Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Arup and Swarup were partners. The partnership deed provides inter alia: (i) That the annual accounts be balanced on 31st December each year; (ii)

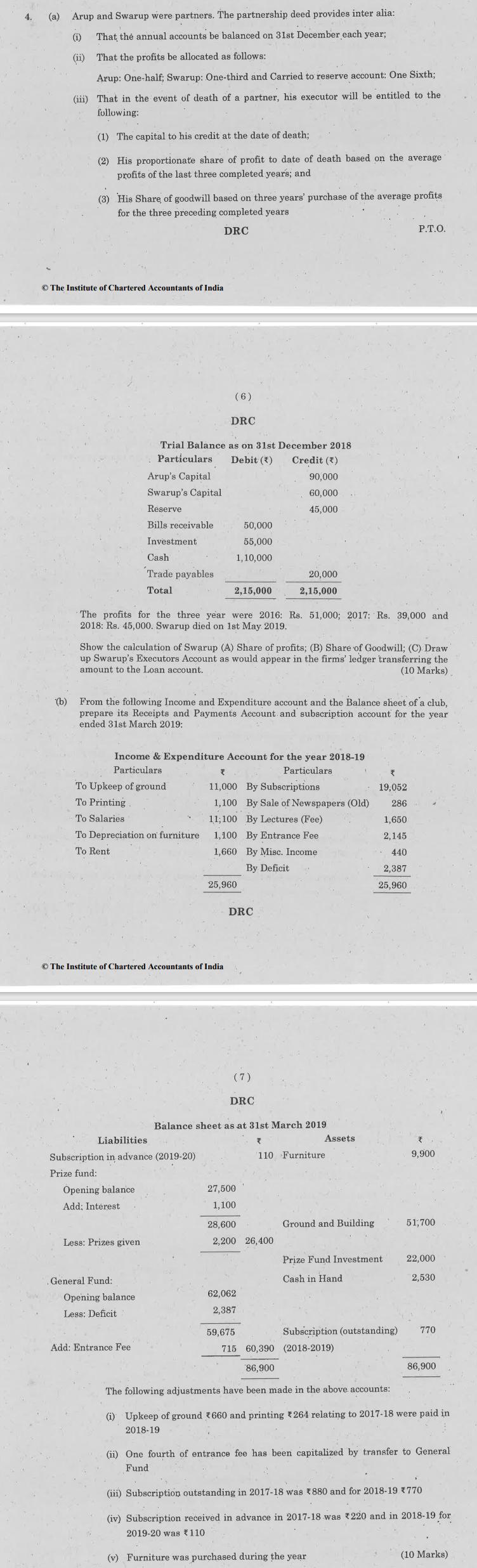

Arup and Swarup were partners. The partnership deed provides inter alia: (i) That the annual accounts be balanced on 31st December each year; (ii) That the profits be allocated as follows: Arup: One-half; Swarup: One-third and Carried to reserve account: One Sixth; (iii) That in the event of death of a partner, his executor will be entitled to the following: (b) (1) The capital to his credit at the date of death; (2) His proportionate share of profit to date of death based on the average profits of the last three completed years; and (3) His Share of goodwill based on three years' purchase of the average profits for the three preceding completed years DRC The Institute of Chartered Accountants of India Investment. Trial Balance as on 31st December 2018 Particulars Debit (*) Credit (*) Arup's Capital Swarup's Capital Reserve Bills receivable Cash Trade payables Total To Upkeep of ground To Printing To Salaries. To Depreciation on furniture To Rent Opening balance Add; Interest Less: Prizes given. General Fund: (6) The profits for the three year were 2016: Rs. 51,000; 2017: Rs. 39,000 and 2018: Rs. 45,000. Swarup died on 1st May 2019. The Institute of Chartered Accountants of India Liabilities Subscription in advance (2019-20) Prize fund: Opening balance Less: Deficit DRC Show the calculation of Swarup (A) Share of profits; (B) Share of Goodwill; (C) Draw up Swarup's Executors Account as would appear in the firms' ledger transferring the amount to the Loan account. (10 Marks) Add: Entrance Fee. From the following Income and Expenditure account and the Balance sheet of a club, prepare its Receipts and Payments Account and subscription account for the year ended 31st March 2019: Income & Expenditure Account for the year 2018-19 Particulars Particulars 2,15,000 50,000 55,000 1,10,000 25,960 11,000 By Subscriptions 1,100 By Sale of Newspapers (Old) 11;100 By Lectures (Fee) 1,100 By Entrance Fee. 1,660 By Misc. Income. By Deficit 90,000 60,000 45,000 DRC 20,000 2,15,000 27,500 1,100 (7) DRC Balance sheet as at 31st March 2019 110 Furniture 28,600 2,200 26,400 62,062 2,387 59,675 Assets Ground and Building 19,052 286 1,650 2,145 440 2,387 25,960 P.T.O. Prize Fund Investment Cash in Hand Subscription (outstanding) 715 60,390 (2018-2019) 86,900 The following adjustments have been made in the above. accounts: 9,900 51,700 22,000 2,530 770 86,900 (i) Upkeep of ground 660 and printing 264 relating to 2017-18 were paid in 2018-19 (ii) One fourth of entrance fee has been capitalized by transfer to General Fund (iii) Subscription outstanding in 2017-18 was *880 and for 2018-19 *770 (iv) Subscription received in advance in 2017-18 was 220 and in 2018-19 for 2019-20 was 110 (v) Furniture was purchased during the year (10 Marks)

Step by Step Solution

★★★★★

3.55 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started