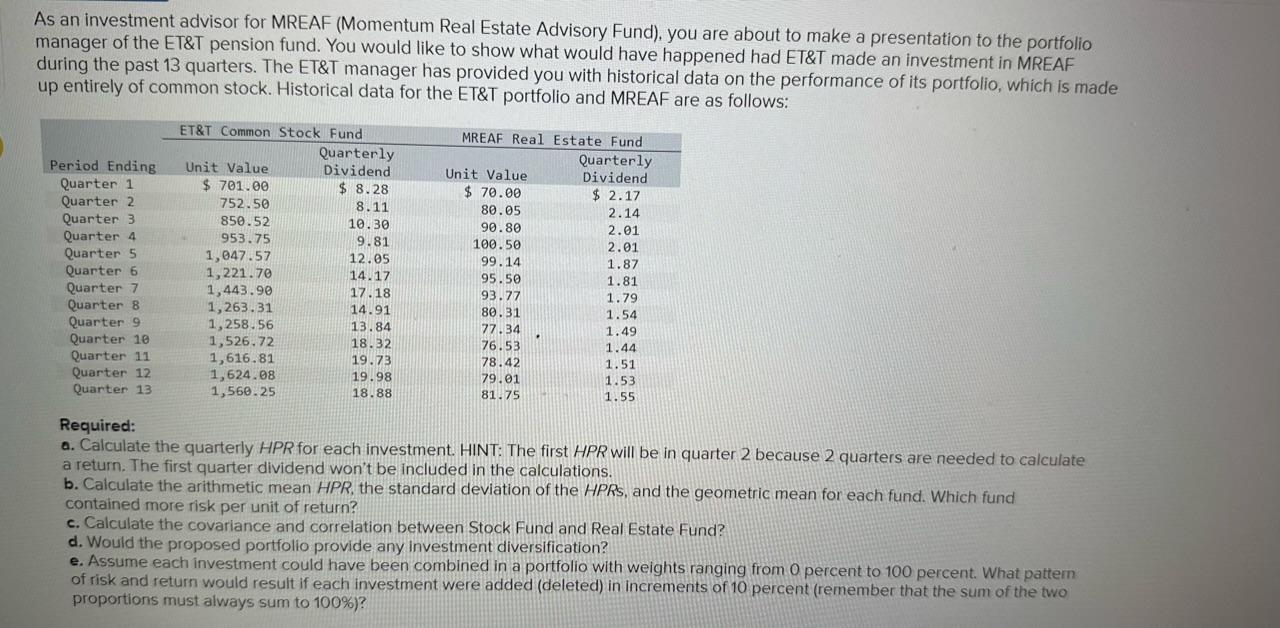

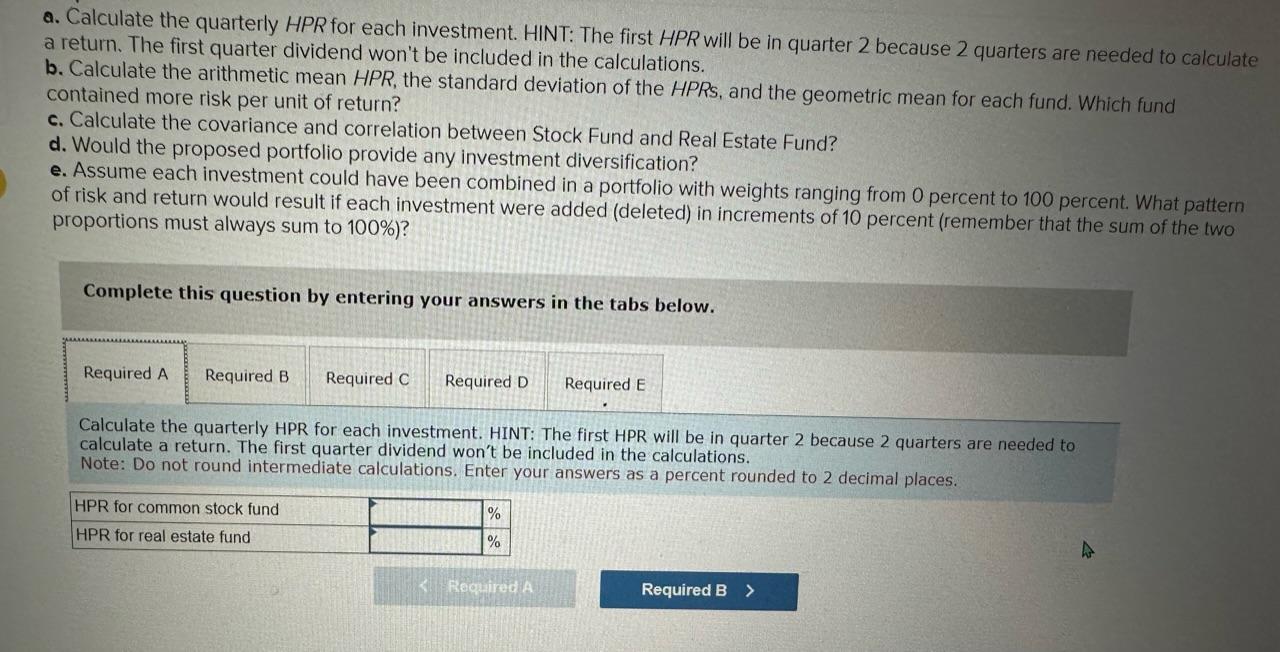

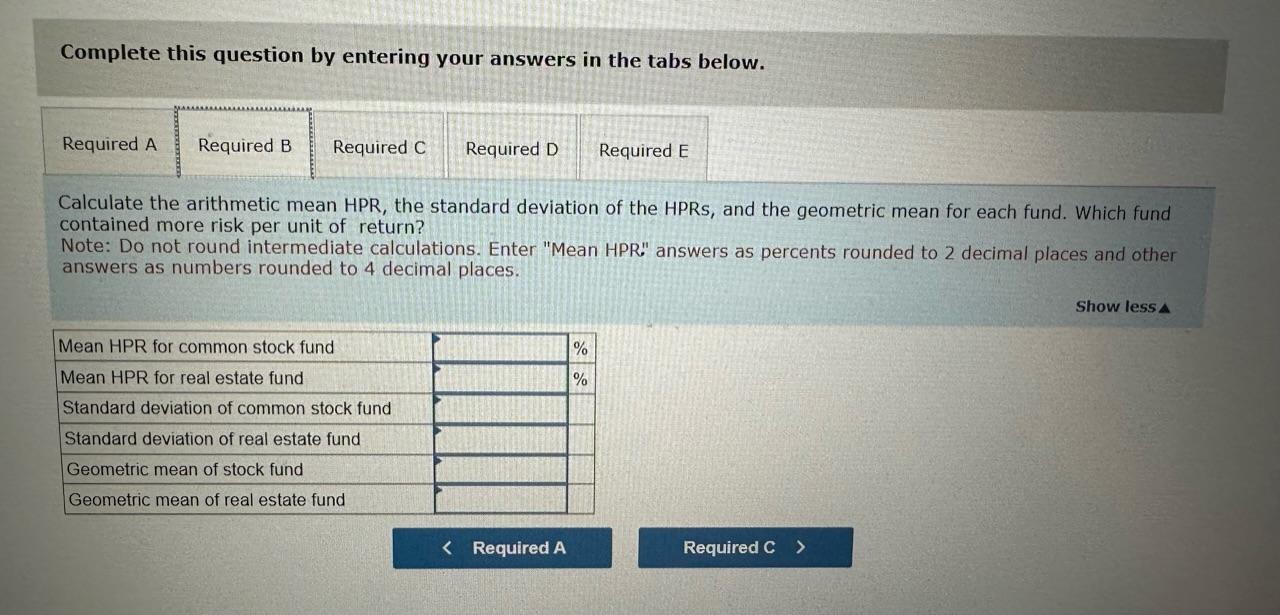

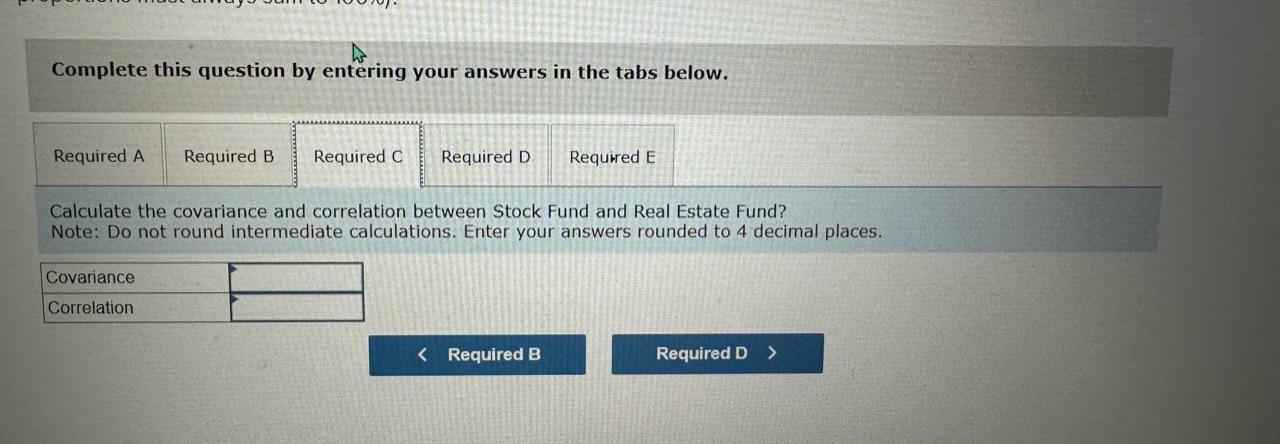

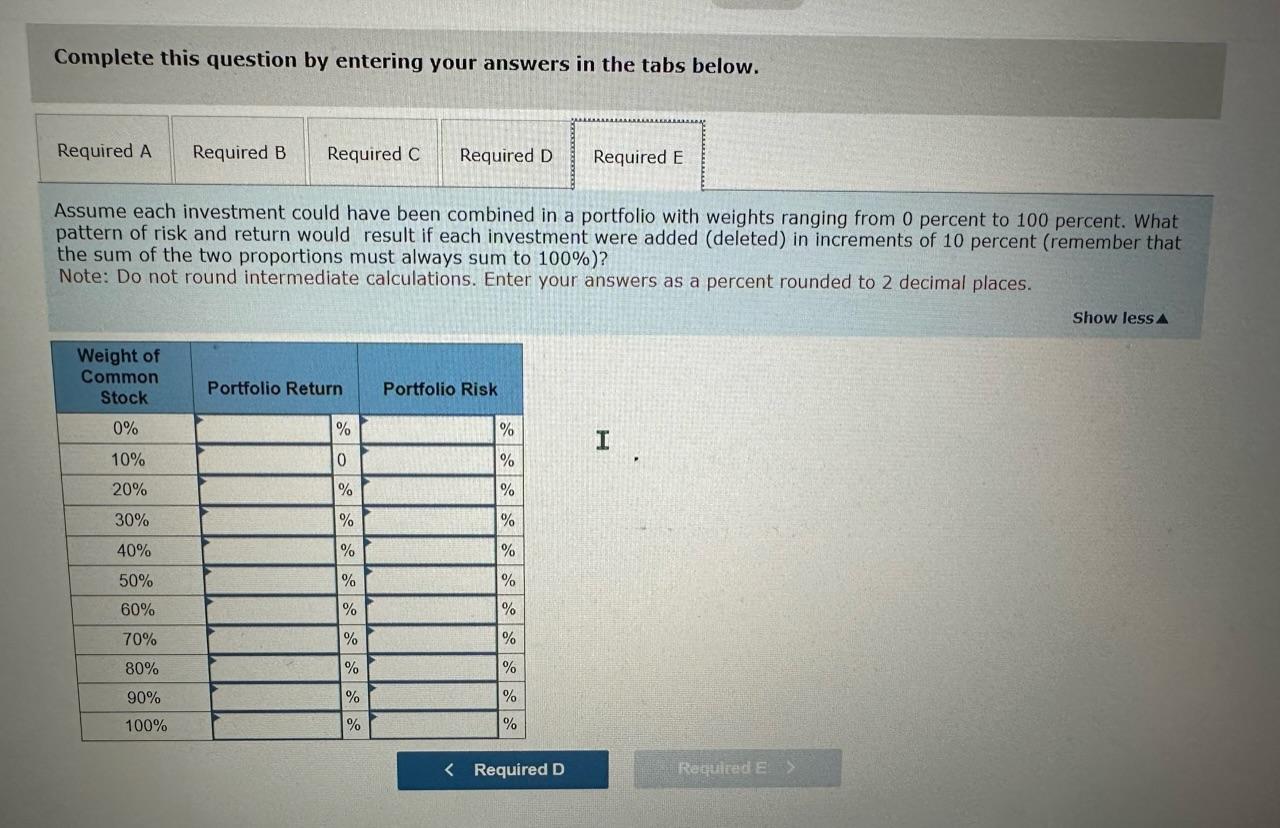

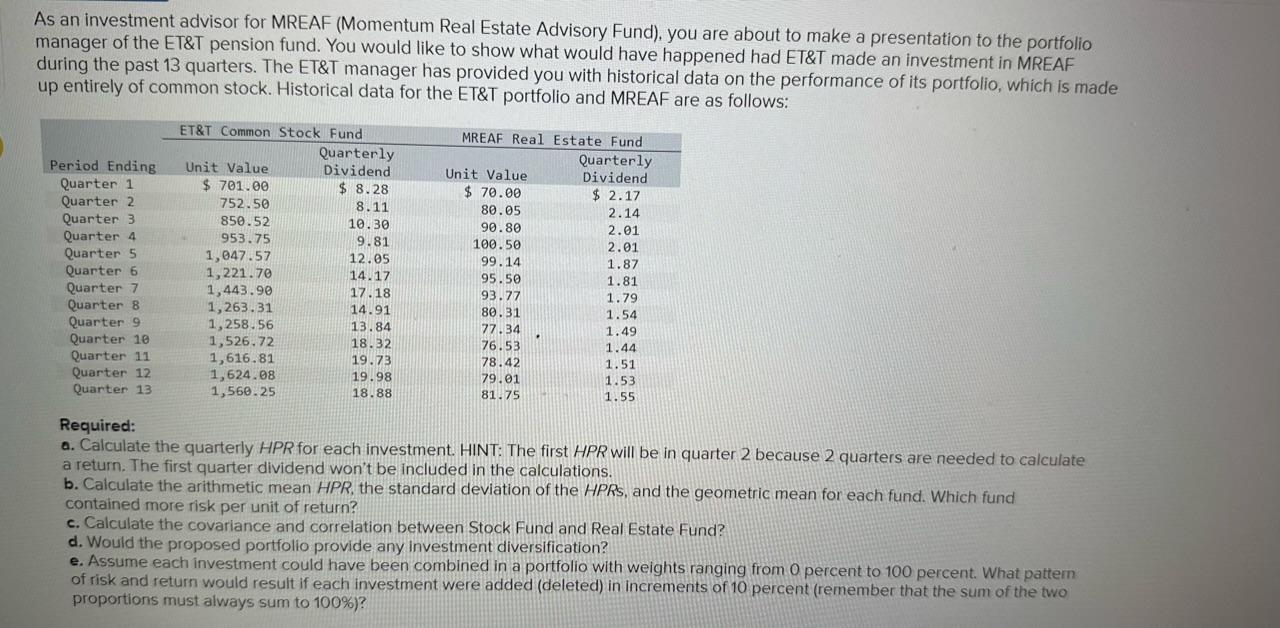

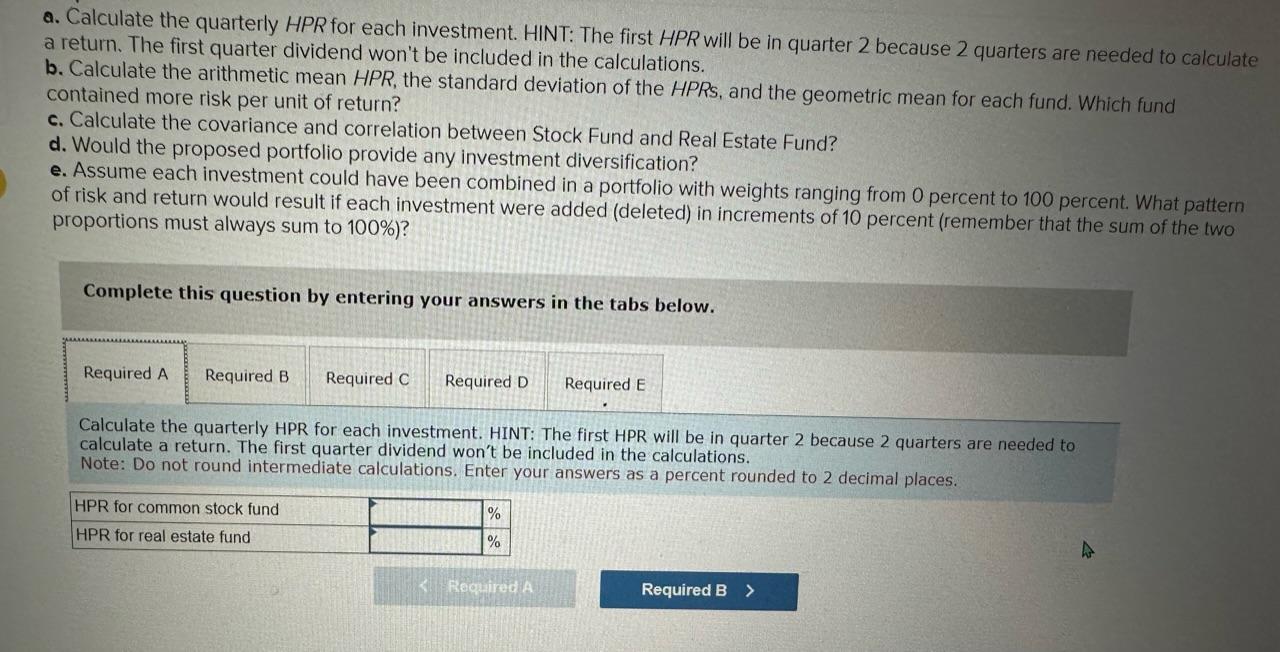

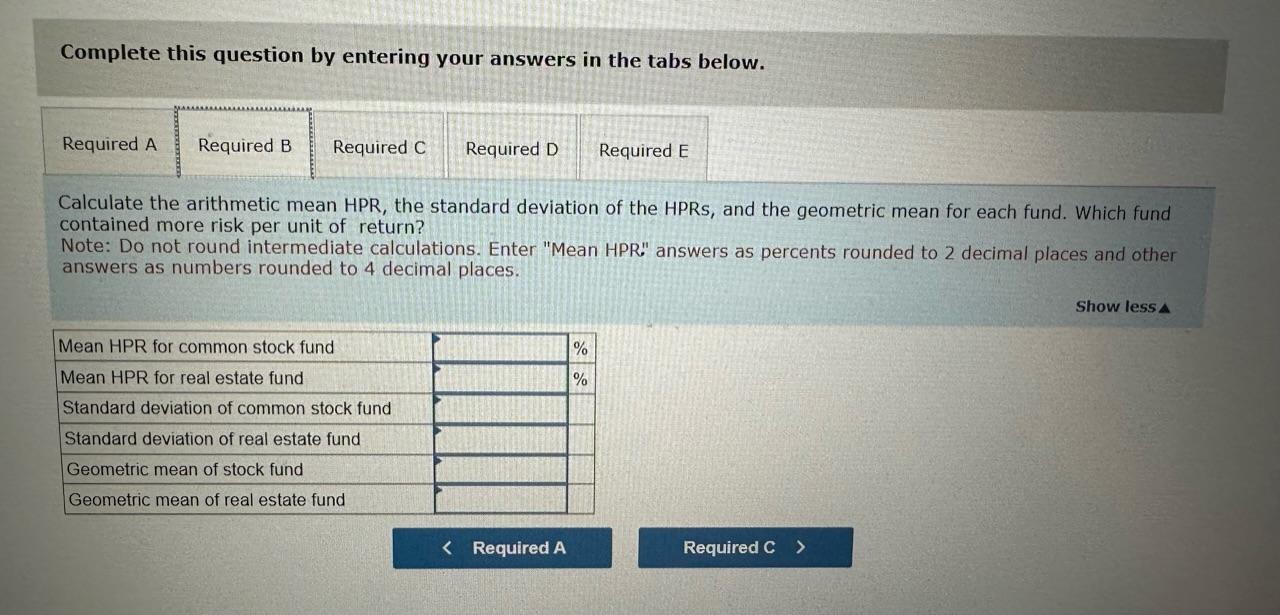

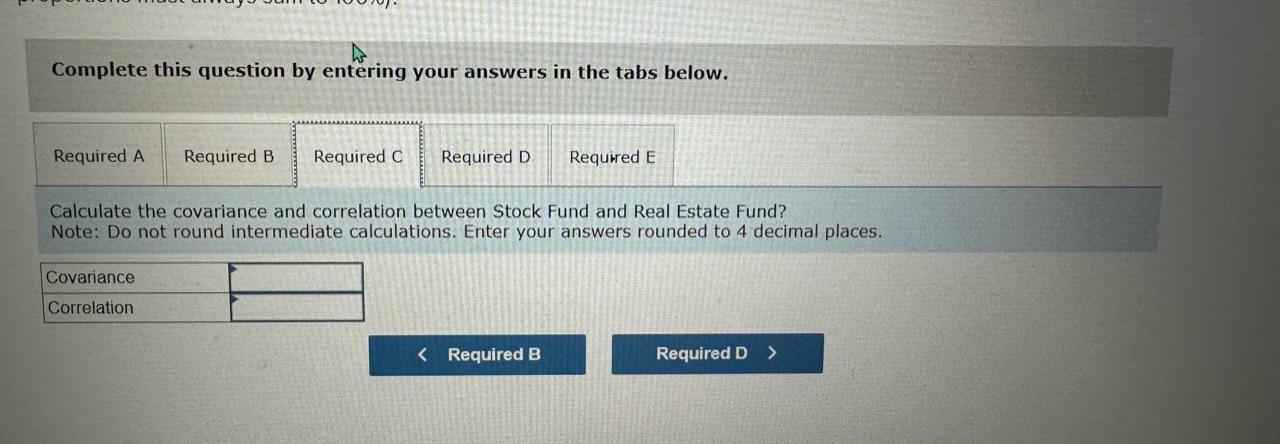

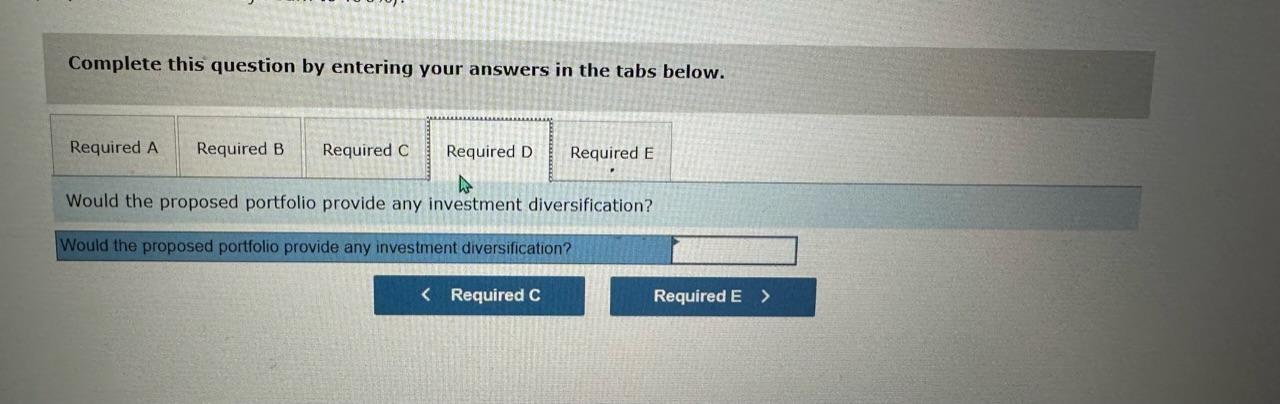

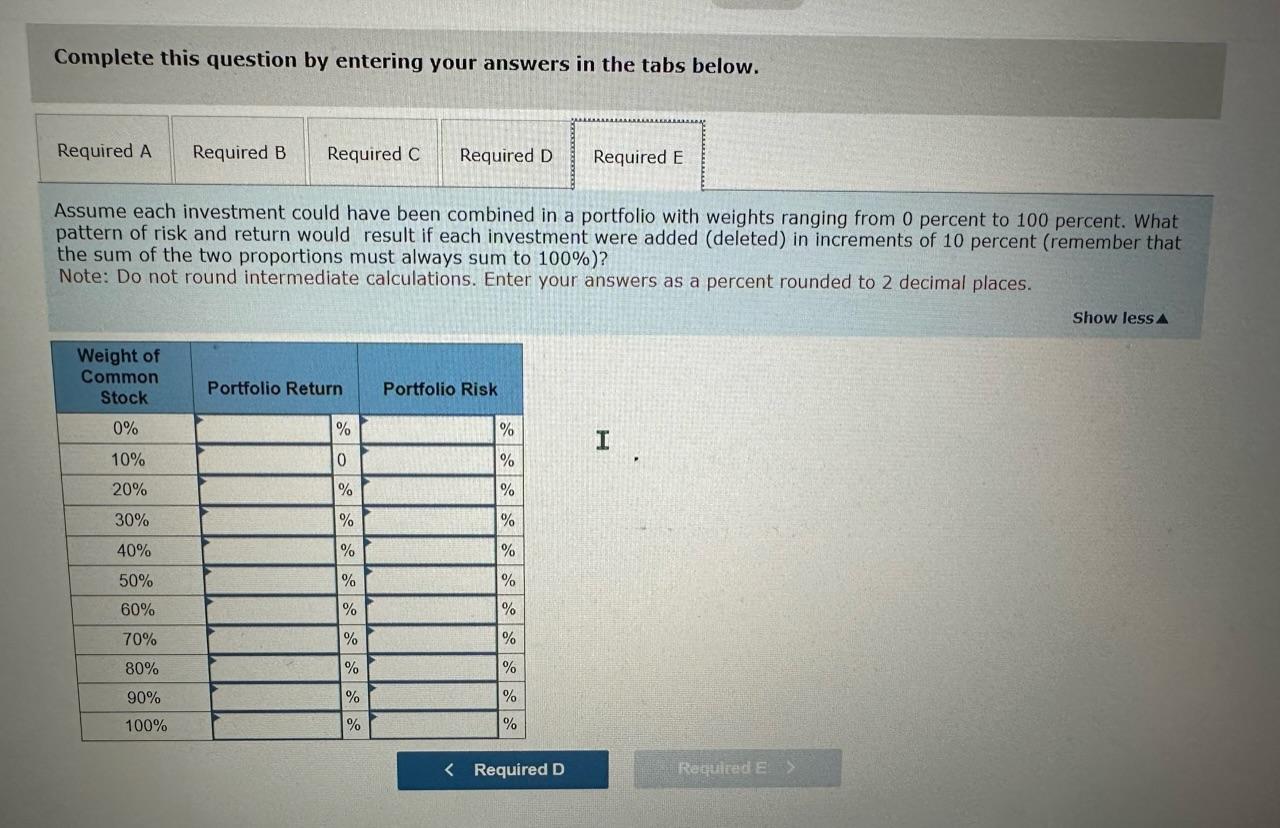

As an investment advisor for MREAF (Momentum Real Estate Advisory Fund), you are about to make a presentation to the portfolio manager of the ET\&T pension fund. You would like to show what would have happened had ET\&T made an investment in MREAF during the past 13 quarters. The ET\&T manager has provided you with historical data on the performance of its portfolio, which is made up entirely of common stock. Historical data for the ET\&T portfolio and MREAF are as follows: Required: a. Calculate the quarterly HPR for each