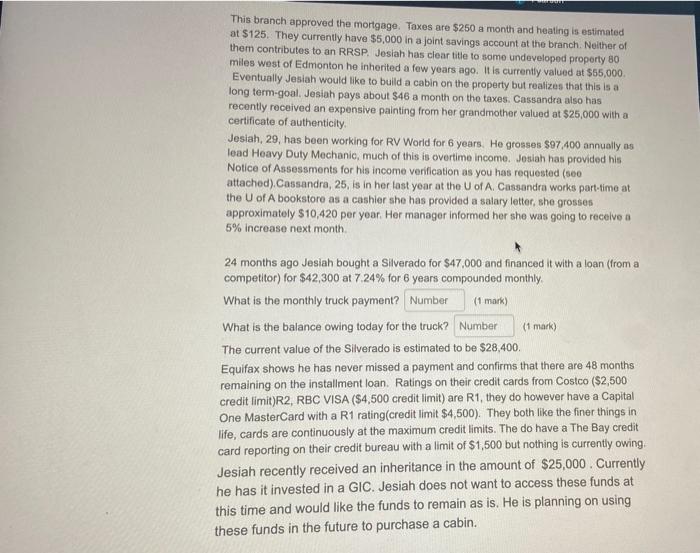

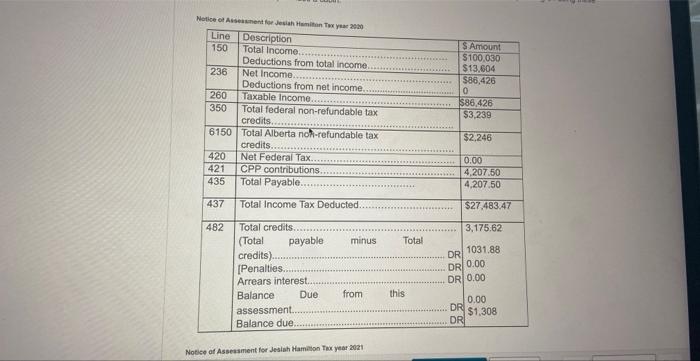

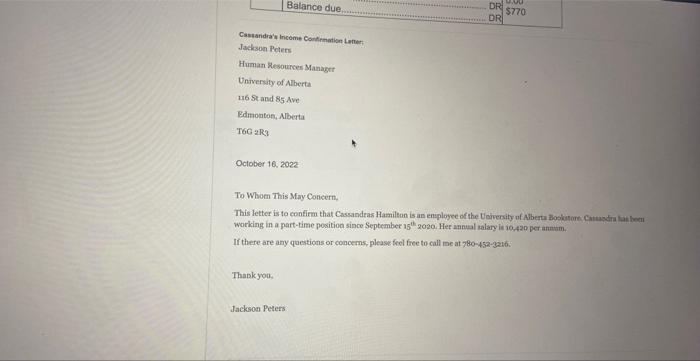

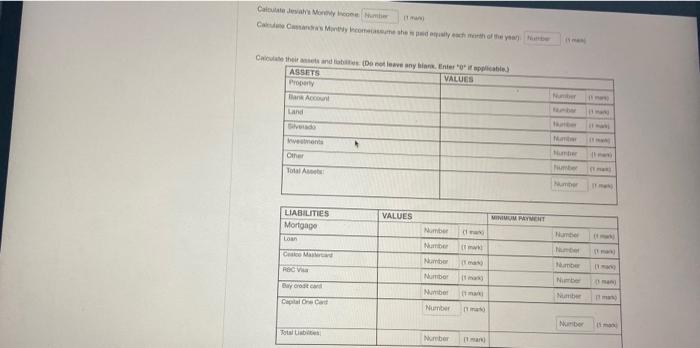

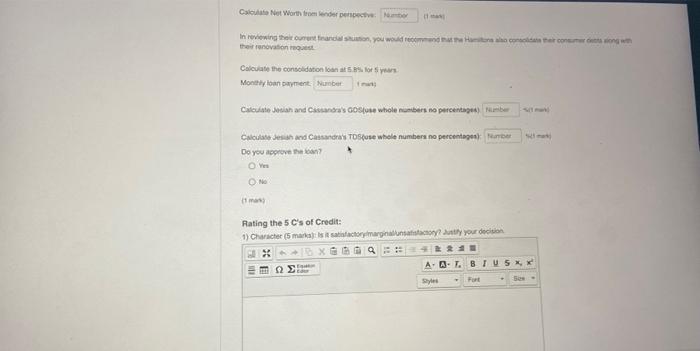

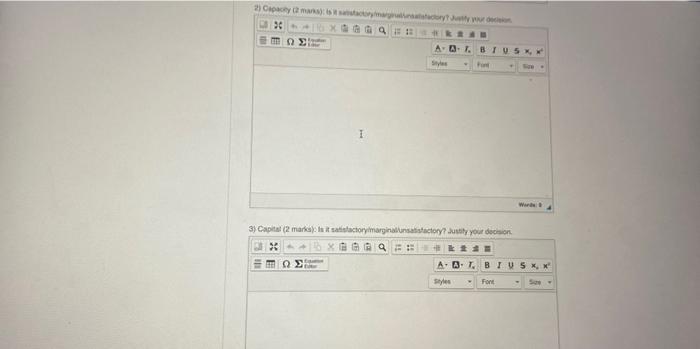

As a lender, go through the information provided and determine if the clients qualify for their loan request. (set your calculator to two decimal points. Note thare are questions that require you to use whole numbers and not enter the percentage sign) Jesiah and Cassandra Hamilion have been married for 2 years. They are presently living In an older home and have come to you seeking financing so that they can renovate their kitchen in their home. Jesiah has priced out the renovation project and brought in some written estimates. He estimates the cost of the renovation to be $27,500. Jesiah and Cassandra want to repay the loan over 5 years. Jeslah has tiken a bullding construction course at NAIT is excited to use the skills he has leamed. The Hamilton's house is valued at $300,000. The mortgage was for $282,000 with a 5 . year term, amortized over 25 years at 3,64%. Please Calculate the Monthly Mortgage Payment: (1 mark) They have made 27 payments on the mortgage. Please calculate the balance owing on the loan. (1 mark) This branch approved the mortgage. Taxes are $250 a month and heating is estimated at $125. They currently have $5,000 in a joint savings account at the branch. Neither of them contributes to an RRSP. Jesiah has clear title to some undeveloped property 80 miles west of Edmonton he inherited a few years ago. It is currently valued at $55,000. Eventually Jesiah would like to build a cabin on the property but realizes that this is a long term-goal. Jesiah pays about $46 a month on the taxes. Cassandra also has recantlv raraivad an Axnansiva naintinn from har arandmnthar valued at $25000 with a at $125. They currently horigage. Taxes are $250 a month and healing is estimated them contributes to an RRSP. Jesia in a joint savings account at the branch. Neither of them contributes to an RRSP. Jesiah has clear title to 30 mo undeveloped proporty 80 Eventually Jesiah would like to buld a cabin on the property but realizes that this is a Evontually Jesiah would like to build a cabin on the property but realizes that this is a long term-goal. Jestah pays about $46 a month on the taxes. Cassandra also has recently received an expensive painting from her grandmother valued at $25,000 with a certificate of authenticity. Jesiah, 29, has been working for RV World for 6 years. He grosses $97,400 annually as lead Heavy Duty Mechanic, much of this is overtime income. Jeslah has provided his Notice of Assessments for his income verification as you has requested (se0 attached), Cassandra, 25, is in her last year at the U of A. Cassandra works part-time at the U of A bookstore as a cashier she has provided a salary letter, she grosses approximately $10,420 per year. Her manager informed her she was going to recelve a 5% increase next month. 