Answered step by step

Verified Expert Solution

Question

1 Approved Answer

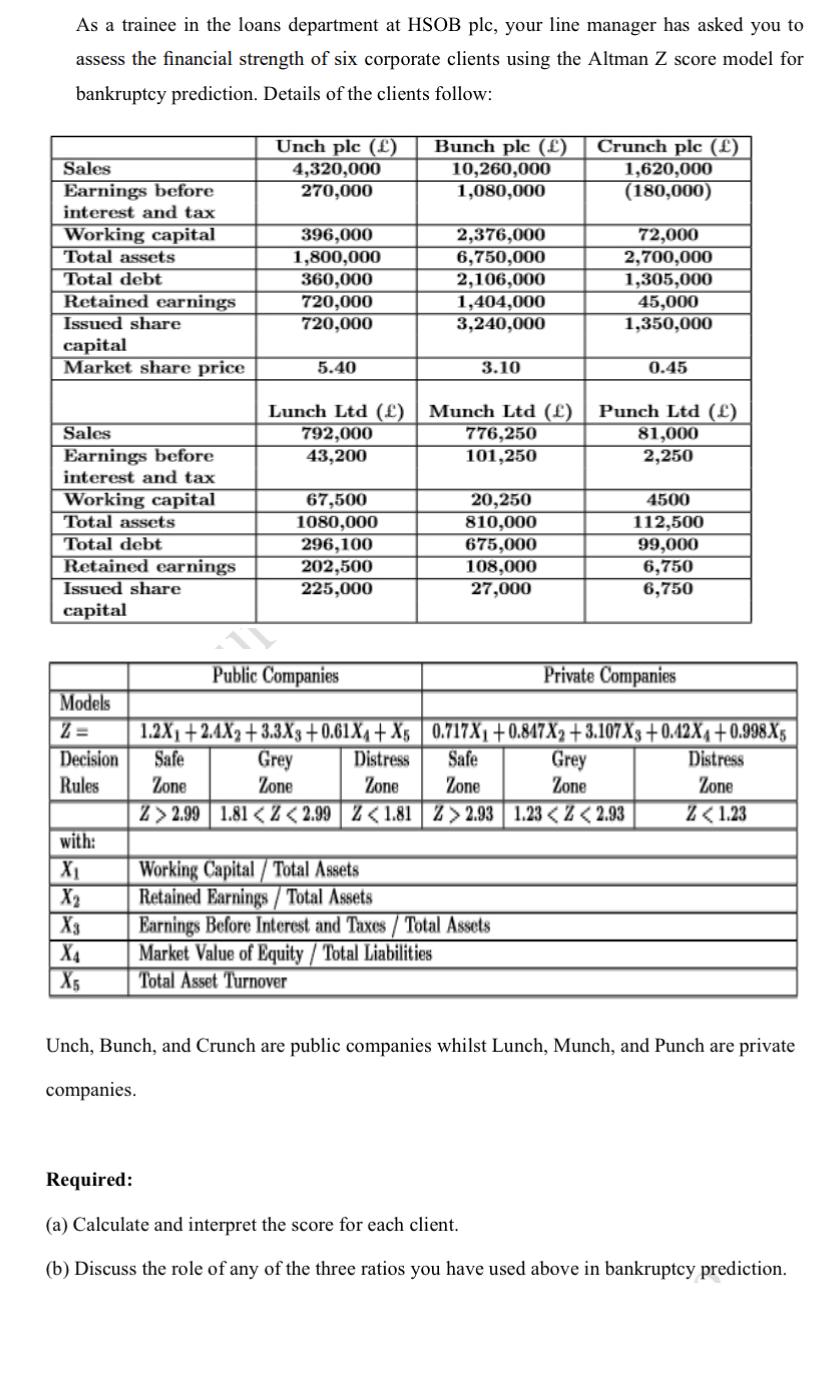

As a trainee in the loans department at HSOB plc, your line manager has asked you to assess the financial strength of six corporate

As a trainee in the loans department at HSOB plc, your line manager has asked you to assess the financial strength of six corporate clients using the Altman Z score model for bankruptcy prediction. Details of the clients follow: Unch plc () Bunch plc () Crunch plc () Sales 4,320,000 10,260,000 Earnings before 270,000 1,080,000 1,620,000 (180,000) interest and tax Working capital 396,000 2,376,000 72,000 Total assets 1,800,000 6,750,000 2,700,000 Total debt 360,000 2,106,000 1,305,000 Retained earnings 720,000 1,404,000 Issued share 720,000 3,240,000 45,000 1,350,000 capital Market share price 5.40 3.10 0.45 Lunch Ltd () Munch Ltd () Punch Ltd () Sales 792,000 776,250 81,000 Earnings before 43,200 101,250 2,250 interest and tax Working capital 67,500 20,250 4500 Total assets 1080,000 810,000 112,500 Total debt 296,100 675,000 99,000 Retained earnings 202,500 108,000 6,750 Issued share 225,000 27,000 6,750 capital Public Companies Private Companies Models 1.2X1+2.4X2+3.3X3+0.61X+X5 0.717X1+0.847X2+3.107X3+0.42X4+0.998X5 Decision Safe Grey Distress Safe Grey Rules Zone Zone Zone Zone Zone Z>2.99 1.81 2.93 1.23

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculation and Interpretation of Altman ZScore for Each Client Unch plc Public Company X1 396000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started