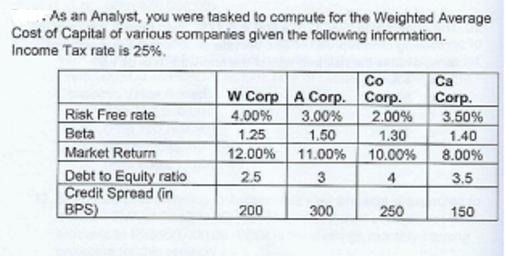

.As an Analyst, you were tasked to compute for the Weighted Average Cost of Capital of various companies given the following information. Income Tax

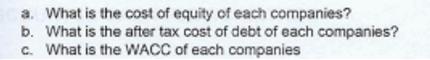

.As an Analyst, you were tasked to compute for the Weighted Average Cost of Capital of various companies given the following information. Income Tax rate is 25%. Risk Free rate Beta Market Return Debt to Equity ratio Credit Spread (in BPS) W Corp A Corp. 3.00% 1.50 11.00% 3 4.00% 1.25 12.00% 2.5 200 300 Co Corp. 2.00% 1.30 10.00% 250 Ca Corp. 3.50% 1.40 8.00% 3.5 150 a. What is the cost of equity of each companies? b. What is the after tax cost of debt of each companies? c. What is the WACC of each companies P4-4. Corporate Valuators, Inc. is assessing the value of two companies, Capital Corp. and Earn, Inc. which projects the following net cashflows in the next five years, with its desired required return. Net cashflows approximates to be its earnings also. The balance sheet of Capital Corp. and Earn, Inc. has recorded Property, Plant and Equipment of P100 Million and P200 Million respectively. Operating Assets are estimated at 80% and 70% respectively and the rest are considered idle. Year 12345 5 Required Return Net Cashflows Capital Corp. Earn, Inc. 9,600,000.00 8,000,000.00 8,800,000,00 10,560,000.00 9,680,000.00 11,616,000.00 10,648,000.00 12,777,600.00 11,712,800.00 14,055,360.00 8.00% 6.00% a. Using Capitalization of Earings, compute for the Equity Value of the 2 companies, b. Which company has higher Equity Value? What will be the minimum selling price of the two companies assuming its Board of Directors decided to sell 20% of its shares to the public?

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the cost of equity we use the Capital Asset Pricing Model CAPM Cost of Equity Risk Fr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started