24 months ago Jesiah bought a Sllverado for $47.000 and financed it with a loan (from a competitor) for $42,300 at 7,24% for 6 years compounded monthly. What is the monthly truck payment? (1 mank) What is the balance owing today for the truck? (1 mark) The current value of the Silverado is estimated to be $28,400. Equifax shows he has never missed a payment and confirms that there are 48 months remaining on the installment loan. Ratings on their credit cards from Costco ($2,500 credit limit)R2, RBC VISA (\$4,500 credit limit) are R1, they do however have a Capital One MasterCard with a R1 rating(credit limit $4,500 ). They both like the finer things in life, cards are continuously at the maximum credit limits. The do have a The Bay credit card reporting on their credit bureau with a limit of $1,500 but nothing is currently owing. Jesiah recently received an inheritance in the amount of $25,000. Currently he has it invested in a GIC. Jesiah does not want to access these funds at this time and would like the funds to remain as is. He is planning on using these funds in the future to purchase a cabin. Notice of Asseistient for Jesiah Hemitun Twe veas resi. Notise of Assesament for Jesish Hammion Tox year 2021 Cassaridra's Mcome Contirmation Lettert To Whom This May Concurn, working in a part-time poxition since September 15th2020. Her annul talary it io.420 per annxam. If there are any questions or concems, please feel free to call me at 7904523216. Thank your, Jackson Peters: Catrulate deyitis Workity thooced Cabulate Net Worth toxet lender perspective: their ianovasion request Monaty lown pwement I raty Catculate whiah and Civangras coss(ute whole nuabers no pereentagest | Culculase Jeit th and Cassateray Tos(ose whele numbers no percentaget) Do you acprove the idis? vis the (t mas) Rating the 5Cs of Credit: 2) Cosacty (2 mansw: is 4) Colialeent (2 markak is it satstacto yimarginalhansatala mory? Justy your oscion. Credit Decision: As a lender, go through the information provided and determine if the clients qualify for their loan request. (set your calculator to two decimal points. Note thare are questions that require you to use whole numbers and not enter the percentage sign) Jesiah and Cassandra Hamilion have been married for 2 years. They are presently living In an older home and have come to you seeking financing so that they can renovate their kitchen in their home. Jesiah has priced out the renovation project and brought in some written estimates. He estimates the cost of the renovation to be $27,500. Jesiah and Cassandra want to repay the loan over 5 years. Jeslah has tiken a bullding construction course at NAIT is excited to use the skills he has leamed. The Hamilton's house is valued at $300,000. The mortgage was for $282,000 with a 5 . year term, amortized over 25 years at 3,64%. Please Calculate the Monthly Mortgage Payment: (1 mark) They have made 27 payments on the mortgage. Please calculate the balance owing on the loan. (1 mark) This branch approved the mortgage. Taxes are $250 a month and heating is estimated at $125. They currently have $5,000 in a joint savings account at the branch. Neither of them contributes to an RRSP. Jesiah has clear title to some undeveloped property 80 miles west of Edmonton he inherited a few years ago. It is currently valued at $55,000. Eventually Jesiah would like to build a cabin on the property but realizes that this is a long term-goal. Jesiah pays