Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a sophisticated energy trader, you apply your knowledge to both crude oil and natural gas markets. Starting Jan 1st 2010 you decide to

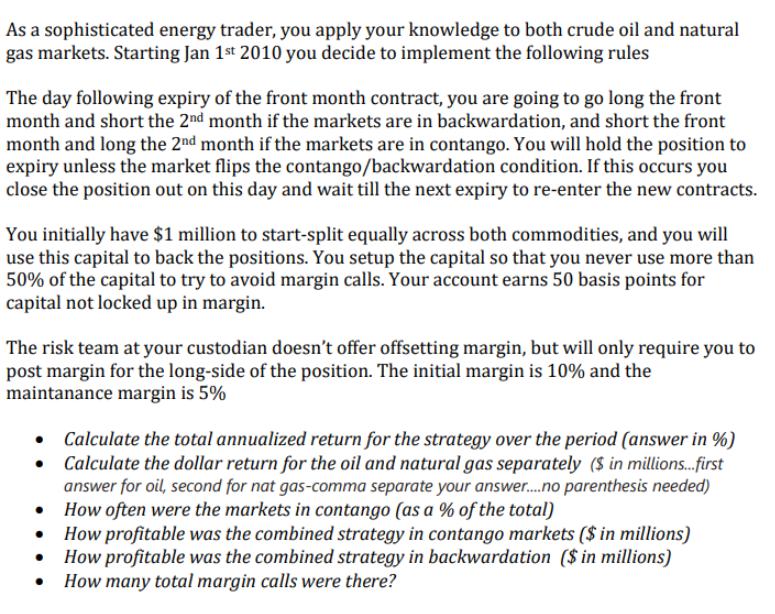

As a sophisticated energy trader, you apply your knowledge to both crude oil and natural gas markets. Starting Jan 1st 2010 you decide to implement the following rules The day following expiry of the front month contract, you are going to go long the front month and short the 2nd month if the markets are in backwardation, and short the front month and long the 2nd month if the markets are in contango. You will hold the position to expiry unless the market flips the contango/backwardation condition. If this occurs you close the position out on this day and wait till the next expiry to re-enter the new contracts. You initially have $1 million to start-split equally across both commodities, and you will use this capital to back the positions. You setup the capital so that you never use more than 50% of the capital to try to avoid margin calls. Your account earns 50 basis points for capital not locked up in margin. The risk team at your custodian doesn't offer offsetting margin, but will only require you to post margin for the long-side of the position. The initial margin is 10% and the maintanance margin is 5% Calculate the total annualized return for the strategy over the period (answer in %) Calculate the dollar return for the oil and natural gas separately ($ in millions...first answer for oil, second for nat gas-comma separate your answer.....no parenthesis needed) How often were the markets in contango (as a % of the total) How profitable was the combined strategy in contango markets ($ in millions) How profitable was the combined strategy in backwardation ($in millions) How many total margin calls were there?

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Crude Oil and Natural Gas Trading Strategy Analysis Methodology We simulated the strategy from Janua...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started