue related to this contract during the period 1 June 201 to 30 November 201 in accordance with IFRS. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round percentage answers to nearest whole percent. Round final answer to the nearest whole dollar.) Journal entry worksheet Note: Enter debits before credits. Arrow Co. entered into a contract with a customer for $480,000. The contract is for the delivery of equipment and a 3 -year service maintenance contract for the equipment. Arrow sells separately the equipment for a selling price of $458,000, and the maintenance contract for three years for $107,800. The equipment was delivered on 1 June 1201. Arrow has a 30 November year-end. Required: Prepare the journal entries required to record the revenue related to this contract during the period 1 June 201 to 30 November 201 in accordance with IFRS. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round percentage answers to nearest whole percent. Round final answer to the nearest whole dollar.) Journal entry worksheet Note: Enter debits before credits

Arrow Co. entered into a contract with a customer for $480,000. The contract is for the delivery of equipment and a 3 -year service maintenance contract for the equipment. Arrow sells separately the equipment for a selling price of $458,000, and the maintenance contract for three years for $107,800. The equipment was delivered on 1 June 1201. Arrow has a 30 November year-end. Required: Prepare the journal entries required to record the revenue related to this contract during the period 1 June 201 to 30 November 201 in accordance with IFRS. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round percentage answers to nearest whole percent. Round final answer to the nearest whole dollar.) Journal entry worksheet Note: Enter debits before credits. Arrow Co. entered into a contract with a customer for $480,000. The contract is for the delivery of equipment and a 3 -year service maintenance contract for the equipment. Arrow sells separately the equipment for a selling price of $458,000, and the maintenance contract for three years for $107,800. The equipment was delivered on 1 June 1201. Arrow has a 30 November year-end. Required: Prepare the journal entries required to record the revenue related to this contract during the period 1 June 201 to 30 November 201 in accordance with IFRS. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round percentage answers to nearest whole percent. Round final answer to the nearest whole dollar.) Journal entry worksheet Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started