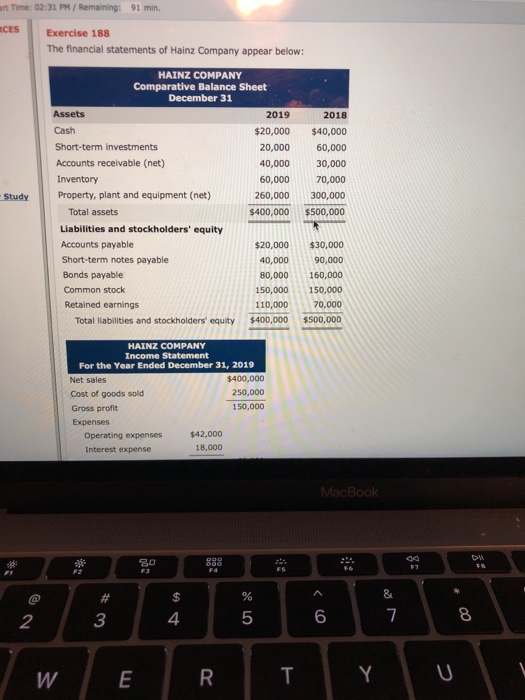

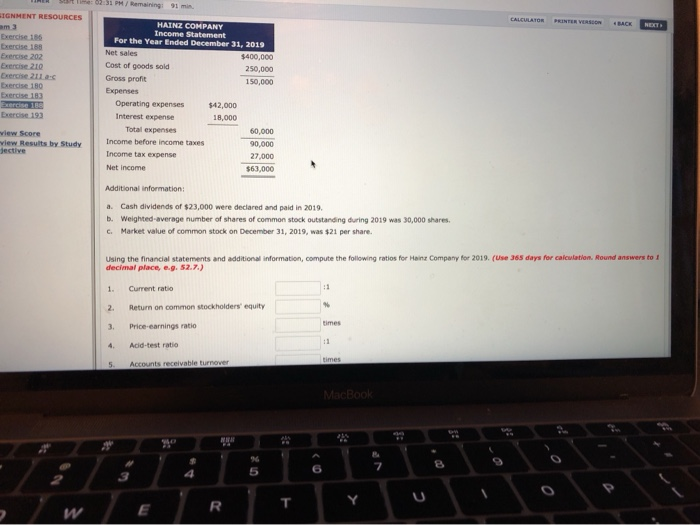

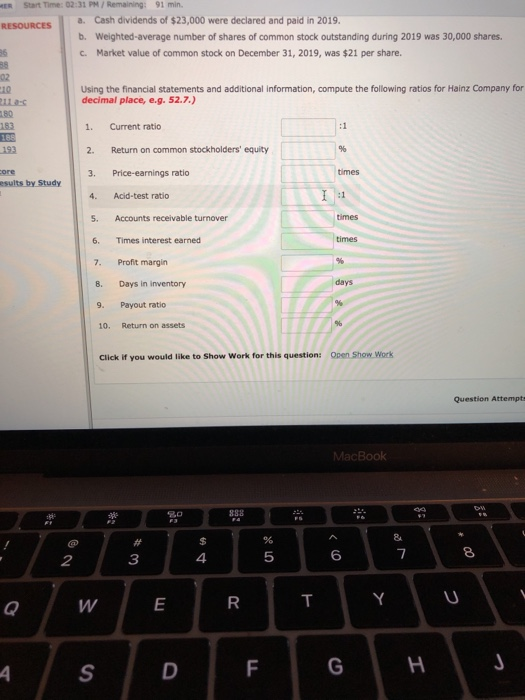

art Time: 02:31 PM / Remaining: 91 min. RCES Exercise 188 The financial statements of Hainz Company appear below: HAINZ COMPANY Comparative Balance Sheet December 31 Assets 2019 Cash $20,000 Short-term investments 20,000 Accounts receivable (net) 40,000 Inventory 60,000 Property, plant and equipment (net) 260,000 Total assets $400,000 Liabilities and stockholders' equity Accounts payable $20,000 Short-term notes payable 40,000 Bonds payable 80,000 Common stock 150,000 Retained earnings 110,000 Total liabilities and stockholders' equity $400,000 2018 $40,000 60,000 30,000 70,000 300,000 $500,000 Study $30,000 90,000 160,000 150,000 70,000 $500,000 HAINZ COMPANY Income Statement For the Year Ended December 31, 2019 Net sales $400,000 Cost of goods sold 250,000 Gross profit 150,000 Expenses Operating expenses $42,000 Interest expense 18,000 MacBook / WERTYU SIGNMENT RESOURCES ALCULATO VE N ETO Exercise 186 Exercise 188 Exercise 202 Exercise 210 Exercise 211ac Exercise 180 Exercise 183 Exercise 18 Exercise 193 HAINZ COMPANY Income Statement For the Year Ended December 31, 2019 Net sales $400,000 Cost of goods sold 250,000 Gross profit 150,000 Expenses Operating expenses $42,000 Interest expense 18.000 Total expenses 60.000 Income before income taxes Income tax expense 27,000 Net income $63,000 view Score view Results by Study jective 90,000 Additional Information a. Cash dividends of $23,000 were declared and paid in 2019. b. Weighted average number of shares of common stock outstanding during 2019 was 30,000 shares C. Market value of common stock on December 31, 2019, was $21 per share. Using the financial statements and additional information, compute the following ratios for Haine Company for 2019. (Use 365 days for calculate decimal place, e.g. 52.7.) Current ratio 2. Return on common stockholders' equity 3. Price earnings ratio 4. Acid-test ratio 5. Accounts receivable turnover times Start Time: 02:31 PM / Remaining: 91 min. RESOURCES a. Cash dividends of $23,000 were declared and paid in 2019. b. Weighted average number of shares of common stock outstanding during 2019 was 30,000 shares. c. Market value of common stock on December 31, 2019, was $21 per share. 10 Using the financial statements and additional information, compute the following ratios for Hainz Company for decimal place, e.g. 52.7.) Current ratio 183 185 193 Return on common stockholders' equity core esults by Study 3. Price-earnings ratio 4. Acid-test ratio 5. Accounts receivable turnover 6. Times interest earned times 7. Profit margin 8. Days in Inventory 9. Payout ratio 10. Return on assets Click if you would like to Show Work for this question: Open Show Work Question Attempt MacBook QwERTY A S D F G H