Question

As a loan officer for BizBank, you have received a request from an established client, LimeOn, for a permanent increase in their overdraft limit to

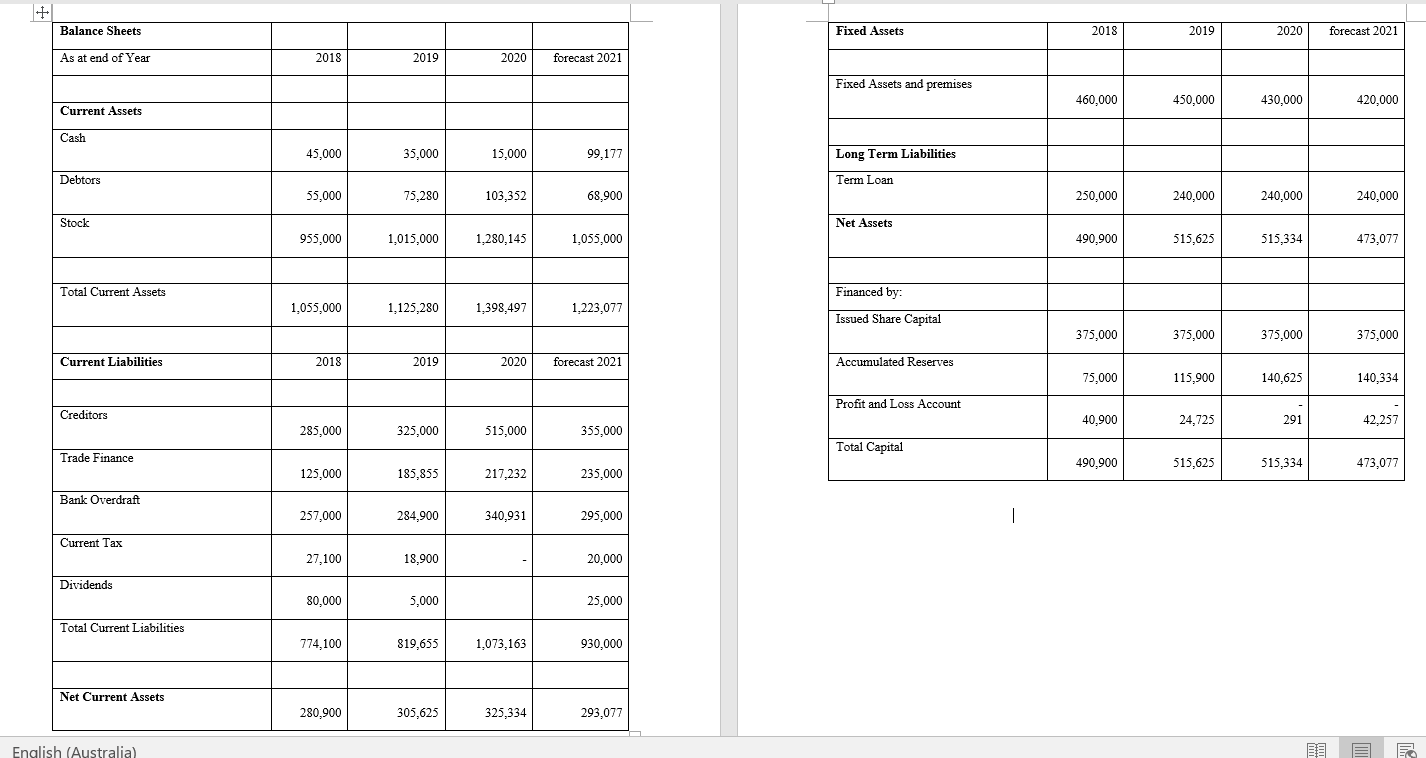

As a loan officer for BizBank, you have received a request from an established client, LimeOn, for a permanent increase in their overdraft limit to $350,000 (from its COVID19 temporary limit of $330,000). LimeOn is also asking for its increased trade finance limit to be increased from $220,000 to $250,000. Up until 2019 LimeOn had an overdraft limit of $280,000.

LimeOn is a well-established sporting apparel company, operating for over thirty years. In all that time LimeOn has banked with BizBank. Originally all LimeOns apparel was made in Melbourne, but increased labour costs meant that these items have been imported for over twenty years now.

The main outlet for LimeOn has always been sales at some inner-city gyms and two suburban shops. The two suburban shops are owned by a company called Lolos, separate to LimeOn. As nearly all the gym sales are cash or credit card, the funds owed to LimeOn by Lolos make up nearly all of the debtors on the balance sheet. Over seventy percent of the sales for LimeOn are via the seven inner city gyms, which are owned by the same company.

Unsurprisingly, the COVID19 lockdown has hit LimeOn hard, which it tried to compensate for by some on line sales. However, the traditional focus of this family firm meant that the online sales were viewed as a temporary measure. Over the 2020 lockdown period, several fashions shifted, meaning new items have to be imported for the 2021 season. This is why LimeOn is requesting an increase in both the overdraft and trade finance facilities. LimeOn is confident it will be able to sell the older style apparel on line at a discount, and estimates that about thirty percent of its 2020 stock is affected.

LimeOn operates out of a rented warehouse and took out a term loan of $250,000 to fit out the warehouse in 2017. This was mainly to purchase shelving and forklift trucks. The majority of LimeOn employees are casual workers who act as stock handlers in the busy periods.

Reviewing this file reminds you that you have gained some weight over the lockdown period. Your company has a generous gym membership program and some new exercise clothes would be worthwhile. You find the LimeOn webpage quite amateurish and not easy to navigate. You also found the payment process a bit difficult.

Based on past experience, your bank values stock on hand in the clothing industry at 40 per cent of book value and applies the same values to shop fittings and used machinery. Given the out-of-date nature of some stock, these are considered to have a value of 30 percent of book value.

LimeOn has provided the relevant financial information below.

Required

Critically evaluate the loan request outlined above and recommend whether you would lend the requested amount. Your answer must indicate the relevant facts of the case; the appropriate concerns with this loan proposal and provide the relevant recommendations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started