Answered step by step

Verified Expert Solution

Question

1 Approved Answer

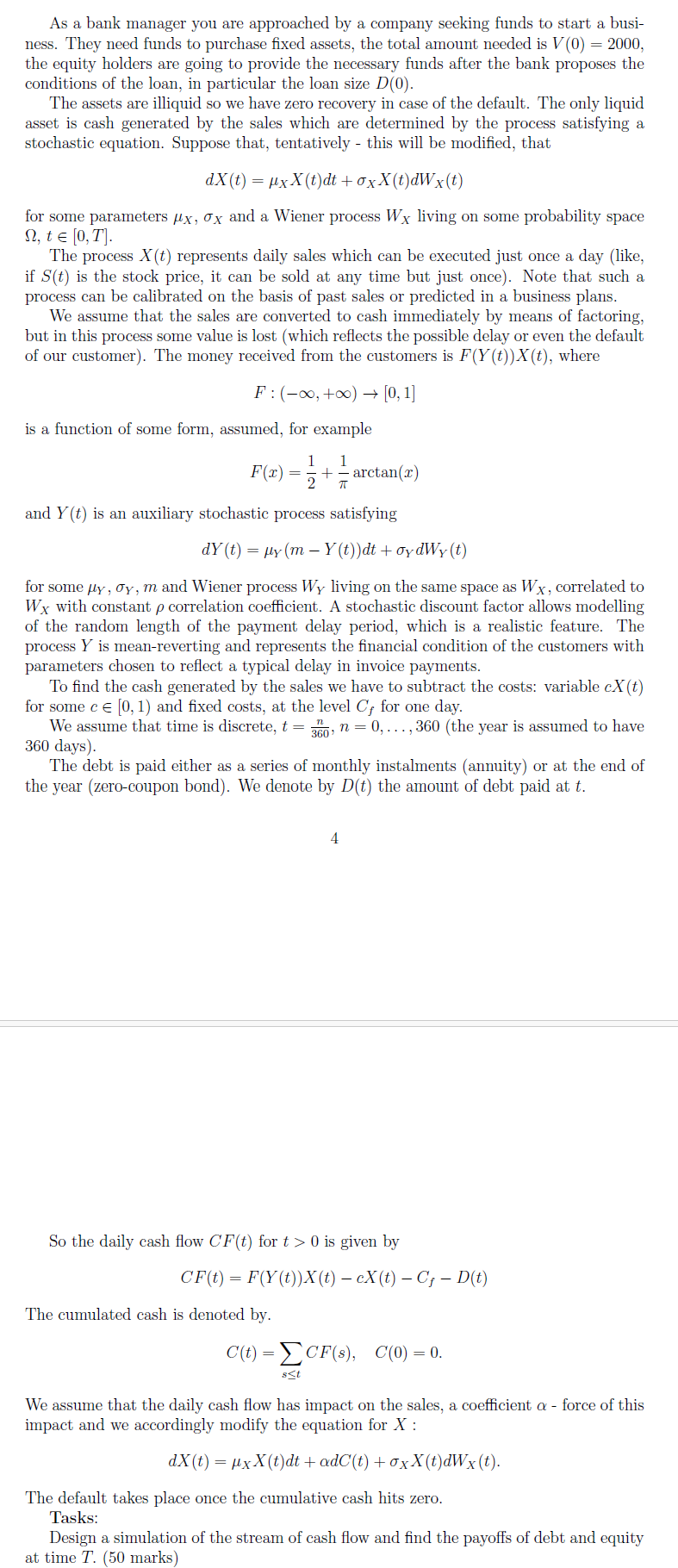

As a bank manager you are approached by a company seeking funds to start a busi - ness. They need funds to purchase fixed assets,

As a bank manager you are approached by a company seeking funds to start a busi

ness. They need funds to purchase fixed assets, the total amount needed is

the equity holders are going to provide the necessary funds after the bank proposes the

conditions of the loan, in particular the loan size

The assets are illiquid so we have zero recovery in case of the default. The only liquid

asset is cash generated by the sales which are determined by the process satisfying a

stochastic equation. Suppose that, tentatively this will be modified, that

for some parameters and a Wiener process living on some probability space

tin

The process represents daily sales which can be executed just once a day like

if is the stock price, it can be sold at any time but just once Note that such a

process can be calibrated on the basis of past sales or predicted in a business plans.

We assume that the sales are converted to cash immediately by means of factoring,

but in this process some value is lost which reflects the possible delay or even the default

of our customer The money received from the customers is where

:

is a function of some form, assumed, for example

and is an auxiliary stochastic process satisfying

for some and Wiener process living on the same space as correlated to

with constant correlation coefficient. A stochastic discount factor allows modelling

of the random length of the payment delay period, which is a realistic feature. The

process is meanreverting and represents the financial condition of the customers with

parameters chosen to reflect a typical delay in invoice payments.

To find the cash generated by the sales we have to subtract the costs: variable

for some cin and fixed costs, at the level for one day.

We assume that time is discrete, dots,the year is assumed to have

days

The debt is paid either as a series of monthly instalments annuity or at the end of

the year zerocoupon bond We denote by the amount of debt paid at

So the daily cash flow for is given by

The cumulated cash is denoted by

We assume that the daily cash flow has impact on the sales, a coefficient force of this

impact and we accordingly modify the equation for :

The default takes place once the cumulative cash hits zero.

Tasks:

Design a simulation of the stream of cash flow and find the payoffs of debt and equity

at time marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started