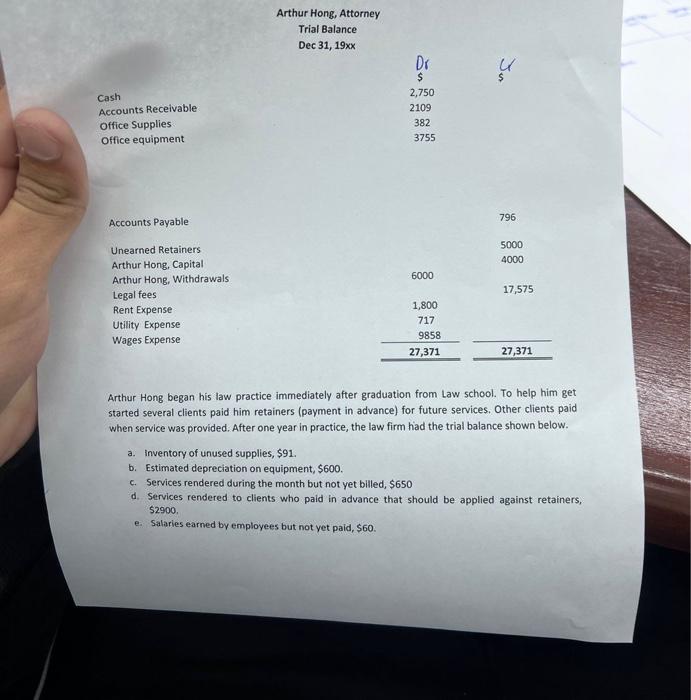

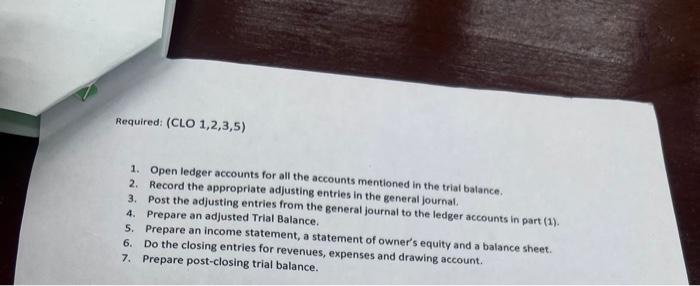

Arthur Hong began his law practice immediately after graduation from Law school. To help him get started several clients paid him retainers (payment in advance) for future services. Other clients paid when service was provided. After one year in practice, the law firm had the trial balance shown below. a. Inventory of unused supplies, $91. b. Estimated depreciation on equipment, $600. c. Services rendered during the month but not yet billed, $650 d. Services rendered to clients who paid in advance that should be applied against retainers, $2900. e. Salaries earned by employees but not yet paid, $60. 1. Open ledger accounts for all the accounts mentioned in the trial balance. 2. Record the appropriate adjusting entries in the general journal. 3. Post the adjusting entries from the general journal to the ledger accounts in part (1). 4. Prepare an adjusted Trial Balance. 5. Prepare an income statement, a statement of owner's equity and a balance sheet. 6. Do the closing entries for revenues, expenses and drawing account. 7. Prepare post-closing trial balance. Arthur Hong began his law practice immediately after graduation from Law school. To help him get started several clients paid him retainers (payment in advance) for future services. Other clients paid when service was provided. After one year in practice, the law firm had the trial balance shown below. a. Inventory of unused supplies, $91. b. Estimated depreciation on equipment, $600. c. Services rendered during the month but not yet billed, $650 d. Services rendered to clients who paid in advance that should be applied against retainers, $2900. e. Salaries earned by employees but not yet paid, $60. 1. Open ledger accounts for all the accounts mentioned in the trial balance. 2. Record the appropriate adjusting entries in the general journal. 3. Post the adjusting entries from the general journal to the ledger accounts in part (1). 4. Prepare an adjusted Trial Balance. 5. Prepare an income statement, a statement of owner's equity and a balance sheet. 6. Do the closing entries for revenues, expenses and drawing account. 7. Prepare post-closing trial balance