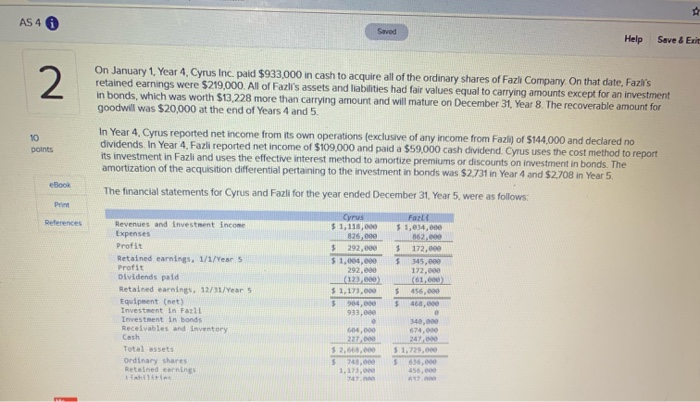

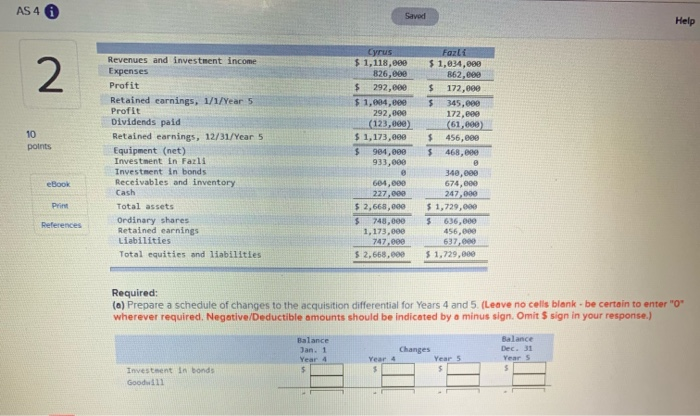

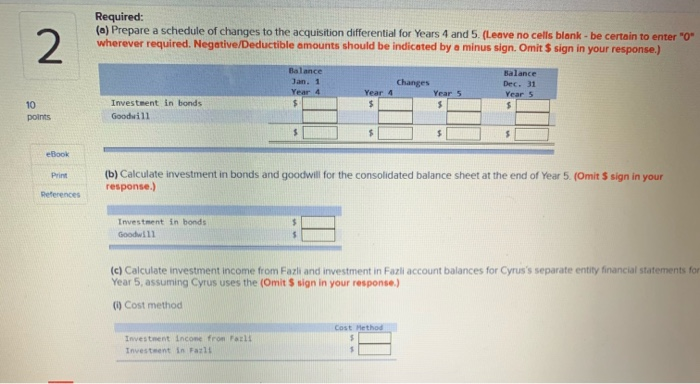

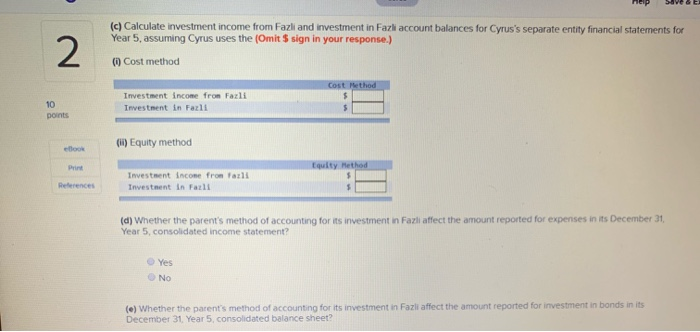

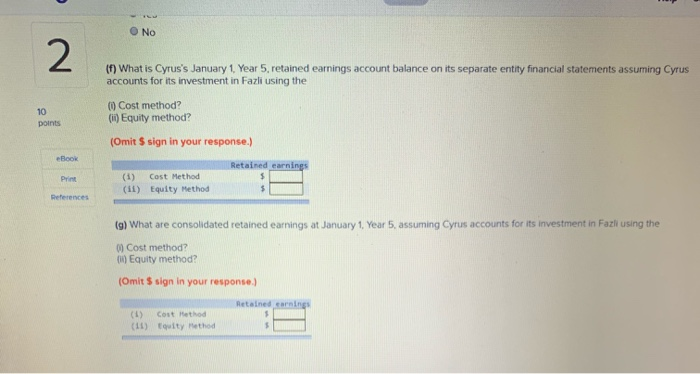

AS 4 6 Saved Help Save & Exit On January 1 Year 4. Cyrus Inc. paid $933.000 in cash to acquire all of the ordinary shares of Fazli Company On that date, Fazi's retained earnings were $219,000. All of Fazli's assets and liabilities had fair values equal to carrying amounts except for an investment in bonds, which was worth $13,228 more than carrying amount and will mature on December 31, Year 8. The recoverable amount for goodwill was $20,000 at the end of Years 4 and 5. In Year 4. Cyrus reported net income from its own operations (exclusive of any income from Fazli) of $144,000 and declared no dividends In Year 4. Fazli reported net income of $109,000 and paid a $59.000 cash dividend. Cyrus uses the cost method to report its investment in Fazli and uses the effective interest method to amortize premiums or discounts on investment in bonds. The amortization of the acquisition differential pertaining to the investment in bonds was $2.731 in Year 4 and $2.708 in Year 5. The financial statements for Cyrus and Fazli for the year ended December 31, Year 5, were as follows: $ 1.110,000 825.000 $ 292,000 $ 1.000.000 For $ 1.034.00 362.000 $ 172.000 Revenues and investment inco Expenses Profit Retained earnings 1/1/Year 5 Profit Dividends paid Retained earnings 12/11/Year 5 Equipant (net) (123.00) $ 1.173.000 172. 61,00) 456,000 $ 933.0 606,00 . 674,000 247.00 Investment in bonds Receivables and Inventory Cash Total assets ordinary shares Retained earnings 1 1.173. 56, Savod Help 5 $ Cyrus $ 1.118.000 826,000 $ 292,000 $ 1.000.000 292.000 (123,000) $ 1.173.000 $ 984,000 933,000 1.034,000 862,000 172,000 145,000 172.000 (61,600) 456,000 468,000 $ $ Revenues and investment income Expenses Profit Retained earnings, 1/1/Year 5 Profit Dividends paid Retained earnings, 12/31/Year 5 Equipment (net) Investment in Farli Investment in bonds Receivables and Inventory Cash Total assets Ordinary shares Retained earnings Liabilities Total equities and liabilities 604,00 227.000 $ 2,668,000 $ 748.000 1.173.00 747.ee $ 2,668,000 340,000 674,00 247,000 $ 1,729,000 $ 636,000 537. $1,729.000 Required: (a) Prepare a schedule of changes to the acquisition differential for Years 4 and 5. Leave no cells blank.be certain to enter"0" wherever required. Negative/Deductible amounts should be indicated by a minus sign. Omit S sign in your response.) Balance Changes Investeert in bonds Goodwill Required: (a) Prepare a schedule of changes to the acquisition differential for Years 4 and 5. (Leave no cells blank - be certain to enter "0" wherever required. Negative/Deductible amounts should be indicated by a minus sign. Omit S sign in your response.) Changes Dec. 31 Investment in bonds Goodwill points (b) Calculate investment in bonds and goodwill for the consolidated balance sheet