Question

In investigating adoption of this technology as Business Operations Manager at Ashley Regional Medical Center, you have estimated the projects NPV to be positive at

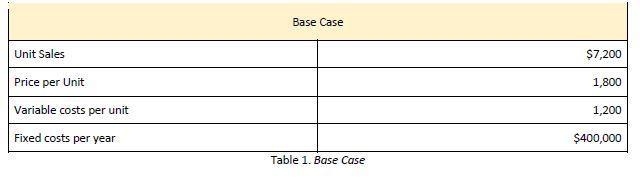

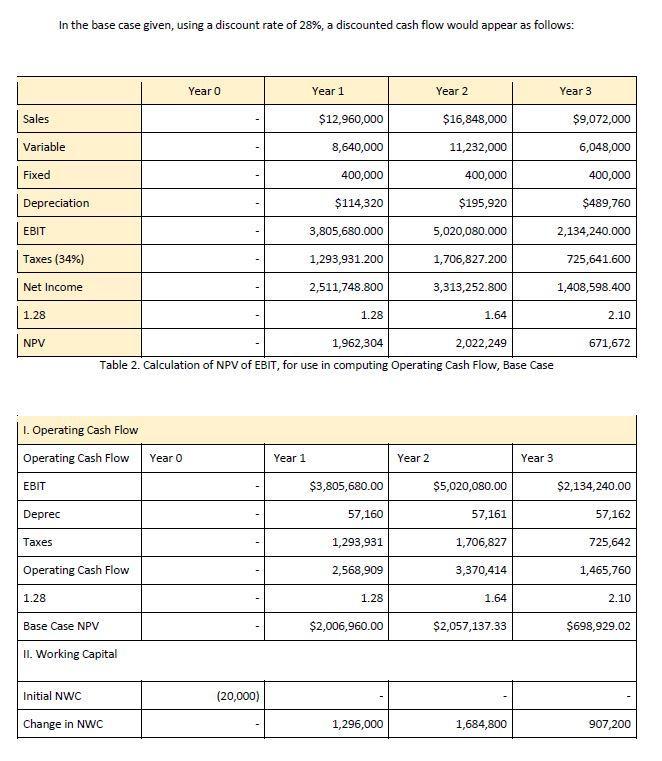

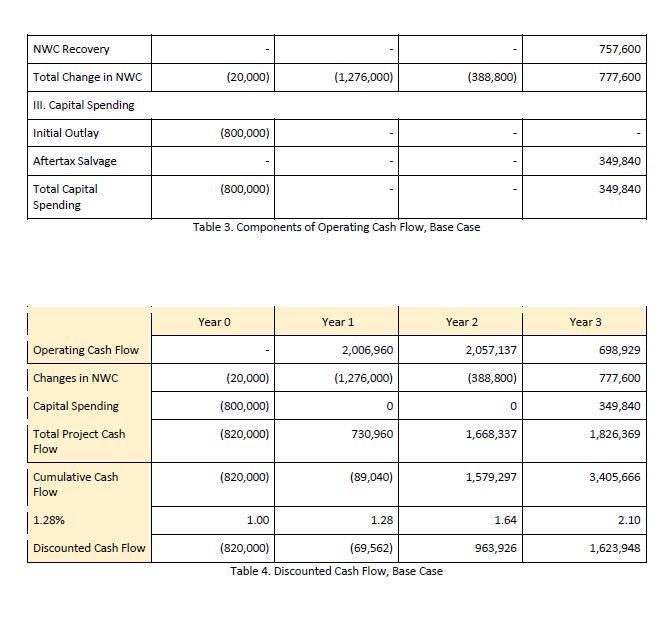

In investigating adoption of this technology as Business Operations Manager at Ashley Regional Medical Center, you have estimated the project’s NPV to be positive at a discount rate of 18%, based on projected cash flows. However, you recognize the possibility of error in these cash flow projections, and you wish to alert decision-makers as to the impact of different assumptions about the future, on these estimates. You intend to present these findings to the Medical Center’s Technology Adoption Board, a group of medical professionals that is most likely unfamiliar with this variety of analysis. As such, while you intend to include a discussion of sensitivity and scenario analyses alongside your estimates, you understand that you will have to put some attention into introducing sensitivity and scenario analysis prior to delivering this judgment. Working capital needs will begin at $20,000, and will be 10% of revenues thereafter, while an initial investment of $800,000 (the price of the Isansys unit) will be required. You have developed the following base estimate of essential data, and will assume that the Isansys system will be depreciated on a MACRS 7-year basis:

As Business Operations Manager at Ashley Regional Medical Center, prepare and attach to the relevant discussion board area a narrated PowerPoint presentation of no more than 8 slides using concepts introduced in this Module to update the Medical Center’s Technology Adoption Board regarding the reliability of NPV estimates. Your presentation must:

1. Evaluate the possibility that forecasted values could differ from the initial NPV estimate, explaining the assumptions and conceptual rationale behind the analyses that you have used to diminish the possibility of error in our estimates, including sensitivity and scenario analyses.

2. Present additional insights to risk associated with project returns that capital market history can offer regarding risk and return associated with this project.

Unit Sales Price per Unit Variable costs per unit Fixed costs per year Base Case Table 1. Base Case $7,200 1,800 1,200 $400,000

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635df22315aa2_180194.pdf

180 KBs PDF File

635df22315aa2_180194.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started