Answered step by step

Verified Expert Solution

Question

1 Approved Answer

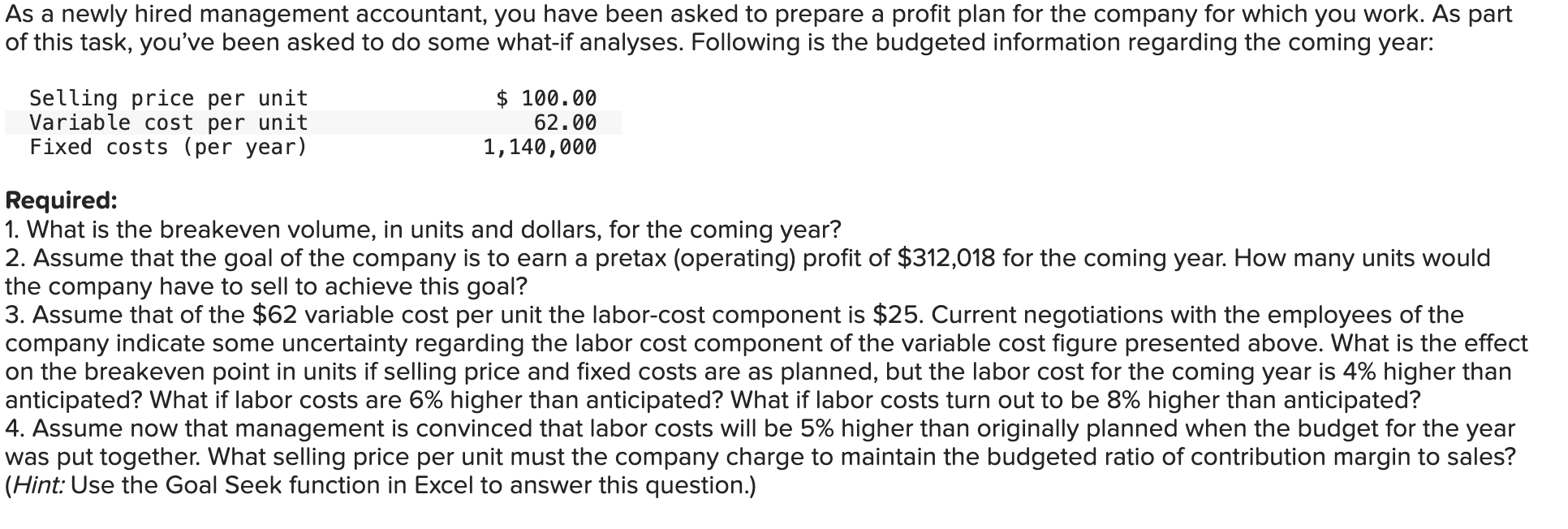

As a newly hired management accountant, you have been asked to prepare a profit plan for the company for which you work. As part of

As a newly hired management accountant, you have been asked to prepare a profit plan for the company for which you work. As part of this task, youve been asked to do some whatif analyses. Following is the budgeted information regarding the coming year: As a newly hired management accountant, you have been asked to prepare a profit plan for the company for which you work. As part

of this task, you've been asked to do some whatif analyses. Following is the budgeted information regarding the coming year:

Required:

What is the breakeven volume, in units and dollars, for the coming year?

Assume that the goal of the company is to earn a pretax operating profit of $ for the coming year. How many units would

the company have to sell to achieve this goal?

Assume that of the $ variable cost per unit the laborcost component is $ Current negotiations with the employees of the

company indicate some uncertainty regarding the labor cost component of the variable cost figure presented above. What is the effect

on the breakeven point in units if selling price and fixed costs are as planned, but the labor cost for the coming year is higher than

anticipated? What if labor costs are higher than anticipated? What if labor costs turn out to be higher than anticipated?

Assume now that management is convinced that labor costs will be higher than originally planned when the budget for the year

was put together. What selling price per unit must the company charge to maintain the budgeted ratio of contribution margin to sales?

Hint: Use the Goal Seek function in Excel to answer this question.tableSituationtable ChangeCost Comrgivertablein DLonenttableRevisedVariable Costper UnittableRevisedContributionMargin perUnittableBreakevenvolumeunitstableUnitChange inBreakevenPointtable Change inBreakevenPointBaseline Assume now that management is convinced that labor costs will be higher than originally planned when the budget for

the year was put together. What selling price per unit must the company charge to maintain the budgeted ratio of contribution

margin to sales? Round your answer to decimal places.Hint: Use the Goal Seek function in Excel to answer this

question.

Selling price per unit $

Variable cost per unit

Fixed costs per year

Required:

What is the breakeven volume, in units and dollars, for the coming year?

Assume that the goal of the company is to earn a pretax operating profit of $ for the coming year. How many units would the company have to sell to achieve this goal?

Assume that of the $ variable cost per unit the laborcost component is $ Current negotiations with the employees of the company indicate some uncertainty regarding the labor cost component of the variable cost figure presented above. What is the effect on the breakeven point in units if selling price and fixed costs are as planned, but the labor cost for the coming year is higher than anticipated? What if labor costs are higher than anticipated? What if labor costs turn out to be higher than anticipated?

Assume now that management is convinced that labor costs will be higher than originally planned when the budget for the year was put together. What selling price per unit must the company charge to maintain the budgeted ratio of contribution margin to sales? Hint: Use the Goal Seek function in Excel to answer this question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started