Question

as And now a bit of math (there won't be much, we promise): To formalize the expected monetary return, imagine that an investment will

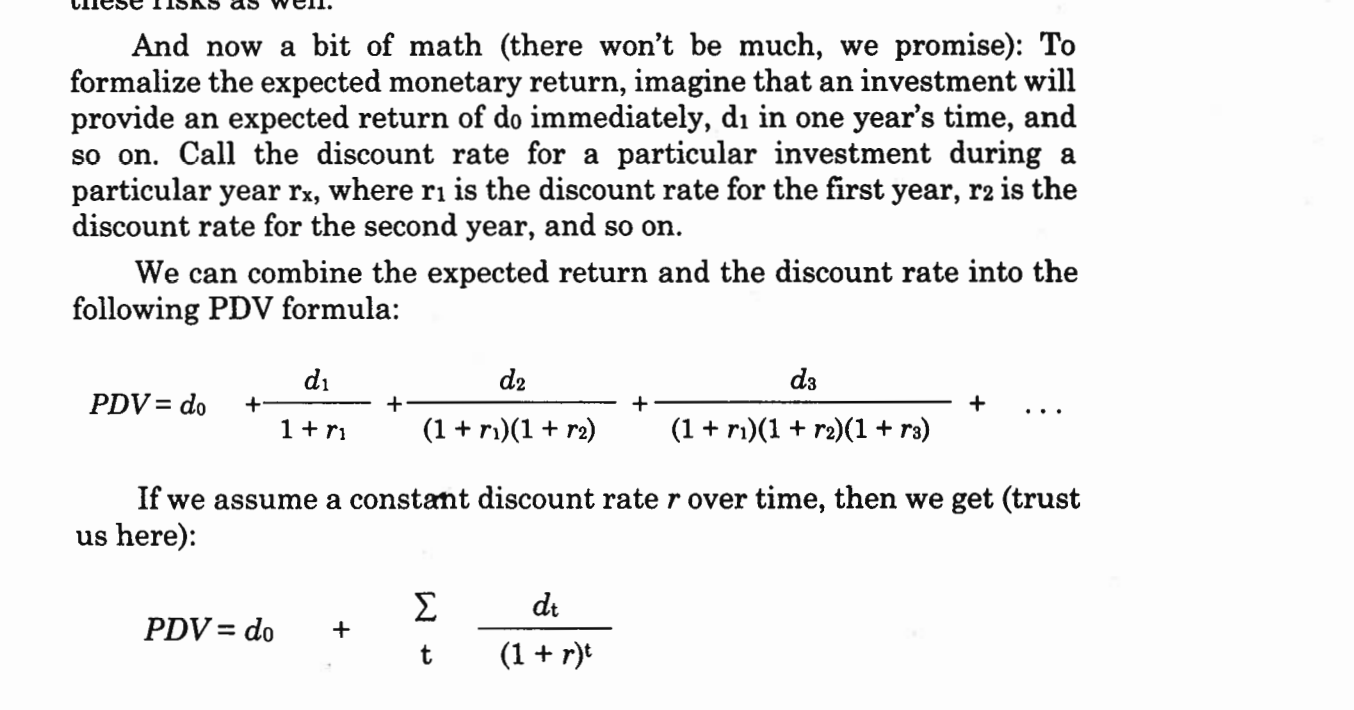

as And now a bit of math (there won't be much, we promise): To formalize the expected monetary return, imagine that an investment will provide an expected return of do immediately, d in one year's time, and so on. Call the discount rate for a particular investment during a particular year rx, where r is the discount rate for the first year, r2 is the discount rate for the second year, and so on. We can combine the expected return and the discount rate into the following PDV formula: d d2 d3 PDV = do + + (1 + r)(1 + r2) (1 + r)(1 + r2)(1 + r3) 1+11 If we assume a constant discount rate r over time, then we get (trust us here): PDV = do W+ dt t (1 + r)t

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Investment Analysis and Portfolio Management

Authors: Frank K. Reilly, Keith C. Brown

10th Edition

538482109, 1133711774, 538482389, 9780538482103, 9781133711773, 978-0538482387

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App