Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a financial analyst for a firm looking to make an investment in its operations, you are tasked with determining how upcoming projects are financed.

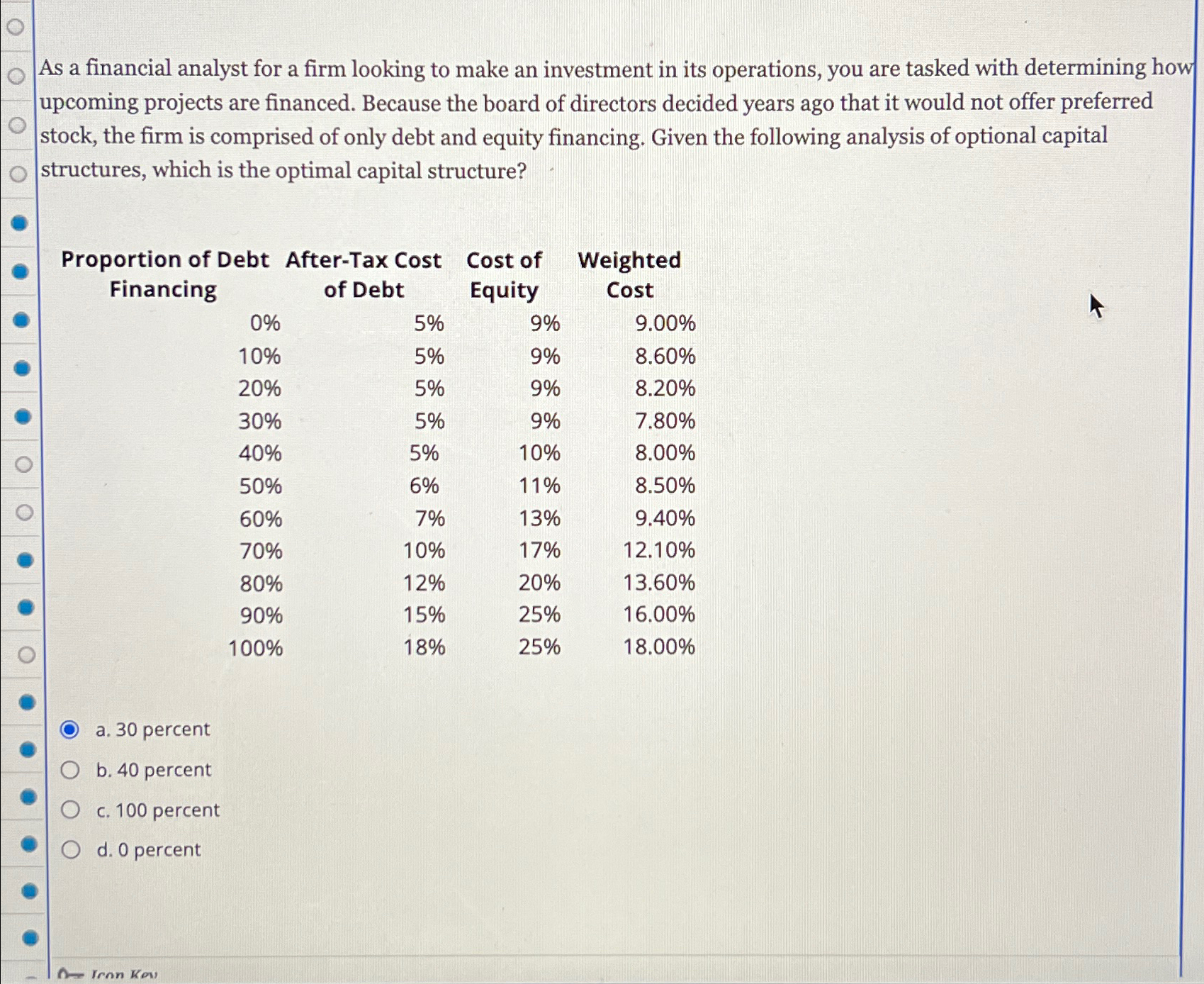

As a financial analyst for a firm looking to make an investment in its operations, you are tasked with determining how upcoming projects are financed. Because the board of directors decided years ago that it would not offer preferred stock, the firm is comprised of only debt and equity financing. Given the following analysis of optional capital structures, which is the optimal capital structure?

tabletableProportion of DebtFinancingtableAfterTax Costof DebttableCost ofEquitytableWeightedCost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started