Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Arthur Korrey is developing a project to start a new professional aquatic baseball league, with teams comprised of humans, dolphins and penguins. He forecasts

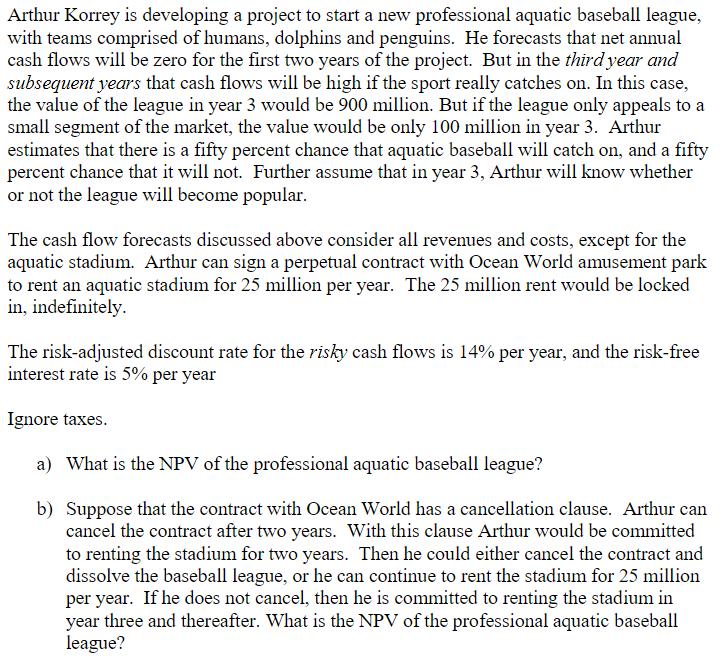

Arthur Korrey is developing a project to start a new professional aquatic baseball league, with teams comprised of humans, dolphins and penguins. He forecasts that net annual cash flows will be zero for the first two years of the project. But in the third year and subsequent years that cash flows will be high if the sport really catches on. In this case, the value of the league in year 3 would be 900 million. But if the league only appeals to a small segment of the market, the value would be only 100 million in year 3. Arthur estimates that there is a fifty percent chance that aquatic baseball will catch on, and a fifty percent chance that it will not. Further assume that in year 3, Arthur will know whether or not the league will become popular. The cash flow forecasts discussed above consider all revenues and costs, except for the aquatic stadium. Arthur can sign a perpetual contract with Ocean World amusement park to rent an aquatic stadium for 25 million per year. The 25 million rent would be locked in, indefinitely. The risk-adjusted discount rate for the risky cash flows is 14% per year, and the risk-free interest rate is 5% per year Ignore taxes. a) What is the NPV of the professional aquatic baseball league? b) Suppose that the contract with Ocean World has a cancellation clause. Arthur can cancel the contract after two years. With this clause Arthur would be committed to renting the stadium for two years. Then he could either cancel the contract and dissolve the baseball league, or he can continue to rent the stadium for 25 million per year. If he does not cancel, then he is committed to renting the stadium in year three and thereafter. What is the NPV of the professional aquatic baseball league?

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the NPV of the project we need to calculate the present value of the cash flows in each year and subtract the initial investment Since ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started