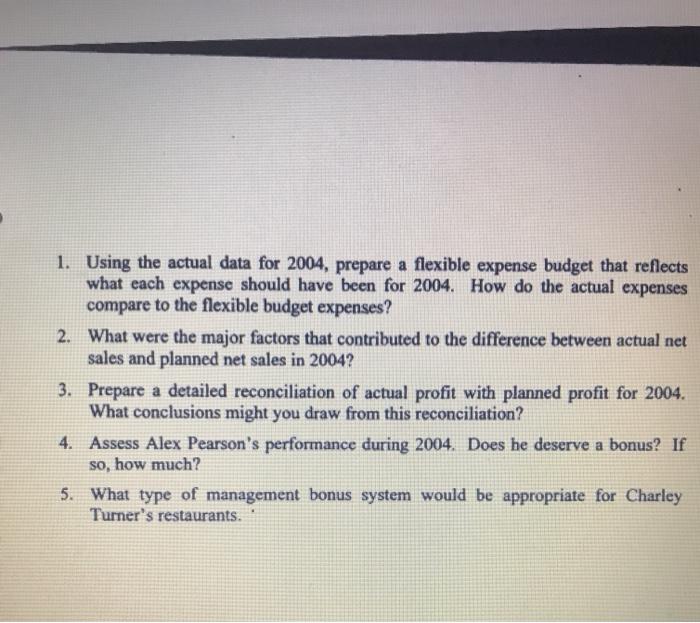

As Alex Pearson reviewed the financial results of Charley's Family Steak House No. 2 for 2004, he could hardly believe that a whole year had gone by since he had met with Charley Turner to explain to him why the restaurant had not reached its planned profit for 2003 and to agree on an operating plan for 2004. His recollections of that meeting were actually quite pleasant, as Mr. Turner had been surprisingly receptive to Alex's analysis and explanation of all of the factors that had contributed to the 2003 profit shortfall. Alex was convinced that his decision to prepare a detailed reconciliation of the 2003 planned profit with the 2003 actual profit, including the identification of those factors for which Alex had control and those for which Mr. Turner had control, had been the major cause for the successful outcome of last year's meeting. However, Mr. Turner's subsequent decision to award Alex a $5,000 bonus for 2003 had come as a most pleasant surprise. This year, Alex was looking forward to discussing Unit No. 2's 2004 performance with Mr. Turner. To prepare for that meeting. Alex reviewed the 2004 operating plan that he and Mr. Turner had agreed upon a year ago for Unit No. 2. The expenses shown in the 2004 plan were determined just as they had been in the 2003 operating plan. Labor costs were expected to average $13.00 per hour for four full-time cooks and $3.25 per hour for cashiers and servers. The lease agreement on the restaurant was not up for renewal until 2006, and so the terms of the monthly rent remained the same as in 2003. A $6,000 increase in management expense over the planned amount for 2003 was expected due to a $4,000 salary increase given to Alex and a $2,000 salary increase given to the assistant restaurant manager. As further preparation for his upcoming meeting with Mr. Turner, Alex prepared an operating statement comparing the actual results with the original plan for 2004 (sce Exhibit 1). In addition, he reflected on some of the trends he had noticed at the restaurant over the course of the past year. Customer count continued to rise, which pleased both Alex and Mr. Turner immensely. Furthermore, the restaurant's 2004 POS reports showed a reduction in coupon use as compared to 2003, and Alex thought this trend should result in a more favorable relationship between gross sales and net sales. However, Alex also noticed a continued unfavorable shift in customer mix toward lunch and away from dinner. Actual prices of food purchased by Mr. Tumer were one percent higher than expected in 2004, and actual labor hours for cooks and actual hourly wages . This year, Alex was looking forward to discussing Unit No. 2's 2004 performance with Mr. Tumer. To prepare for that meeting, Alex reviewed the 2004 operating plan that he and Mr. Turner had agreed upon a year ago for Unit No. 2. The expenses shown in the 2004 plan were determined just as they had been in the 2003 operating plan. Labor costs were expected to average $13.00 per hour for four full-time cooks and $3.25 per hour for cashiers and servers. The lease agreement on the restaurant was not up for renewal until 2006, and so the terms of the monthly rent remained the same as in 2003. A $6,000 increase in management expense over the planned amount for 2003 was expected due to a $4,000 salary increase given to Alex and a $2,000 salary increase given to the assistant restaurant manager. As further preparation for his upcoming meeting with Mr. Turner, Alex prepared an operating statement comparing the actual results with the original plan for 2004 (see Exhibit 1). In addition, he reflected on some of the trends he had noticed at the restaurant over the course of the past year. Customer count continued to rise, which pleased both Alex and Mr. Turner immensely. Furthermore, the restaurant's 2004 POS reports showed a reduction in coupon use as compared to 2003, and Alex thought this trend should result in a more favorable relationship between gross sales and net sales. However, Alex also noticed a continued unfavorable shift in customer mix toward lunch and away from dinner. Actual prices of food purchased by Mr. Turner were one percent higher than expected in 2004, and actual labor hours for cooks and actual hourly wages for cooks, cashiers and servers were as planned. There were no menu price changes during 2004. Alex knew Mr. Turner would want to understand the profit impact of any deviations from plan. Therefore, he decided to prepare a detailed reconciliation of the 2004 planned profit with the 2004 actual profit. Alex hoped this year's meeting with Mr. Turner would go as well as last year's meeting and that he would receive another bonus for his management of Unit No. 2 in 2004. RT V: MCS: PLANNING, BUDGETING, AND STRATEGIC PROFITABILITY ANALYSIS 1. Using the actual data for 2004, prepare a flexible expense budget that reflects what each expense should have been for 2004. How do the actual expenses compare to the flexible budget expenses? 2. What were the major factors that contributed to the difference between actual net sales and planned net sales in 2004? 3. Prepare a detailed reconciliation of actual profit with planned profit for 2004. What conclusions might you draw from this reconciliation? 