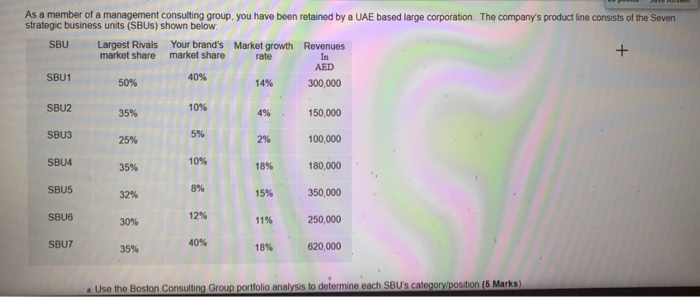

As a member of a management consulting group, you have been retained by a UAE based large corporation. The company's product line consists of the Seven strategic business units (SBU) shown below SBU Largest Rivals Your brand's Market growth Revenues market share market share rate In + AED SBU1 40% 50% 14% 300,000 SBU2 10% 35% 150,000 SBU3 5% 25% 2% 100,000 SBU4 10% 35% 18% 180,000 SBU5 8% 32% 15% 350,000 SBU6 12% 30% 11% 250,000 SBUT 40% 35% 18% 620,000 Use the Boston Consulting Group portfolio analysis to determine each SBU's category/position (6 Marks) a. Use the Boston Consulting Group portfolio analysis to determine each SBU's category/position (5 Marks) b Describe each SBUs in terms of cash flows and investment/divestment strategy (5 Marks)? c What do you think, overall cash flows of the company will be positive, neutral or negative currently? What will be the situation of cash flows after 10 years (5 Marks)? d. What are the challenges of the CEO of this company and what actions and initiatives should be taken by the management (5 Marks? e In the current situation in your opinion, the company should divest its dog(s) or they should keep them? Explain your answer? (5 Marks) As a member of a management consulting group, you have been retained by a UAE based large corporation. The company's product line consists of the Seven strategic business units (SBU) shown below SBU Largest Rivals Your brand's Market growth Revenues market share market share rate In + AED SBU1 40% 50% 14% 300,000 SBU2 10% 35% 150,000 SBU3 5% 25% 2% 100,000 SBU4 10% 35% 18% 180,000 SBU5 8% 32% 15% 350,000 SBU6 12% 30% 11% 250,000 SBUT 40% 35% 18% 620,000 Use the Boston Consulting Group portfolio analysis to determine each SBU's category/position (6 Marks) a. Use the Boston Consulting Group portfolio analysis to determine each SBU's category/position (5 Marks) b Describe each SBUs in terms of cash flows and investment/divestment strategy (5 Marks)? c What do you think, overall cash flows of the company will be positive, neutral or negative currently? What will be the situation of cash flows after 10 years (5 Marks)? d. What are the challenges of the CEO of this company and what actions and initiatives should be taken by the management (5 Marks? e In the current situation in your opinion, the company should divest its dog(s) or they should keep them? Explain your