Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a market risk analyst, each day you calculate VaR from the available prior data. Then, you wait ten days to compare your prediction

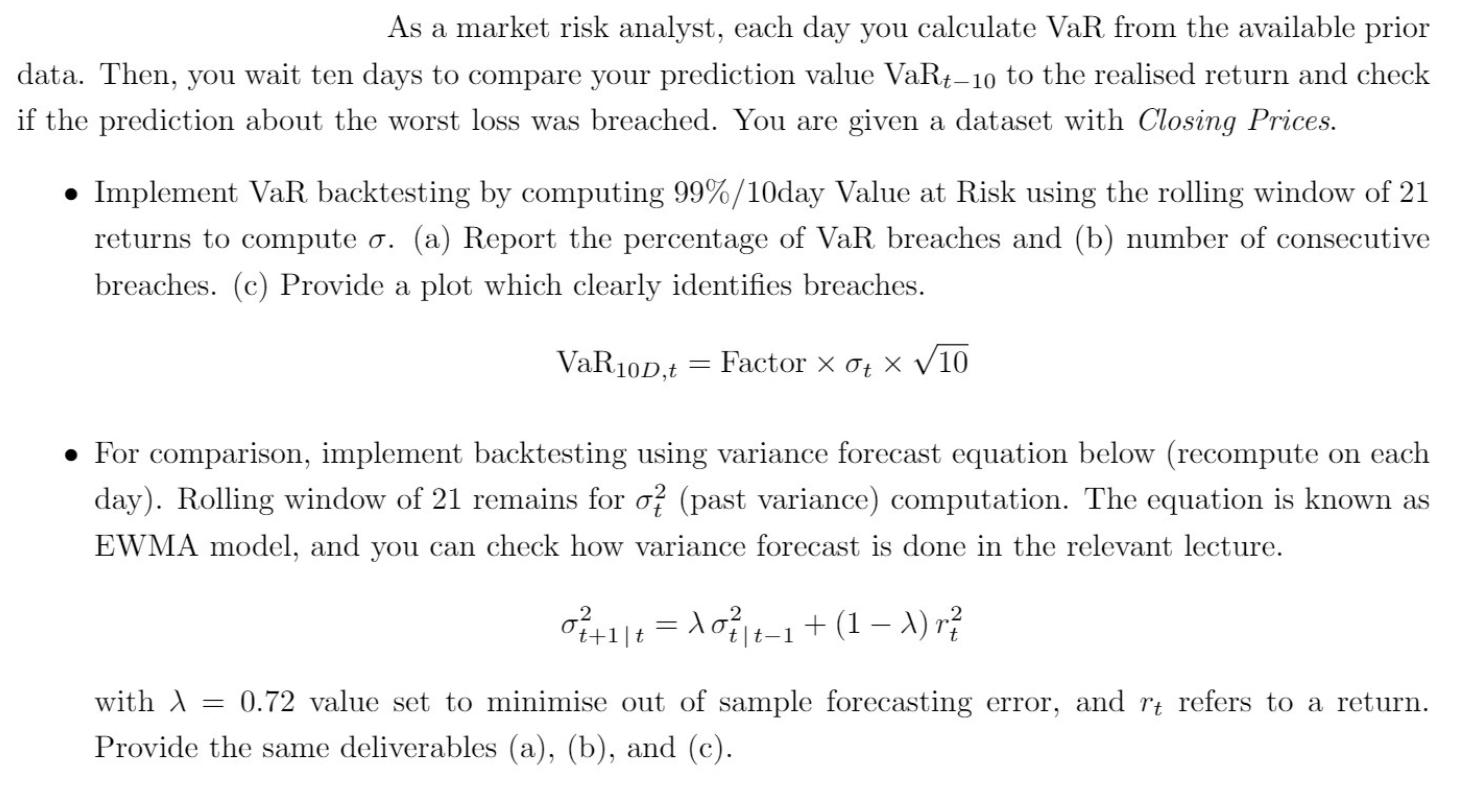

As a market risk analyst, each day you calculate VaR from the available prior data. Then, you wait ten days to compare your prediction value VaRt-10 to the realised return and check if the prediction about the worst loss was breached. You are given a dataset with Closing Prices. Implement VaR backtesting by computing 99%/10day Value at Risk using the rolling window of 21 returns to compute o. (a) Report the percentage of VaR breaches and (b) number of consecutive breaches. (c) Provide a plot which clearly identifies breaches. VaR10D,t = Factor X ot x V /10 For comparison, implement backtesting using variance forecast equation below (recompute on each day). Rolling window of 21 remains for o? (past variance) computation. The equation is known as EWMA model, and you can check how variance forecast is done in the relevant lecture. o +1 | t = 0 | t1 + (1 X) r with X 0.72 value set to minimise out of sample forecasting error, and rt refers to a return. Provide the same deliverables (a), (b), and (c).

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to implement VaR backtesting and compare the results using the historical and EWM...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started