investment. HINT: The first HPR will be in quarter 2 because 2 quarters are needed to calculate a return. The first quarter dividend won't be included in the calculations. b. Calculate the arithmetic mean HPR, the standard deviation of the HPRs, and the geometric mean for each fund. Which fund contained more risk per unit of return? c. Calculate the covariance and correlation between Stock Fund and Real Estate Fund? d. Would the proposed portfolio provide any investment diversification? e. Assume each investment could have been combined in a portfolio with weights ranging from 0 percent to 100 percent. What pattem of risk and return would result if each investment were added (deleted) in increments of 10 percent (remember that the sum of the two proportions must always sum to 100% ? a. Calculate the quarterly HPR for each investment. HINT: The first HPR will be in quarter 2 because 2 quarters are needed to calculate a return. The first quarter dividend won't be included in the calculations. b. Calculate the arithmetic mean HPR, the standard deviation of the HPRs, and the geometric mean for each fund. Which fund contained more risk per unit of return? c. Calculate the covariance and correlation between Stock Fund and Real Estate Fund? d. Would the proposed portfolio provide any investment diversification? e. Assume each investment could have been combined in a portfolio with weights ranging from 0 percent to 100 percent. What pattern of risk and return would result if each investment were added (deleted) in increments of 10 percent (remember that the sum of the two proportions must always sum to 100%) ? Complete this question by entering your answers in the tabs below. Calculate the quarterly HPR for each investment. HINT: The first HPR will be in quarter 2 because 2 quarters are needed to calculate a return. The first quarter dividend won't be included in the calculations. Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Complete this question by entering your answers in the tabs below. Calculate the arithmetic mean HPR, the standard deviation of the HPRs, and the geometric mean for each fund. Which fund contained more risk per unit of return? Note: Do not round intermediate calculations. Enter "Mean HPR" answers as percents rounded to 2 decimal places and other answers as numbers rounded to 4 decimal places. Complete this question by entering your answers in the tabs below. Calculate the covariance and correlation between Stock Fund and Real Estate Fund? Note: Do not round intermediate calculations. Enter your answers rounded to 4 decimal places. Complete this question by entering your answers in the tabs below. Would the proposed portfolio provide any investment diversification? Would the proposed portfolio provide any investment diversification? Complete this question by entering your answers in the tabs below. Assume each investment could have been combined in a portfolio with weights ranging from 0 percent to 100 percent. What pattern of risk and return would result if each investment were added (deleted) in increments of 10 percent (remember that the sum of the two proportions must always sum to 100% )? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. As an investment advisor for MREAF (Momentum Real Estate Advisory Fund), you are about to make a presentation to the portfolio manager of the ET\&T pension fund. You would like to show what would have happened had ET\&T made an investment in MREAF during the past 13 quarters. The ET\&T manager has provided you with historical data on the performance of its portfolio, which is made up entirely of common stock. Historical data for the ET\&T portfolio and MREAF are as follows: Required: a. Calculate the quarterly HPR for each investment. HINT: The first HPR will be in quarter 2 because 2 quarters are needed to calculate a return. The first quarter dividend won't be included in the calculations. b. Calculate the arithmetic mean HPR, the standard deviation of the