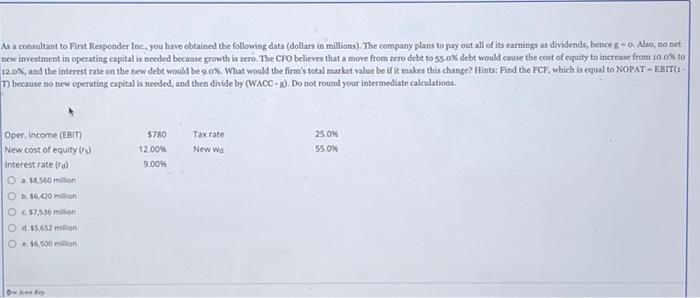

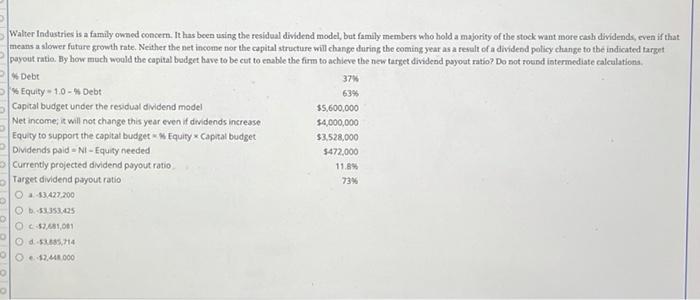

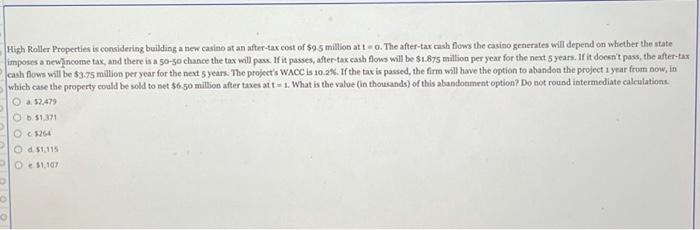

As a consultant to First Responder Inc., you have obtained the following data (dollars in millions). The company plans to pay out all of its earnings as dividends, hence go. Also, no net new investment in operating capital is needed because growth is zero. The CFO believes that a move from zero debt to 55.0% debt would cause the cost of equity to increase from 100% to 12.0%, and the interest rate on the new debt would be 9.0%. What would the firm's total market value be if it makes this change? Hints: Find the FCF, which is equal to NOPATEBITC ) because no new operating capital is needed, and then divide by (WACC - x). Do not round your intermediate calculations. 5780 1200W 9.00% Tax rate New w 25.0% 550W Oper. Income (EBIT New cost of equitys) Interest rateira) O 8.560 million 56.420 million 57,536 million O d. 15.652 min O $6.500 million 0 Walter Industries is a family owned concern. It has been using the residual dividend model, but family members who hold a majority of the stock want more cash dividends, even if that means a lower future growth rate. Neither the net income not the capital structure will change during the coming year as a result of a dividend policy change to the indicated target payout ratio. By how much would the capital budget have to be cut to enable the firm to achieve the new target dividend payout ratio? Do not round intermediate calculations Debt 37% Equity 10 - Debt 63% Capital budget under the residual dividend model $5,600,000 Net income, it will not change this year even if dividends increase $4,000,000 Equity to support the capitat budget - Equity Capital budget $3.528,000 Dividends paid - NI-Equity needed Currently projected dividend payout ratio Target dividend payout ratio $472,000 11.8% 73% -$3.427,200 53353.05 0.52,681,001 Od: 53.185,714 12.48000 High Roller Properties is considering building a new casino at an after-tax cost of $95 million atto. The after-tax cash flows the casino generates will depend on whether the state imposes a new income tax, and there is a 50-50 chance the tax will pass. If it passes, after-tax cash flows will be $1.875 million per year for the next years. If it doesn't pass, the after-tax cash flows will be $3,75 million per year for the next 5 years. The project's WAOC is 102%. If the tax is passed, the firm will have the option to abandon the project 1 year from now, in which case the property could be sold to net $650 million after taxes att* 1. What is the value in thousands) of this abandonment option? Do not round intermediate calculation a $2.479 O 651.371 @1264 d. 51.115 $1.107