about $46 a month on the taxes. Cassandra also has recantlv raraivad an Axnansiva naintinn from har arandmnthar valued at $25000 with a at $125. They currently horigage. Taxes are $250 a month and healing is estimated them contributes to an RRSP. Jesia in a joint savings account at the branch. Neither of them contributes to an RRSP. Jesiah has clear title to 30 mo undeveloped proporty 80 Eventually Jesiah would like to buld a cabin on the property but realizes that this is a Evontually Jesiah would like to build a cabin on the property but realizes that this is a long term-goal. Jestah pays about $46 a month on the taxes. Cassandra also has recently received an expensive painting from her grandmother valued at $25,000 with a certificate of authenticity. Jesiah, 29, has been working for RV World for 6 years. He grosses $97,400 annually as lead Heavy Duty Mechanic, much of this is overtime income. Jeslah has provided his Notice of Assessments for his income verification as you has requested (se0 attached), Cassandra, 25, is in her last year at the U of A. Cassandra works part-time at the U of A bookstore as a cashier she has provided a salary letter, she grosses approximately $10,420 per year. Her manager informed her she was going to recelve a 5% increase next month. 24 months ago Jesiah bought a Sllverado for $47.000 and financed it with a loan (from a competitor) for $42,300 at 7,24% for 6 years compounded monthly. What is the monthly truck payment? (1 mank) What is the balance owing today for the truck? (1 mark) The current value of the Silverado is estimated to be $28,400. Equifax shows he has never missed a payment and confirms that there are 48 months remaining on the installment loan. Ratings on their credit cards from Costco ($2,500 credit limit)R2, RBC VISA (\$4,500 credit limit) are R1, they do however have a Capital One MasterCard with a R1 rating(credit limit $4,500 ). They both like the finer things in life, cards are continuously at the maximum credit limits. The do have a The Bay credit card reporting on their credit bureau with a limit of $1,500 but nothing is currently owing. Jesiah recently received an inheritance in the amount of $25,000. Currently he has it invested in a GIC. Jesiah does not want to access these funds at this time and would like the funds to remain as is. He is planning on using these funds in the future to purchase a cabin. Notice of Asseistient for Jesiah Hemitun Twe veas resi. Notise of Assesament for Jesish Hammion Tox year 2021 Cassaridra's Mcome Contirmation Lettert To Whom This May Concurn, working in a part-time poxition since September 15th2020. Her annul talary it io.420 per annxam. If there are any questions or concems, please feel free to call me at 7904523216. Thank your, Jackson Peters: Catrulate deyitis Workity thooced Cabulate Net Worth toxet lender perspective: their ianovasion request Monaty lown pwement I raty Catculate whiah and Civangras coss(ute whole nuabers no pereentagest | Culculase Jeit th and Cassateray Tos(ose whele numbers no percentaget) Do you acprove the idis? vis the (t mas) Rating the 5Cs of Credit: 2) Cosacty (2 mansw: is 4) Colialeent (2 markak is it satstacto yimarginalhansatala mory? Justy your oscion. Credit Decision