HPRs, and the geometric mean for each fund. Which fund contained more risk per unit of return? c. Calculate the covariance and correlation between Stock Fund and Real Estate Fund? d. Would the proposed portfolio provide any investment diversification? e. Assume each investment could have been combined in a portfolio with weights ranging from 0 percent to 100 percent. What pattem of risk and return would result if each investment were added (deleted) in increments of 10 percent (remember that the sum of the two proportions must always sum to 100% ? a. Calculate the quarterly HPR for each investment. HINT: The first HPR will be in quarter 2 because 2 quarters are needed to calculate a return. The first quarter dividend won't be included in the calculations. b. Calculate the arithmetic mean HPR, the standard deviation of the HPRs, and the geometric mean for each fund. Which fund contained more risk per unit of return? c. Calculate the covariance and correlation between Stock Fund and Real Estate Fund? d. Would the proposed portfolio provide any investment diversification? e. Assume each investment could have been combined in a portfolio with weights ranging from 0 percent to 100 percent. What pattern of risk and return would result if each investment were added (deleted) in increments of 10 percent (remember that the sum of the two proportions must always sum to 100%) ? Complete this question by entering your answers in the tabs below. Calculate the quarterly HPR for each investment. HINT: The first HPR will be in quarter 2 because 2 quarters are needed to calculate a return. The first quarter dividend won't be included in the calculations. Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Complete this question by entering your answers in the tabs below. Calculate the arithmetic mean HPR, the standard deviation of the HPRs, and the geometric mean for each fund. Which fund contained more risk per unit of return? Note: Do not round intermediate calculations. Enter "Mean HPR" answers as percents rounded to 2 decimal places and other answers as numbers rounded to 4 decimal places. Complete this question by entering your answers in the tabs below. Calculate the covariance and correlation between Stock Fund and Real Estate Fund? Note: Do not round intermediate calculations. Enter your answers rounded to 4 decimal places. Complete this question by entering your answers in the tabs below. Would the proposed portfolio provide any investment diversification? Would the proposed portfolio provide any investment diversification? Complete this question by entering your answers in the tabs below. Assume each investment could have been combined in a portfolio with weights ranging from 0 percent to 100 percent. What pattern of risk and return would result if each investment were added (deleted) in increments of 10 percent (remember that the sum of the two proportions must always sum to 100% )? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places