Question

As a CEO of a private firm, you are considering a government contract that will generate a constant and risk-free cash flow of $100

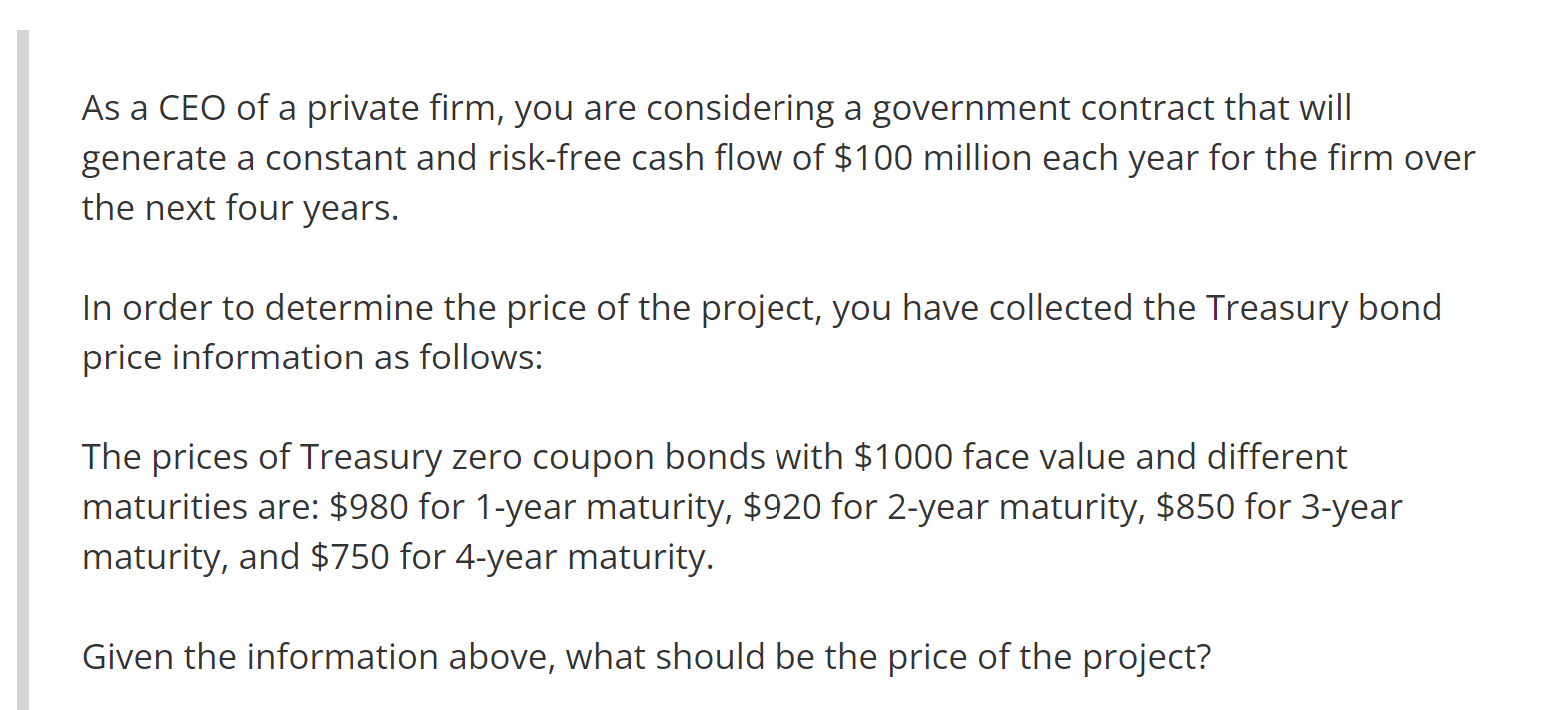

As a CEO of a private firm, you are considering a government contract that will generate a constant and risk-free cash flow of $100 million each year for the firm over the next four years. In order to determine the price of the project, you have collected the Treasury bond price information as follows: The prices of Treasury zero coupon bonds with $1000 face value and different maturities are: $980 for 1-year maturity, $920 for 2-year maturity, $850 for 3-year maturity, and $750 for 4-year maturity. Given the information above, what should be the price of the project?

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To determine the price of the project we need to calculate the present value of the cash flows it ge...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Advanced Accounting In Canada

Authors: Hilton Murray, Herauf Darrell

7th Edition

1259066487, 978-1259066481

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App