at the end of Year 5. Omit S sign in your response.) peterences Investment in bonds Goodwill (c) Calculate investment income from Fazli and investment in Fazli account balances for Cyrus's separate entity financial statements for Year 5, assuming Cyrus uses the (Omit Sign in your response.) Cost method Investment income from rails Investeent in Fazil (c) Calculate investment income from Fazli and investment in Fazli account balances for Cyrus's separate entity financial statements for Year 5, assuming Cyrus uses the (Omit 5 sign in your response.) Cost method Invest Income from Farli Investment in Farli (H) Equity method Investment income from Farli Investment in Fall (d) Whether the parent's method of accounting for its investment in Farhaffect the amount reported for expenses in its December 31 Year 5, consolidated income statement? Yes No (e) Whether the parent's method of accounting for its investment in Fazli affect the amount reported for investment in bonds in its December 31 Year 5 consolidated balance sheet? No (f) What is Cyrus's January 1 Year 5. retained earnings account balance on its separate entity financial statements assuming Cyrus accounts for its investment in Fazli using the (0) Cost method? (1) Equity method? points (Omit $ sign in your response.) Book Retained earnings (1) Cost Method (11) Equity Method References (g) What are consolidated retained earnings at January 1, Year 5, assuming Cyrus accounts for its investment in Fazli using the 0) Cost method? 06) Equity method? (Omit $ sign in your response.) Retained earnings (1) Cost Method (11) Equity Method AS 4 6 Saved Help Save & Exit On January 1 Year 4. Cyrus Inc. paid $933.000 in cash to acquire all of the ordinary shares of Fazli Company On that date, Fazi's retained earnings were $219,000. All of Fazli's assets and liabilities had fair values equal to carrying amounts except for an investment in bonds, which was worth $13,228 more than carrying amount and will mature on December 31, Year 8. The recoverable amount for goodwill was $20,000 at the end of Years 4 and 5. In Year 4. Cyrus reported net income from its own operations (exclusive of any income from Fazli) of $144,000 and declared no dividends In Year 4. Fazli reported net income of $109,000 and paid a $59.000 cash dividend. Cyrus uses the cost method to report its investment in Fazli and uses the effective interest method to amortize premiums or discounts on investment in bonds. The amortization of the acquisition differential pertaining to the investment in bonds was $2.731 in Year 4 and $2.708 in Year 5. The financial statements for Cyrus and Fazli for the year ended December 31, Year 5, were as follows: $ 1.110,000 825.000 $ 292,000 $ 1.000.000 For $ 1.034.00 362.000 $ 172.000 Revenues and investment inco Expenses Profit Retained earnings 1/1/Year 5 Profit Dividends paid Retained earnings 12/11/Year 5 Equipant (net) (123.00) $ 1.173.000 172. 61,00) 456,000 $ 933.0 606,00 . 