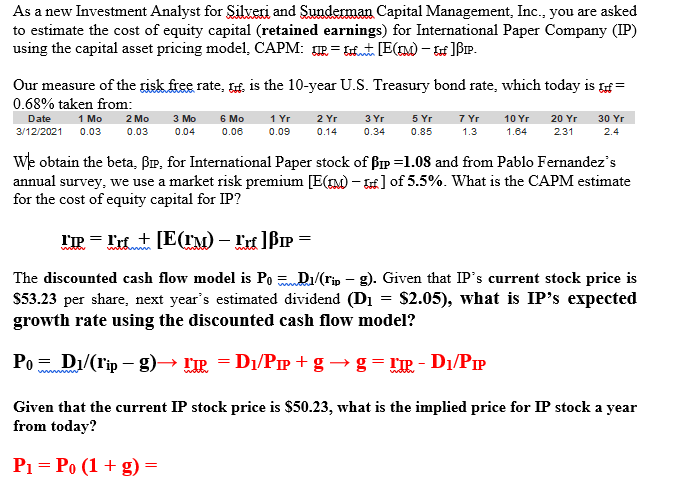

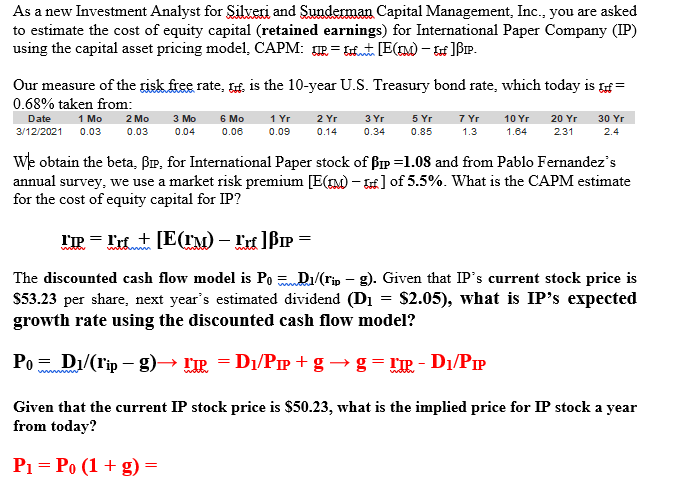

As a new Investment Analyst for Silveri and Sunderman Capital Management, Inc., you are asked to estimate the cost of equity capital (retained earnings) for International Paper Company (IP) using the capital asset pricing model, CAPM: dr. = Isimte [E(mm) - If]BIP. Our measure of the risk free rate, I. is the 10-year U.S. Treasury bond rate, which today is = 0.68% taken from: 20 Yr 30 Yr Date 3/12/2021 6 Mo 1 Mo 0.03 2 Mo 0.03 3 Mo 0.04 1 Yr 0.09 2 Yr 0.14 3 Yr 0.34 5 Yr 0.85 7 Yr 1.3 10 Yr 1.84 0.06 2.31 2.4 We obtain the beta, Bir, for International Paper stock of Bup=1.08 and from Pablo Fernandez's annual survey, we use a market risk premium [E(IM - 6] of 5.5%. What is the CAPM estimate for the cost of equity capital for IP? I'IP = Print [E(IM) - Irf IBIP = The discounted cash flow model is Po Di/(rip - g). Given that IP's current stock price is $53.23 per share, next year's estimated dividend (D1 = $2.05), what is IP's expected growth rate using the discounted cash flow model? Po D1/(l'ip - g) ITP. = Dj/Pp+g g=LTP-Dj/PIP Given that the current IP stock price is $50.23, what is the implied price for IP stock a year from today? P1 = P. (1 + g) = As a new Investment Analyst for Silveri and Sunderman Capital Management, Inc., you are asked to estimate the cost of equity capital (retained earnings) for International Paper Company (IP) using the capital asset pricing model, CAPM: dr. = Isimte [E(mm) - If]BIP. Our measure of the risk free rate, I. is the 10-year U.S. Treasury bond rate, which today is = 0.68% taken from: 20 Yr 30 Yr Date 3/12/2021 6 Mo 1 Mo 0.03 2 Mo 0.03 3 Mo 0.04 1 Yr 0.09 2 Yr 0.14 3 Yr 0.34 5 Yr 0.85 7 Yr 1.3 10 Yr 1.84 0.06 2.31 2.4 We obtain the beta, Bir, for International Paper stock of Bup=1.08 and from Pablo Fernandez's annual survey, we use a market risk premium [E(IM - 6] of 5.5%. What is the CAPM estimate for the cost of equity capital for IP? I'IP = Print [E(IM) - Irf IBIP = The discounted cash flow model is Po Di/(rip - g). Given that IP's current stock price is $53.23 per share, next year's estimated dividend (D1 = $2.05), what is IP's expected growth rate using the discounted cash flow model? Po D1/(l'ip - g) ITP. = Dj/Pp+g g=LTP-Dj/PIP Given that the current IP stock price is $50.23, what is the implied price for IP stock a year from today? P1 = P. (1 + g) =