Question

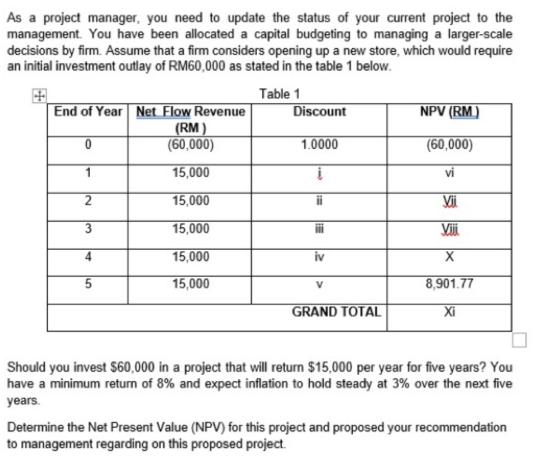

As a project manager, you need to update the status of your current project to the management. You have been allocated a capital budgeting

As a project manager, you need to update the status of your current project to the management. You have been allocated a capital budgeting to managing a larger-scale decisions by firm. Assume that a firm considers opening up a new store, which would require an initial investment outlay of RM60,000 as stated in the table 1 below. Table 1 End of Year Net Flow Revenue (RM) (60,000) 15,000 15,000 15,000 15,000 15,000 0 2 3 4 5 Discount 1.0000 iv V GRAND TOTAL NPV (RM) (60,000) vi Vii Vii X 8,901.77 Xi Should you invest $60,000 in a project that will return $15,000 per year for five years? You have a minimum return of 8% and expect inflation to hold steady at 3% over the next five years. Determine the Net Present Value (NPV) for this project and proposed your recommendation to management regarding on this proposed project.

Step by Step Solution

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Project Management A Systems Approach to Planning Scheduling and Controlling

Authors: Harold Kerzner

10th Edition

978-047027870, 978-0-470-5038, 470278706, 978-0470278703

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App