Answered step by step

Verified Expert Solution

Question

1 Approved Answer

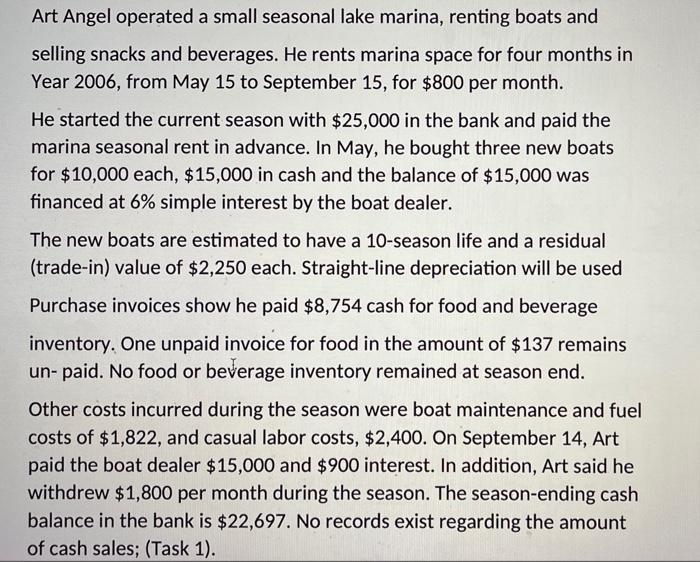

Art Angel operated a small seasonal lake marina, renting boats and selling snacks and beverages. He rents marina space for four months in Year

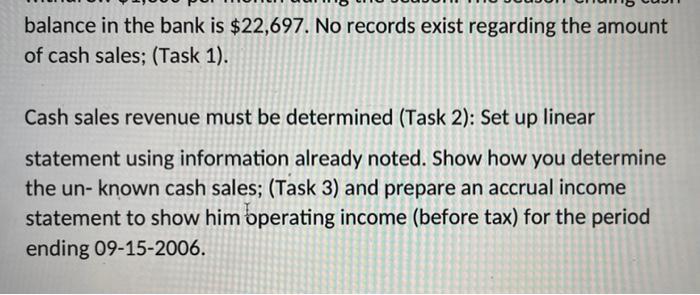

Art Angel operated a small seasonal lake marina, renting boats and selling snacks and beverages. He rents marina space for four months in Year 2006, from May 15 to September 15, for $800 per month. He started the current season with $25,000 in the bank and paid the marina seasonal rent in advance. In May, he bought three new boats for $10,000 each, $15,000 in cash and the balance of $15,000 was financed at 6% simple interest by the boat dealer. The new boats are estimated to have a 10-season life and a residual (trade-in) value of $2,250 each. Straight-line depreciation will be used Purchase invoices show he paid $8,754 cash for food and beverage inventory. One unpaid invoice for food in the amount of $137 remains un- paid. No food or beverage inventory remained at season end. Other costs incurred during the season were boat maintenance and fuel costs of $1,822, and casual labor costs, $2,400. On September 14, Art paid the boat dealer $15,000 and $900 interest. In addition, Art said he withdrew $1,800 per month during the season. The season-ending cash balance in the bank is $22,697. No records exist regarding the amount of cash sales; (Task 1). balance in the bank is $22,697. No records exist regarding the amount of cash sales; (Task 1). Cash sales revenue must be determined (Task 2): Set up linear statement using information already noted. Show how you determine the un- known cash sales; (Task 3) and prepare an accrual income statement to show him operating income (before tax) for the period ending 09-15-2006.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Computation of cash sales Dale Particular Amount S May Total cash outflow Prepaid rent 3200 Cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started