Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a bond trader at Goldman Sachs, you predict that the FOMC will lower the key interest rate in the upcoming meeting on Wednesday. Currently

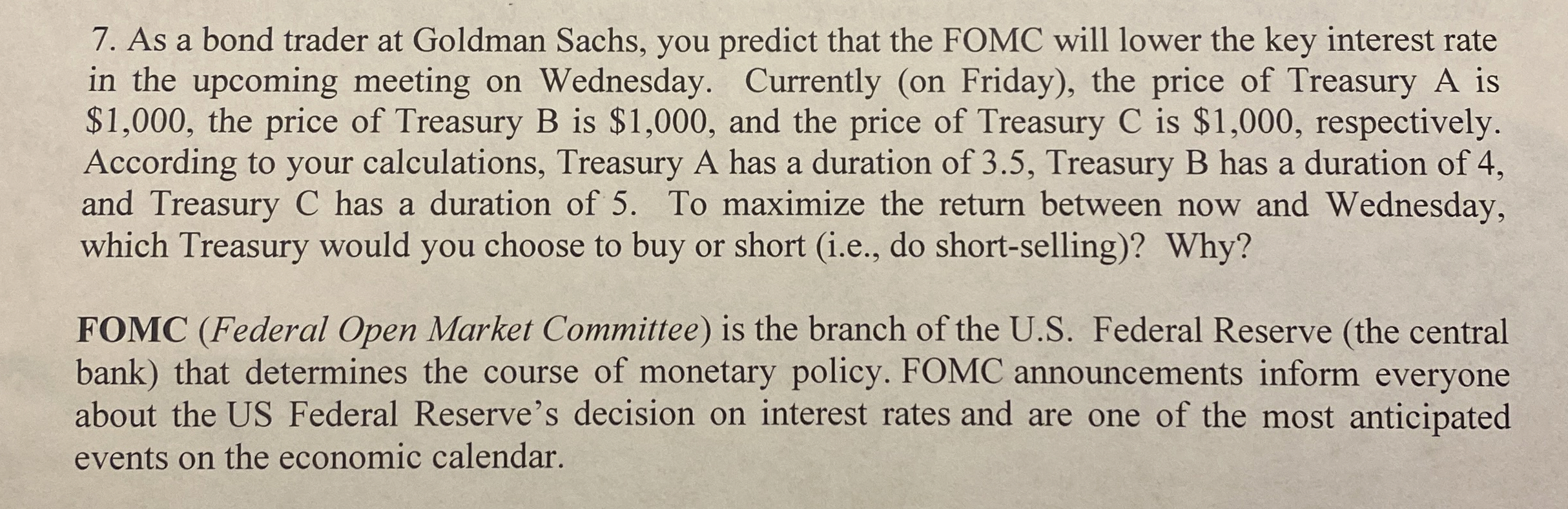

As a bond trader at Goldman Sachs, you predict that the FOMC will lower the key interest rate in the upcoming meeting on Wednesday. Currently on Friday the price of Treasury A is $ the price of Treasury B is $ and the price of Treasury C is $ respectively. According to your calculations, Treasury A has a duration of Treasury B has a duration of and Treasury C has a duration of To maximize the return between now and Wednesday, which Treasury would you choose to buy or short ie do shortselling Why?

FOMC Federal Open Market Committee is the branch of the US Federal Reserve the central bank that determines the course of monetary policy. FOMC announcements inform everyone about the US Federal Reserve's decision on interest rates and are one of the most anticipated events on the economic calendar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started