Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a result of the numerous lockdowns experienced in the state, Coffee-Bars Pty Ltd has had an extremely difficult time meeting its expenses at

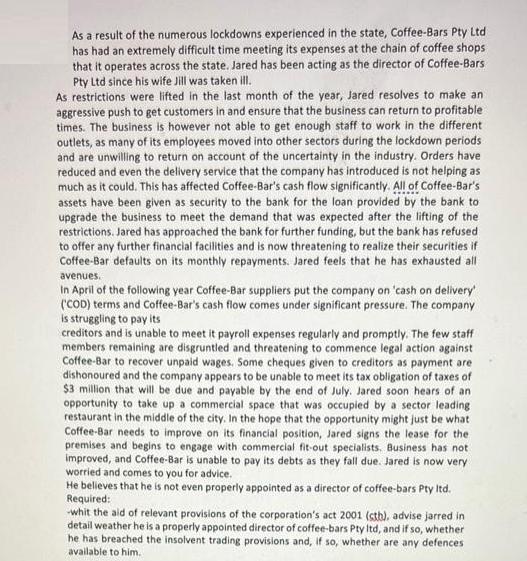

As a result of the numerous lockdowns experienced in the state, Coffee-Bars Pty Ltd has had an extremely difficult time meeting its expenses at the chain of coffee shops. that it operates across the state. Jared has been acting as the director of Coffee-Bars Pty Ltd since his wife Jill was taken ill. As restrictions were lifted in the last month of the year, Jared resolves to make an aggressive push to get customers in and ensure that the business can return to profitable times. The business is however not able to get enough staff to work in the different outlets, as many of its employees moved into other sectors during the lockdown periods and are unwilling to return on account of the uncertainty in the industry. Orders have reduced and even the delivery service that the company has introduced is not helping as much as it could. This has affected Coffee-Bar's cash flow significantly. All of Coffee-Bar's assets have been given as security to the bank for the loan provided by the bank to upgrade the business to meet the demand that was expected after the lifting of the restrictions. Jared has approached the nk for further funding, but the bank has refused to offer any further financial facilities and is now threatening to realize their securities if Coffee-Bar defaults on its monthly repayments. Jared feels that he has exhausted all avenues. In April of the following year Coffee-Bar suppliers put the company on 'cash on delivery (COD) terms and Coffee-Bar's cash flow comes under significant pressure. The company is struggling to pay its creditors and is unable to meet it payroll expenses regularly and promptly. The few staff members remaining are disgruntled and threatening to commence legal action against Coffee-Bar to recover unpaid wages. Some cheques given to creditors as payment are dishonoured and the company appears to be unable to meet its tax obligation of taxes of $3 million that will be due and payable by the end of July. Jared soon hears of an opportunity to take up a commercial space that was occupied by a sector leading restaurant in the middle of the city. In the hope that the opportunity might just be what Coffee-Bar needs to improve on its financial position, Jared signs the lease for the premises and begins to engage with commercial fit-out specialists. Business has not improved, and Coffee-Bar is unable to pay its debts as they fall due. Jared is now very worried and comes to you for advice. He believes that he is not even properly appointed as a director of coffee-bars Pty Itd. Required: -whit the aid of relevant provisions of the corporation's act 2001 (stb), advise jarred in detail weather he is a properly appointed director of coffee-bars Pty Itd, and if so, whether he has breached the insolvent trading provisions and, if so, whether are any defences available to him.

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Under the Corporations Act 2001 Cth a director ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started