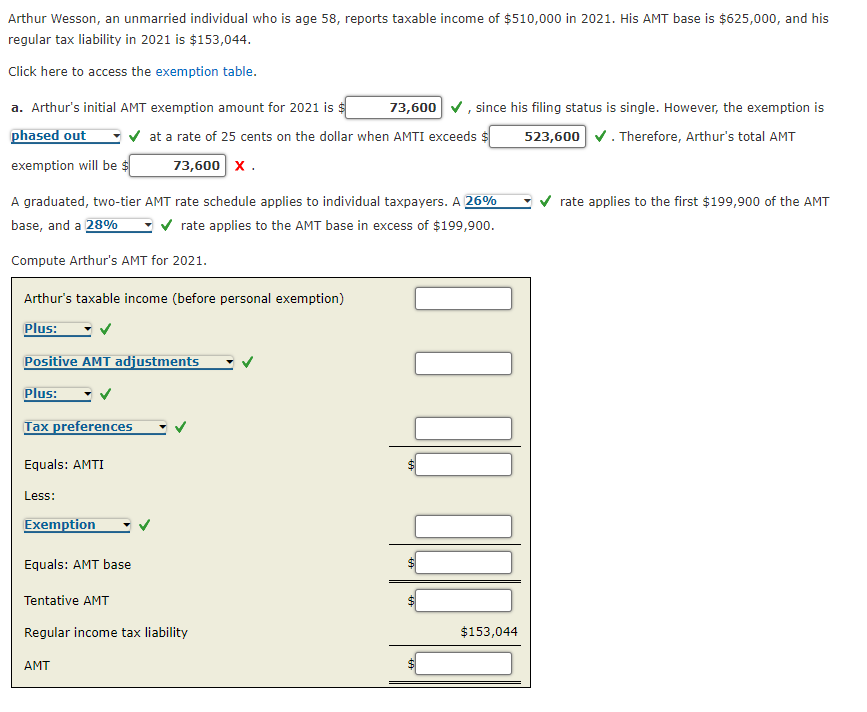

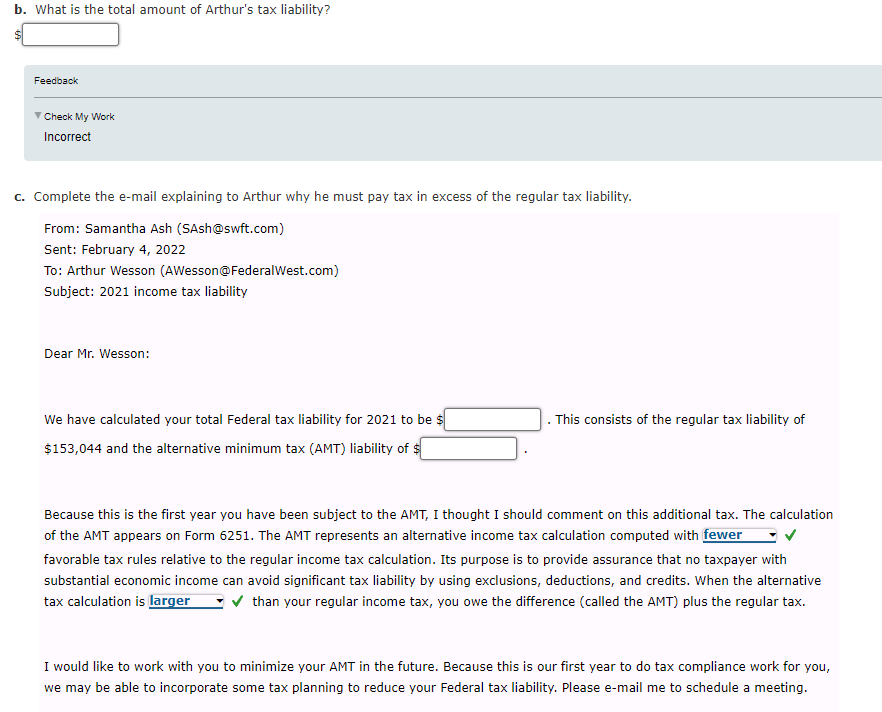

Arthur Wesson, an unmarried individual who is age 58, reports taxable income of $510,000 in 2021. His AMT base is $625,000, and his regular tax liability in 2021 is $153,044. Click here to access the exemption table. a. Arthur's initial AMT exemption amount for 2021 is $ 73,600 , since his filing status is single. However, the exemption is phased out at a rate of 25 cents on the dollar when AMTI exceeds $ 523,600 . Therefore, Arthur's total AMT exemption will be $ 73,600 X rate applies to the first $199,900 of the AMT A graduated, two-tier AMT rate schedule applies to individual taxpayers. A 26% base, and a 28% rate applies to the AMT base in excess of $199,900. Compute Arthur's AMT for 2021. Arthur's taxable income (before personal exemption) Plus: Positive AMT adjustments Plus: Tax preferences Equals: AMTI Less: Exemption Equals: AMT base $ Tentative AMT Regular income tax liability $153,044 AMT b. What is the total amount of Arthur's tax liability? Feedback Check My Work Incorrect C. Complete the e-mail explaining to Arthur why he must pay tax in excess of the regular tax liability. From: Samantha Ash (SAsh@swft.com) Sent: February 4, 2022 To: Arthur Wesson (AWesson@FederalWest.com) Subject: 2021 income tax liability Dear Mr. Wesson: . This consists of the regular tax liability of We have calculated your total Federal tax liability for 2021 to be s $153,044 and the alternative minimum tax (AMT) liability of $ Because this is the first year you have been subject to the AMT, I thought I should comment on this additional tax. The calculation of the AMT appears on Form 6251. The AMT represents an alternative income tax calculation computed with fewer favorable tax rules relative to the regular income tax calculation. Its purpose is to provide assurance that no taxpayer with substantial economic income can avoid significant tax liability by using exclusions, deductions, and credits. When the alternative tax calculation is larger than your regular income tax, you owe the difference (called the AMT) plus the regular tax. I would like to work with you to minimize your AMT in the future. Because this is our first year to do tax compliance work for you, we may be able to incorporate some tax planning to reduce your Federal tax liability. Please e-mail me to schedule a meeting