4. Assess Alex Pearson's performance during 2004. Does he deserve a bonus? If so, how much? 5. What type of management bonus system would be appropriate for Charley Turner's restaurants. As Alex Pearson reviewed the financial results of Charley's Family Steak House No. 2 for 2004, he could hardly believe that a whole year had gone by since he had met with Charley Turner to explain to him why the restaurant had not reached its planned profit for 2003 and to agree on an operating plan for 2004. His recollections of that meeting were actually quite pleasant, as Mr. Turner had been surprisingly receptive to Alex's analysis and explanation of all of the factors that had contributed to the 2003 profit shortfall. Alex was convinced that his decision to prepare a detailed reconciliation of the 2003 planned profit with the 2003 actual profit, including the identification of those factors for which Alex had control and those for which Mr. Turner had control, had been the major cause for the successful outcome of last year's meeting. However, Mr. Turner's subsequent decision to award Alex a $5,000 bonus for 2003 had come as a most pleasant surprise. This year, Alex was looking forward to discussing Unit No. 2's 2004 performance with Mr. Turner. To prepare for that meeting. Alex reviewed the 2004 operating plan that he and Mr. Turner had agreed upon a year ago for Unit No. 2. The expenses shown in the 2004 plan were determined just as they had been in the 2003 operating plan. Labor costs were expected to average $13.00 per hour for four full-time cooks and $3.25 per hour for cashiers and servers. The lease agreement on the restaurant was not up for renewal until 2006, and so the terms of the monthly rent remained the same as in 2003. A $6,000 increase in management expense over the planned amount for 2003 was expected due to a $4,000 salary increase given to Alex and a $2,000 salary increase given to the assistant restaurant manager. As further preparation for his upcoming meeting with Mr. Turner, Alex prepared an operating statement comparing the actual results with the original plan for 2004 (sce Exhibit 1). In addition, he reflected on some of the trends he had noticed at the restaurant over the course of the past year. Customer count continued to rise, which pleased both Alex and Mr. Turner immensely. Furthermore, the restaurant's 2004 POS reports showed a reduction in coupon use as compared to 2003, and Alex thought this trend should result in a more favorable relationship between gross sales and net sales. However, Alex also noticed a continued unfavorable shift in customer mix toward lunch and away from dinner. Actual prices of food purchased by Mr. Tumer were one percent higher than expected in 2004, and actual labor hours for cooks and actual hourly wages . This year, Alex was looking forward to discussing Unit No. 2's 2004 performance with Mr. Tumer. To prepare for that meeting, Alex reviewed the 2004 operating plan that he and Mr. Turner had agreed upon a year ago for Unit No. 2. The expenses shown in the 2004 plan were determined just as they had been in the 2003 operating plan. Labor costs were expected to average $13.00 per hour for four full-time cooks and $3.25 per hour for cashiers and servers. The lease agreement on the restaurant was not up for renewal until 2006, and so the terms of the monthly rent remained the same as in 2003. A $6,000 increase in management expense over the planned amount for 2003 was expected due to a $4,000 salary increase given to Alex and a $2,000 salary increase given to the assistant restaurant manager. As further preparation for his upcoming meeting with Mr. Turner, Alex prepared an operating statement comparing the actual results with the original plan for 2004 (see Exhibit 1). In addition, he reflected on some of the trends he had noticed at the restaurant over the course of the past year. Customer count continued to rise, which pleased both Alex and Mr. Turner immensely. Furthermore, the restaurant's 2004 POS reports showed a reduction in coupon use as compared to 2003, and Alex thought this trend should result in a more favorable relationship between gross sales and net sales. However, Alex also noticed a continued unfavorable shift in customer mix toward lunch and away from dinner. Actual prices of food purchased by Mr. Turner were one percent higher than expected in 2004, and actual labor hours for cooks and actual hourly wages for cooks, cashiers and servers were as planned. There were no menu price changes during 2004. Alex knew Mr. Turner would want to understand the profit impact of any deviations from plan. Therefore, he decided to prepare a detailed reconciliation of the 2004 planned profit with the 2004 actual profit. Alex hoped this year's meeting with Mr. Turner would go as well as last year's meeting and that he would receive another bonus for his management of Unit No. 2 in 2004. RT V: MCS: PLANNING, BUDGETING, AND STRATEGIC PROFITABILITY ANALYSIS 1. Using the actual data for 2004, prepare a flexible expense budget that reflects what each expense should have been for 2004. How do the actual expenses compare to the flexible budget expenses? 2. What were the major factors that contributed to the difference between actual net sales and planned net sales in 2004? 3. Prepare a detailed reconciliation of actual profit with planned profit for 2004. What conclusions might you draw from this reconciliation? 4. Assess Alex Pearson's performance during 2004. Does he deserve a bonus? If so, how much? 5. What type of management bonus system would be appropriate for Charley Turner's restaurants