674,000 247.00 Investment in bonds Receivables and Inventory Cash Total assets ordinary shares Retained earnings 1 1.173. 56, Savod Help 5 $ Cyrus $ 1.118.000 826,000 $ 292,000 $ 1.000.000 292.000 (123,000) $ 1.173.000 $ 984,000 933,000 1.034,000 862,000 172,000 145,000 172.000 (61,600) 456,000 468,000 $ $ Revenues and investment income Expenses Profit Retained earnings, 1/1/Year 5 Profit Dividends paid Retained earnings, 12/31/Year 5 Equipment (net) Investment in Farli Investment in bonds Receivables and Inventory Cash Total assets Ordinary shares Retained earnings Liabilities Total equities and liabilities 604,00 227.000 $ 2,668,000 $ 748.000 1.173.00 747.ee $ 2,668,000 340,000 674,00 247,000 $ 1,729,000 $ 636,000 537. $1,729.000 Required: (a) Prepare a schedule of changes to the acquisition differential for Years 4 and 5. Leave no cells blank.be certain to enter"0" wherever required. Negative/Deductible amounts should be indicated by a minus sign. Omit S sign in your response.) Balance Changes Investeert in bonds Goodwill Required: (a) Prepare a schedule of changes to the acquisition differential for Years 4 and 5. (Leave no cells blank - be certain to enter "0" wherever required. Negative/Deductible amounts should be indicated by a minus sign. Omit S sign in your response.) Changes Dec. 31 Investment in bonds Goodwill points (b) Calculate investment in bonds and goodwill for the consolidated balance sheet at the end of Year 5. Omit S sign in your response.) peterences Investment in bonds Goodwill (c) Calculate investment income from Fazli and investment in Fazli account balances for Cyrus's separate entity financial statements for Year 5, assuming Cyrus uses the (Omit Sign in your response.) Cost method Investment income from rails Investeent in Fazil (c) Calculate investment income from Fazli and investment in Fazli account balances for Cyrus's separate entity financial statements for Year 5, assuming Cyrus uses the (Omit 5 sign in your response.) Cost method Invest Income from Farli Investment in Farli (H) Equity method Investment income from Farli Investment in Fall (d) Whether the parent's method of accounting for its investment in Farhaffect the amount reported for expenses in its December 31 Year 5, consolidated income statement? Yes No (e) Whether the parent's method of accounting for its investment in Fazli affect the amount reported for investment in bonds in its December 31 Year 5 consolidated balance sheet? No (f) What is Cyrus's January 1 Year 5. retained earnings account balance on its separate entity financial statements assuming Cyrus accounts for its investment in Fazli using the (0) Cost method? (1) Equity method? points (Omit $ sign in your response.) Book Retained earnings (1) Cost Method (11) Equity Method References (g) What are consolidated retained earnings at January 1, Year 5, assuming Cyrus accounts for its investment in Fazli using the 0) Cost method? 06) Equity method? (Omit $ sign in your response.) Retained earnings (1) Cost Method (11) Equity Method