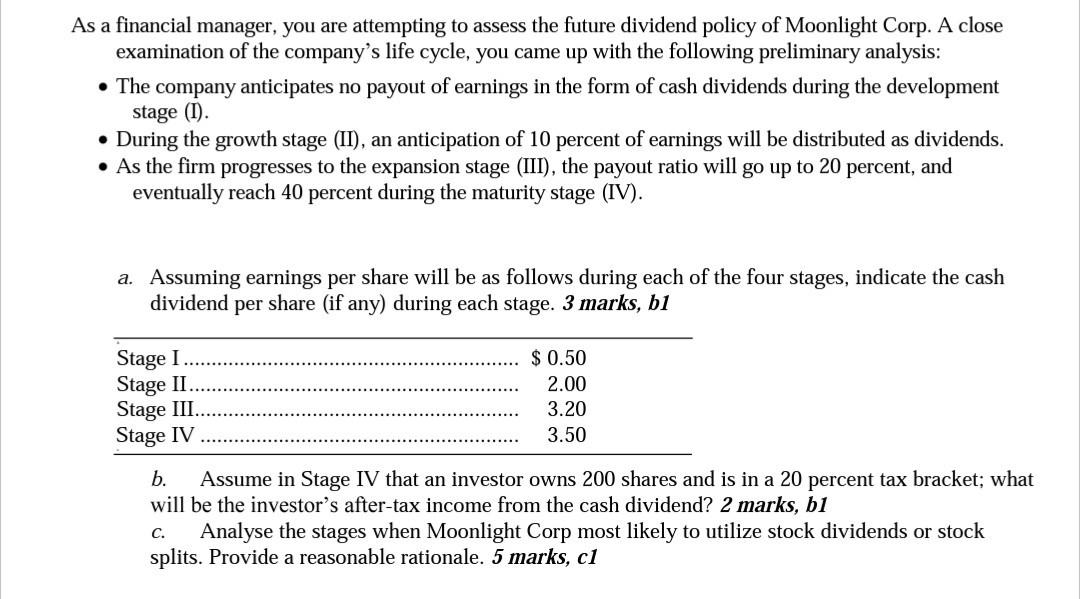

As a financial manager, you are attempting to assess the future dividend policy of Moonlight Corp. A close examination of the company's life cycle, you came up with the following preliminary analysis: The company anticipates no payout of earnings in the form of cash dividends during the development stage (I). During the growth stage (II), an anticipation of 10 percent of earnings will be distributed as dividends. As the firm progresses to the expansion stage (III), the payout ratio will go up to 20 percent, and eventually reach 40 percent during the maturity stage (IV). a. Assuming earnings per share will be as follows during each of the four stages, indicate the cash dividend per share (if any) during each stage. 3 marks, b1 $ 0.50 Stage I. Stage II.. Stage III.. 2.00 3.20 Stage IV 3.50 b. Assume in Stage IV that an investor owns 200 shares and is in a 20 percent tax bracket; what will be the investor's after-tax income from the cash dividend? 2 marks, b1 C. Analyse the stages when Moonlight Corp most likely to utilize stock dividends or stock splits. Provide a reasonable rationale. 5 marks, c1 As a financial manager, you are attempting to assess the future dividend policy of Moonlight Corp. A close examination of the company's life cycle, you came up with the following preliminary analysis: The company anticipates no payout of earnings in the form of cash dividends during the development stage (I). During the growth stage (II), an anticipation of 10 percent of earnings will be distributed as dividends. As the firm progresses to the expansion stage (III), the payout ratio will go up to 20 percent, and eventually reach 40 percent during the maturity stage (IV). a. Assuming earnings per share will be as follows during each of the four stages, indicate the cash dividend per share (if any) during each stage. 3 marks, b1 $ 0.50 Stage I. Stage II.. Stage III.. 2.00 3.20 Stage IV 3.50 b. Assume in Stage IV that an investor owns 200 shares and is in a 20 percent tax bracket; what will be the investor's after-tax income from the cash dividend? 2 marks, b1 C. Analyse the stages when Moonlight Corp most likely to utilize stock dividends or stock splits. Provide a reasonable rationale. 5 marks, c1